- House prices rose by an average of £4,200 in the year to May, Halifax said.

- They fell 0.1% over the past month.

- Rate cut planned for autumn could inject more optimism into the market

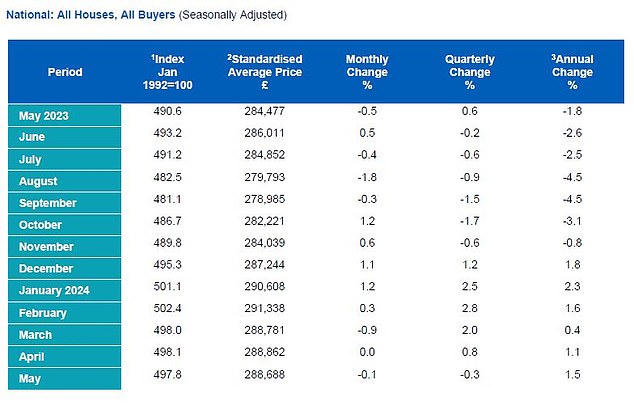

House prices rose in the year to May, with the value of the average house rising by £4,200 to £288,688 over the 12 months, according to Halifax.

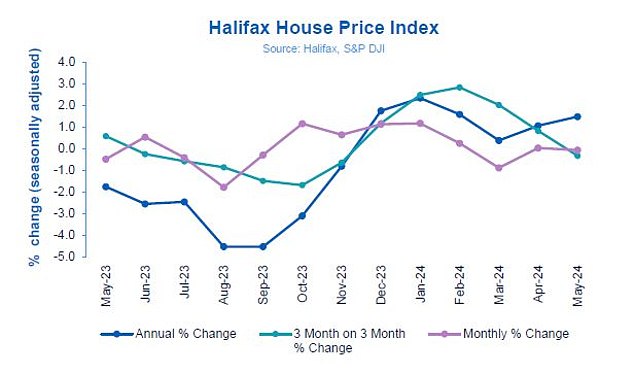

The 1.5 percent increase was the sixth consecutive month that prices rose on an annual basis and surpassed the 1.1 percent increase recorded in April.

However, prices only rose one or two percent in each of those months and were preceded by several months of price declines.

Buyers’ market: House prices rose last year, but only slightly

Experts said buyers and sellers were still anticipating a cut in the Bank of England’s base rate and predicted a bigger bounce in the market after that.

On a month-on-month basis, prices fell 0.1 per cent between April and May, the mortgage lender said – around £170 in cash terms.

Halifax mortgage director Amanda Bryden said more stable house prices and mortgage rates were improving confidence among homebuyers.

He said: ‘Market activity remained resilient throughout the spring months, supported by strong nominal wage growth and some evidence of improving confidence about the economic outlook.

‘This has been reflected in a generally stable outlook in terms of property price movements, with the average cost of a property having changed little over the past three months.

‘A period of relative stability in both house prices and interest rates should give a degree of confidence to both buyers and sellers.

“While homebuyers and those remortgaging will continue to respond to changes in borrowing costs, against a backdrop of limited supply of available properties, the market is unlikely to see large fluctuations in the short term.”

Slight increase: house prices rose 1.5% year-on-year through May, but fell throughout the month

Over time: Last year saw a series of price drops followed by marginal increases.

Jason Tebb, president of OnTheMarket, said it was still a buyers’ market and many were looking to negotiate a good deal.

“With property prices stabilizing, buyers remain sensitive to what they are willing to pay and consider themselves in a good negotiating position,” he said.

Tebb also noted that planned reductions in the Bank of England’s base rate, currently scheduled for August, were injecting some optimism into the market.

“Affordability has been limited thanks to numerous interest rate increases and the cost of living crisis, but with inflation moving in the right direction, there is a growing sense that the worst may be behind us,” he said. .

This could push down mortgage rates, which, while below their fall 2023 peak, have remained stubbornly high.

Tom Bill, UK head of residential research at agent Knight Frank, said many buyers were still waiting for a rate cut before acting.

“House prices remain under pressure as an interest rate cut approaches,” he said.

‘There should be a more notable rebound this autumn, when the first rate cut since March 2020 is likely to have occurred and the political context has stabilized. We expect UK prices to rise by 3 per cent this year as the prospect of more mortgage rates starting with ‘3’ approaches.

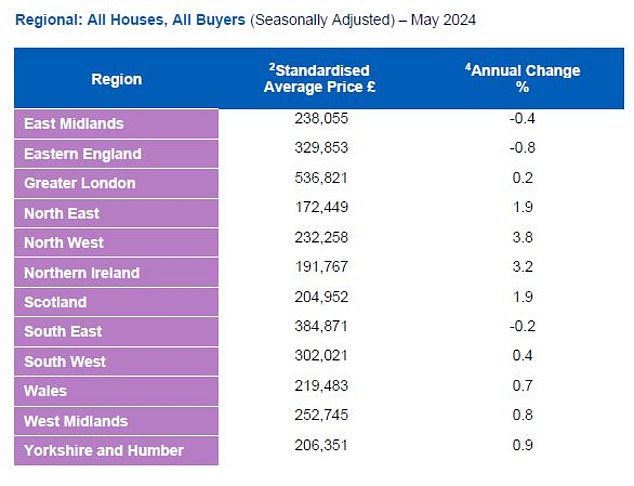

Regionally, the North West saw the biggest increases in house prices, rising 3.8 per cent in the year to May. The average property price remains below the national average at £232,258.

Locations: Some regions performed better than others over the past year

Northern Ireland also saw a 3.2 per cent rise, taking the typical property to £191,767.

The east of England recorded the biggest drop in annual growth across the UK. House prices now average £329,853, down -0.8 per cent on May.

Prices also fell in the East Midlands (0.4 per cent) and the South East (0.2 per cent).