House prices fell slightly in March as the spring real estate market got off to a dull start in the south, but the north fared much better.

The latest Nationwide house price index showed a slight decline of 0.2 percent in average property values last month, but the drop came in a statistical quirk as a traditionally busier month ended slowly.

The monthly decline was due to a seasonal adjustment – which aims to smooth out months that tend to be more and less active – while the unadjusted average house price actually rose slightly from £260,420 in February to £261.14 in March.

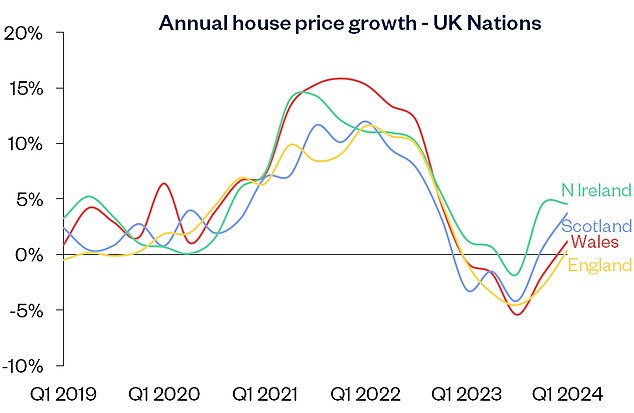

It means that the average number of homes has risen by 1.6 per cent annually, according to Nationwide data, with the headline numbers having been pulled back by the faltering property market in southern England.

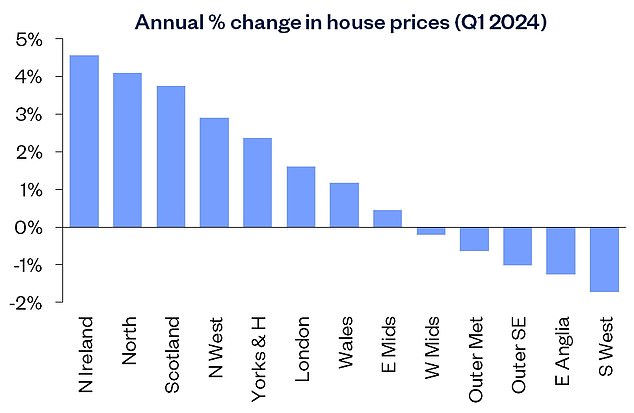

All regions saw an improvement in the annual rate of change in the first quarter of 2024

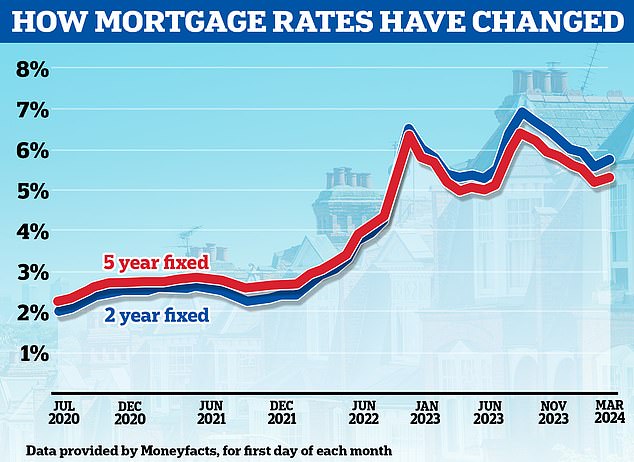

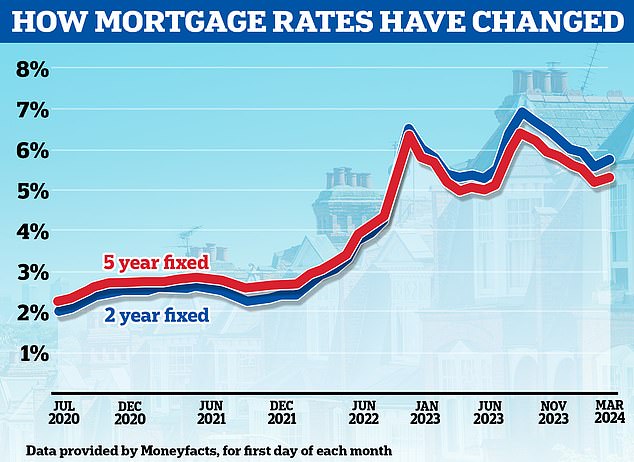

Robert Gardner, chief economist at Nationwide, suggested higher mortgage rates continue to weigh heavily on potential buyers.

