The average price of petrol rose by 4p a liter in February, while diesel soared by almost 5p, marking the biggest monthly increase in five months, the RAC says.

A combination of oil rising above $80 and the pound being worth just $1.26 (with oil traded in dollars) drove up wholesale costs for UK fuel retailers, costs that have quickly shifted drivers to higher prices at the pump.

The news comes ahead of Wednesday’s spring budget statement, in which Chancellor Jeremy Hunt is expected to provide some relief to the country’s motorists by freezing fuel duty for the 14th year in a row and maintaining the “temporary” tax cut. 5 pence per liter on petrol and diesel. which was introduced in 2022 to neutralize the increase in fuel prices.

Your browser does not support iframes.

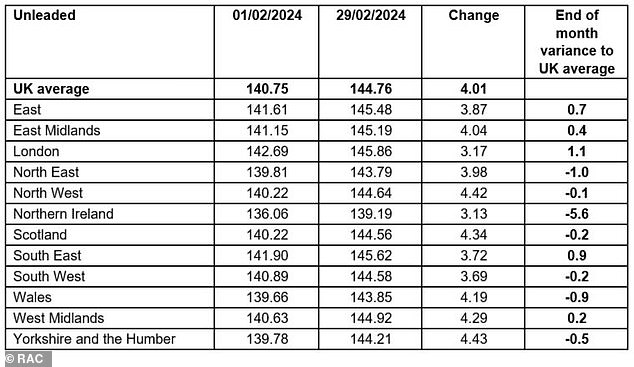

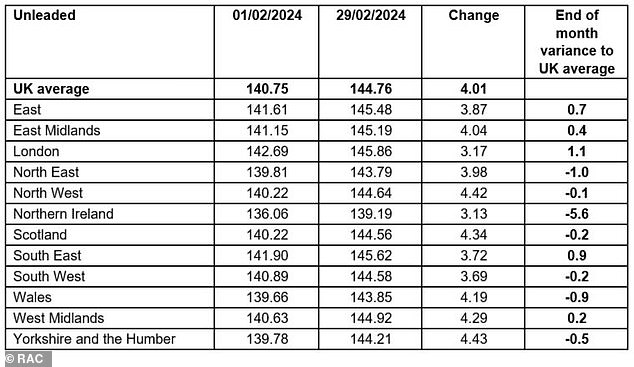

The RAC’s monthly Fuel Watch report said petrol rose from 140.75p at the start of February to 144.76p at the close, adding more than £2 to the price of a full tank (£77.41 to £79.62 ).

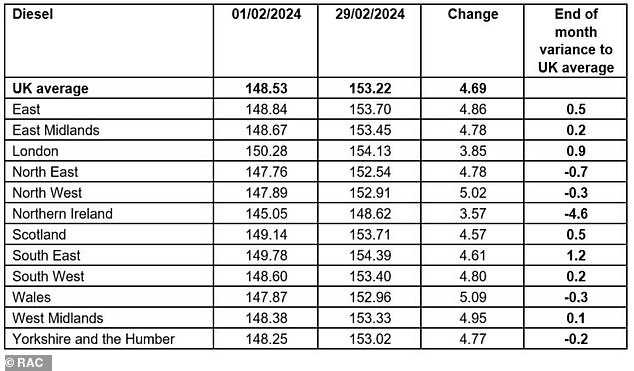

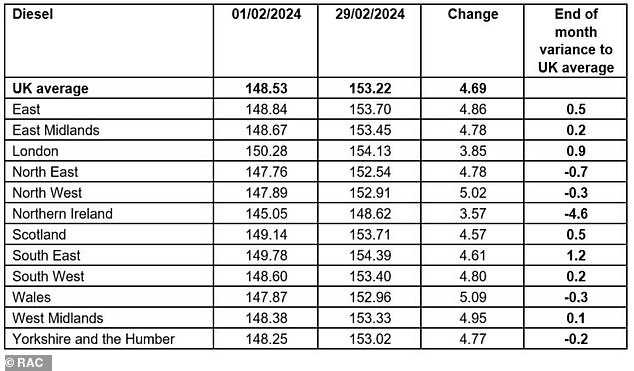

Diesel rose from 148.53p to 153.22p (4.7p), increasing the cost of filling up an average 55-litre family car from £2.60 to £84.27.

It is the largest monthly increase for both fuels since September.

Northern Ireland drivers get the best deal on fuel

Drivers in Northern Ireland pay around 5.6p less per liter for petrol than the rest of the UK, according to the RAC.

The report also identified a widening of regional fuel prices, especially when comparing Northern Ireland to the UK average.

