Table of Contents

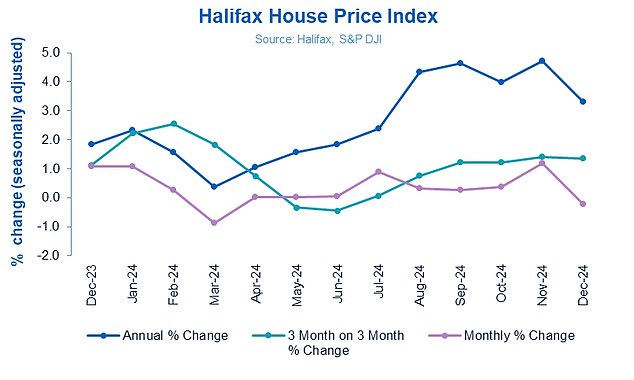

House prices fell slightly in December, according to the latest figures from Halifax.

The 0.2 percent drop last month marks the first decline since June, and one of Britain’s biggest lenders had previously recorded five months of consecutive growth.

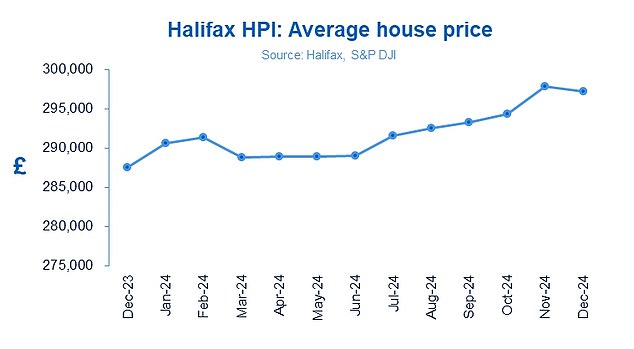

This means house prices ended last year up 3.3 per cent, with a typical home worth £297,166. In total, house prices have increased by just under £10,000 in 2024.

Amanda Bryden, Halifax mortgage director, said: “The housing market was broadly stable in early 2024, with house price growth taking off from the summer.

‘In the second half of the year, house prices rose in response to falls in mortgage rates, along with income growth, leading to financial pressures easing somewhat for buyers.

“The impending changes to stamp duty thresholds have also given potential first-time buyers even more motivation to get on the housing ladder and press ahead with their home buying plans.”

“Together, these elements meant that mortgage demand recovered, reaching the highest level in more than two years and returning to levels seen before the pandemic.”

Rising: House prices ended 2024 up 3.3% over the year, with the average house price at £297,166

He adds: “In many areas of the country, housing prices were also boosted by demand that exceeded supply, possibly further amplified by the fact that homeowners postponed putting their properties up for sale, such as in anticipation of mortgage rates falling further.

Where are prices rising the most and least?

Prices in Northern Ireland continue to rise more than anywhere else in the UK, with the average house increasing by 7.4 per cent a year.

House prices in Wales rose 4.6 per cent compared to the previous year, with properties now costing an average of £226,646.

Scotland saw a smaller rise in house prices compared to the rest of the UK, with properties in the country now going for £209,959, up 2.4 per cent on the previous year.

In England, house prices in the North West rose 5.3 per cent compared to the previous year, with properties now costing an average of £238,832, the biggest growth of any English region.

London maintains the highest average house price in the UK, at £547,614, up 3.3 per cent on last year.

What’s next for house prices in 2025?

Halifax has forecast modest house price growth of between 0 per cent and 3 per cent in 2025, along with a small further increase in the number of transactions.

“Provided employment conditions do not deteriorate markedly due to a more recent weakening, buyer demand should hold up relatively well and, taking all this into account, we continue to anticipate modest house price growth this year,” he added. Amanda Bryden.

Anthony Codling, European head of housing and building materials at investment bank RBC Capital Markets, expects prices to rise in 2025.

‘December’s drop ended a streak of five consecutive monthly increases, but with wages expected to rise and mortgage rates to fall in 2025, we expect house prices to rise in 2025.

‘The stampede stampede will likely prop up prices in the first three months of the year, before the baton from house prices passes to mortgage rates.

“Uncertainty remains around the broader macroeconomic outlook, but housing demand continues to outstrip supply and our love affair with home ownership has not been affected by the rising cost of living, higher for longer mortgage rates or the budget.”

Christmas drop: prices fell slightly in December, 0.2 percent, after five consecutive monthly increases

Buying agent Jonathan Hopper, chief executive of Garrington Property Finders, says he is already witnessing fierce competition among first-time buyers trying to navigate the stamp duty changes.

However, he says it’s a different market for those trying to sell to companies that are scaling up or down.

‘In the higher areas of the market, things are becoming more difficult for sellers. An increase in the number of homes for sale has given buyers a wide variety of options and, with it, the leverage to push through difficult negotiations.

‘In response, many sellers are forced to keep asking prices low or risk having their home sit unsold on the shelves.

‘At the same time, most wealthy buyers remain very price sensitive. With plenty of great properties to choose from, many are prioritizing value, taking their time and negotiating hard, all of which is keeping price growth in check.’

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.