“While activity has recovered from weak levels seen in late 2023,” he said, “it remains relatively subdued by historical standards.”

‘For example, the number of mortgages approved for the purchase of homes in January was approximately 15 percent below pre-pandemic levels. This largely reflects the impact of higher interest rates on affordability.

“While mortgage rates are below mid-2023 highs, they remain well above lows in the wake of the pandemic.”

What’s happening to house prices across Britain?

Despite the focus of the reports on house price figures, the British housing market does not simply move as a whole. It consists of thousands of local markets that will all perform differently from each other.

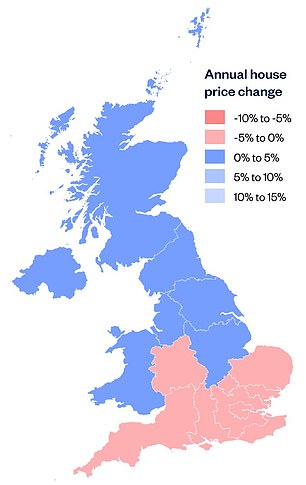

These differences are even visible at the regional level, where there are signs of a North-South divide. In general, prices rise in the north and fall in the south.

North-South divide: House prices rise in the north and fall in the south

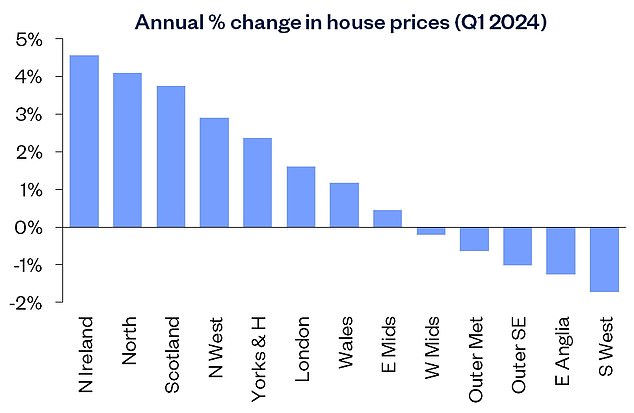

For example, the average house price in Northern Ireland increased by 4.6 percent year-on-year during the first three months of 2024, according to Nationwide.

Prices in Scotland are 3.7 percent higher in the past three months than in the same period in 2023.

And in the north of England, the average home rose by 4 percent in the first three months of this year compared to the same period last year.

Meanwhile, prices in the South West are down 1.7 per cent compared to this time last year and prices in East Anglia are down 1.3 per cent.

Anna Clare Harper, CEO of sustainable investment adviser GreenResi, said: ‘The housing market is not a single market – it is millions of small locations down to street level, each becoming more or less popular over time, influenced by different factors ranging of solvency of local governments for new local development plans.

‘Then there are factors that influence the pricing of individual properties, including the cost of owning the property; costs to maintain the property; and affordability, which, especially for young people, is determined by the cost and availability of financing.

‘So market prices for March reflect millions of individual negotiations, striking a balance between what one buyer wanted and what one seller needed, during that month.

“All of these factors and more are important when evaluating properties today and predicting what will happen to prices tomorrow.”

Regional differences: The housing market is made up of thousands of local markets that will all perform very differently from each other

What next for house prices?

Last week, Zoopla announced that it expects house prices to level off in the second half of 2024, thanks to higher mortgage rates, reduced purchasing power and more homes coming onto the market.

In total, according to the real estate website, there are a fifth more homes for sale than at the beginning of 2023. This greater availability will keep price increases under control.

Many buyers continue to negotiate hard on price, while price remains largely a buyer’s market. Two-fifths of the sales agreed in March took place at a price that was 5 percent or more below the asking price.