Price data shows that drivers in Northern Ireland pay – on average – 5.6 pence per liter less for petrol than the rest of the country, while diesel is 4.6 pence cheaper.

The RAC said this is “particularly galling” for drivers in the rest of the UK, and claimed that large retailers in Northern Ireland are operating on “tighter margins”.

Looking at average margins across the UK, retailers are currently charging around 10p per liter on average on both petrol and diesel.

“Supermarkets in particular have significantly increased their margins to 8p per liter, up from 6p in 2019. Luckily for drivers, this is lower than the last two years, when they were around 9.5p.” said RAC fuels expert Simon Williams. saying.

“We hope that the eventual creation of the watchdog recommended by the Competition and Markets Authority will help put an end to this postcode lottery that treats drivers so unfairly,” he added.

As can be seen from this table, the average price of petrol in Northern Ireland is 136.06p, while in the south-east of England drivers pay 141.90p for unleaded petrol.

Motorists in Northern Ireland are paying an average of 4.6 pence less per liter for diesel than the rest of the UK, the RAC report highlights. The difference is because NI traders pocket smaller operating margins.

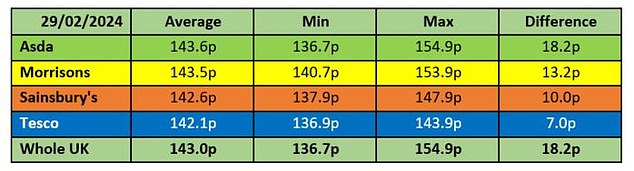

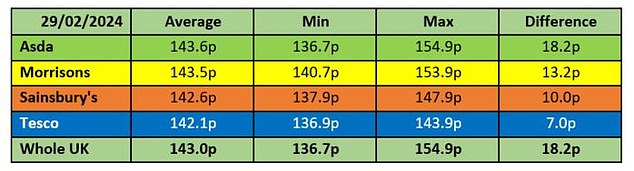

Are supermarkets playing fair with drivers? There is an 18p a liter difference between Asda’s cheapest and most expensive petrol station

The motoring group says motorists across the UK continue to get the best deal by filling up at petrol stations run by the big four supermarket chains.

Unleaded is just under 2p (1.8p) cheaper when bought at a supermarket filling station (143p vs 144.76p), although diesel is just a penny cheaper ( 152.1 pv vs. 153.22 pence).

It also highlights that there is a difference of 18p per liter between supermarket stations selling lower-priced and higher-priced unleaded petrol, both Asda sites.

The lowest price was 136.7p at its sites in Middleton, Leeds and Ballyclare, north of Belfast in Northern Ireland, and the most expensive was 163.9p at Parkgate Road in Chester.

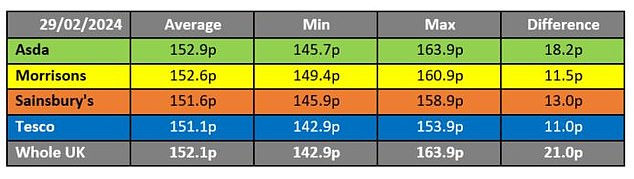

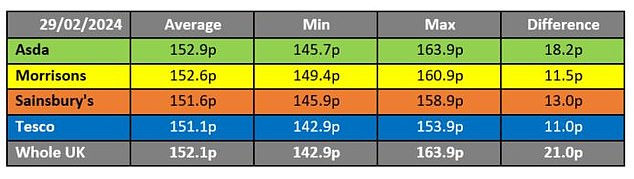

For diesel, the difference between the cheapest and most expensive supermarket stations is greater: 21p.

Tesco offered drivers the lowest price at 142.9p in Banbridge in Northern Ireland and Asda the most expensive at 163.9p, also on Parkgate Road in Chester.

Williams said: ‘Our data shows that in February, drivers suffered the largest average monthly fuel price increases since September 2023.

“What’s more, the 4.7p increase in diesel was the 14th largest since 2000 and the 4p increase in petrol was the 17th largest increase since the turn of the century.”

PETROL: Supermarkets may be the cheapest place to fill up on average, but the price difference at service stations operated by the same retailer can differ by up to 18.2p for unleaded fuel, in the case of Asda.

DIESEL: Asda also has the biggest price difference between its most expensive and least expensive service stations. The difference in the postal code lottery is, like gasoline, 18.2 liters per year.

Drivers across the country will welcome the Chancellor’s announcement in tomorrow’s Budget on fuel cost taxation.

Jeremy Hunt is expected to freeze fuel duty for the 14th year in a row and will extend the ‘temporary’ 5p cut in fuel duty for another year as he seeks to calm Tory nerves over dire television ratings. opinion polls.

This is estimated to save drivers £5 billion combined over the next 12 months..

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.