Table of Contents

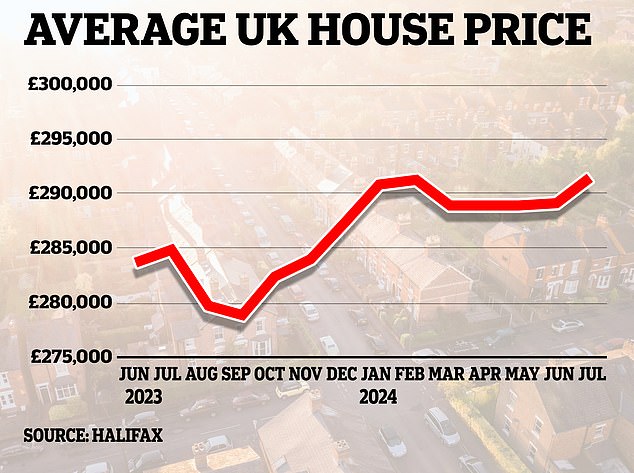

House prices rose in July, according to the latest figures from Halifax, as falling mortgage rates helped galvanise the market.

The average home value rose by 0.8 per cent between June and July, representing a monthly increase of £2,200.

House prices rose 2.3 percent year-on-year, the highest level so far in 2024.

The average home is now worth £291,268, up from £289,042 in June.

Record month: average house price is £291,268, £2,200 more than the previous month

Amanda Bryden, head of mortgages at Halifax, said: ‘Last week’s Bank of England base rate cut, which follows recent reductions in mortgage rates, is encouraging for those looking to refinance their mortgage, buy a first home or move up the property ladder.

‘Against the backdrop of lower mortgage rates and potential additional base rate reductions, we anticipate home prices will continue a modest upward trend for the remainder of this year.’

The Halifax figures, which are based on its own mortgage lending, are in line with Nationwide’s house price data from last week.

Britain’s biggest mutual fund revealed that average house prices rose 0.3 percent between June and July and said that year-on-year, house prices rose 2.1 percent.

Experts said falling interest rates and mortgage rates had triggered the rally.

Nicky Stevenson, managing director of national property group Fine & Country, said: ‘The Bank of England’s recent rate cut will provide further dynamism to the housing market as we enter the second half of 2024.

‘In response, lenders have started a rate war, reducing offers to remain competitive. This change is a game-changer for prospective buyers.

‘Lower rates translate into reduced monthly payments and increased purchasing power, potentially opening doors for those who previously couldn’t afford them.’

A radical change: the Bank of England cut the base interest rate from 5.25% to 5% on August 1

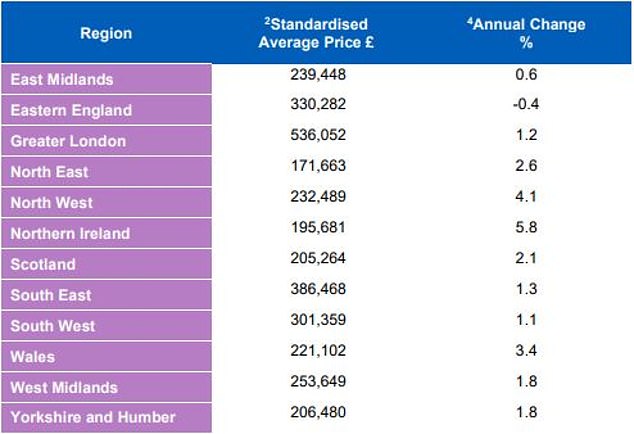

Regional division persists

Northern Ireland continues to record the highest house price growth of any nation or region, up 5.8 per cent year-on-year, according to Halifax.

House prices in the North West also saw strong growth, up 4.1 percent compared to the previous year.

In Wales, house prices rose 3.4 per cent to £221,102, the highest price recorded since October 2022.

House prices in Scotland rose by 2.1 percent compared to the previous year.

The only region or nation to record a fall was the East of England. Properties here now have an average value of £330,282, down 0.4 per cent on last year.

Iain McKenzie, chief executive of The Guild of Property Professionals, said: “It is particularly encouraging to see strong performance in regions such as Northern Ireland and the North West.

‘This regional variation highlights the diverse nature of the UK housing market and the opportunities available in different areas.’

What’s next for home prices?

At the start of the year, almost all major forecasts suggested prices would fall throughout 2024.

Today, almost all real estate commentators are convinced that the only way is up.

“UK house prices have regained momentum,” said Anthony Codling, head of European housing and building materials at investment bank RBC Capital Markets.

‘The value of the average home has increased by £6,650 in the last 12 months.

‘Last week we saw the first rate cut in banks, and we believe mortgage rates will continue to trend lower in the coming months.

“Couple this with rising wages and easing cost-of-living pressures, and house prices seem likely to continue to rise.”

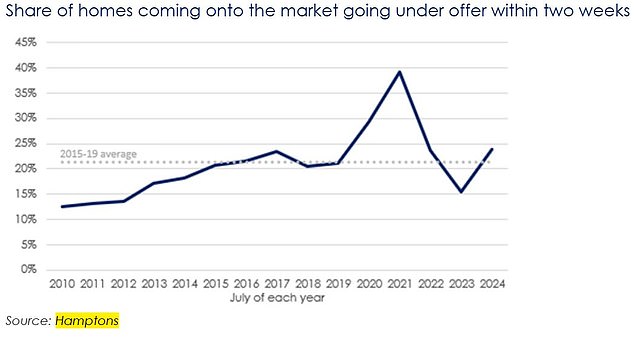

In addition to the rising average home price, there are new signs that the market is gradually shifting from a buyer’s market to a seller’s market again.

How fast do houses sell?

According to separate data from real estate agency Hamptons, nearly a quarter of the homes that came on the market in the first half of July were listed within two weeks.

This figure represents an increase from the 15 percent recorded during the same period in 2023 and the 19 percent recorded between January and June of this year.

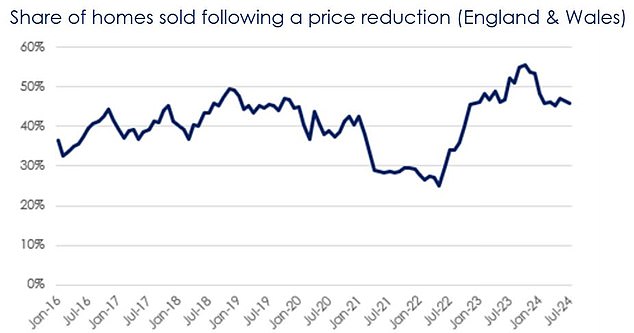

The share of sellers accepting deep sales price discounts has also fallen to its lowest level since mortgage rates spiked in late 2022.

Only 2.2 per cent of sellers in England and Wales accepted an offer that was more than 10 per cent below their final asking price in July, down from a peak of 5.1 per cent in December 2022.

And rising home prices and lower mortgage rates have meant fewer sellers are having to lower their asking price.

Around 46 per cent of homes sold in England and Wales in July saw a price reduction, down slightly from 47 per cent in June this year and 56 per cent in October 2023, when price reductions peaked.

Jonathan Hopper, chief executive of buying agency Garrington Property Finders, said: ‘The latest anecdotal evidence shows that estate agents are beginning to see an increase in buyer enquiries as consumer confidence rises.

‘In some areas, the number of homes for sale is high compared to the number of buyers, and this imbalance is turning the market into a buyer’s area.

‘However, the prospect of cheaper mortgages has finally arrived, and many potential buyers who had been waiting are asking themselves: ‘if not now, when?’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.