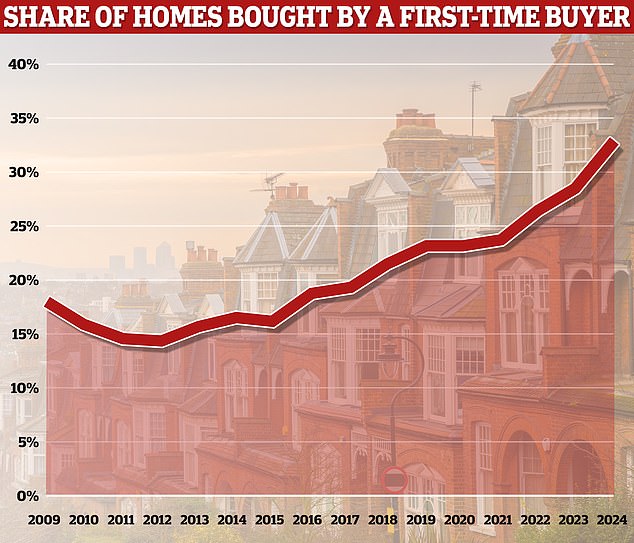

Against this background, starters on the market seem to see an opportunity, according to real estate company Hamptons.

Yesterday it emerged that first-time buyers are responsible for 33 percent of purchases in Great Britain this year, a record high.

Market milestone: First-time buyers bought 33% of homes sold in Britain so far this year, an all-time high

Brokers appear confident that momentum will increase across the market, especially as we enter spring, which is traditionally the busiest time of year.

Ed Phillips, CEO of property agents Lomond, said: ‘While we are yet to see a significant jump in property values, market momentum is building, with a strong foundation now in place to enable further growth as we focus on which is traditionally the case. the busiest time of the year.’

Marc von Grundherr, managing director of Benham and Reeves said: ‘As we approach the spring selling season, a very marginal decline in the monthly growth rate of house prices should be seen as nothing more than a market taking a breather before the floodgates open .

Verona Frankish, CEO of online real estate agent Yopa, added: ‘The appetite of the country’s homebuyers may have been dampened by higher mortgage rates, but it has certainly not disappeared, as evidenced by the improvements seen in mortgage prices in recent have been observed for years. months.

‘With the seasonal spring surge in market activity also imminent, it is only a matter of time before we see the UK property market moving up a gear, both in terms of sales volumes and house price growth.’

However, while many real estate agents are confident that house prices will rise from here on out, much will ultimately depend on mortgage rates, which are much higher than two or five years ago and limit borrowing power.

Recently, the decline in costs has come to a standstill and rates have risen slightly. Since February 1, the average two-year interest rate has risen from 5.56 to 5.8 percent, following the Bank of England’s decision to maintain the base rate at the beginning of the month.

Meanwhile, the average five-year interest rate has risen from 5.18 percent to 5.38 percent since February 1. The lowest fixed rates are now above 4 percent.

We’re on the rise again: Mortgage rates have started to rise again after falling back from the highs they reached in the summer

Jonathan Hopper, CEO of Garrington Property Finders said: ‘Two things are clear from Nationwide’s latest snapshot of the UK property market. The increase in price increases at the beginning of the year is easing, and large regional differences remain.

‘While buyer confidence is back and last year’s widespread price falls are clearly in the rear-view mirror, price increases continue to be dampened by high borrowing costs.

‘In the first quarter of 2024, the mortgage market was alternately an accelerator and a brake for the real estate market.

‘The wave of interest rate cuts in January sounded the starting gun and enticed thousands of potential buyers and movers who had given up in 2023 to return to the table.

‘But in recent weeks many lenders have suspended their interest rate cuts, which is now keeping the rise in property prices in check.’

Nationwide’s Robert Gardner added: ‘With cost-of-living pressure easing as inflation returns to target, consumer confidence is improving.’

Indeed, surveyors are reporting an increase in new buyer inquiries and new sales instructions in recent months.

“Moreover, housing affordability is improving, albeit gradually, as income growth continues to outpace house price growth by a healthy margin.

“If these trends continue, activity is likely to gain momentum, although the pace of the recovery is still likely to be strongly influenced by interest rate developments.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.