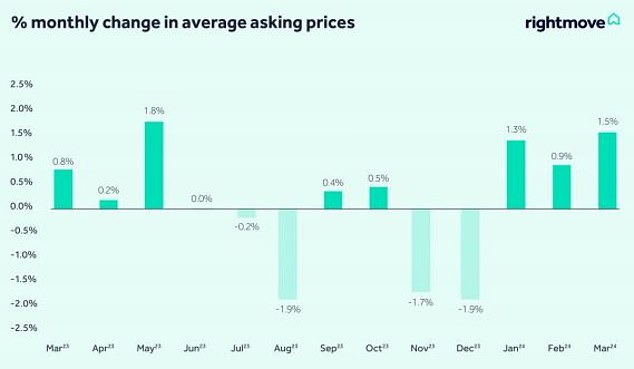

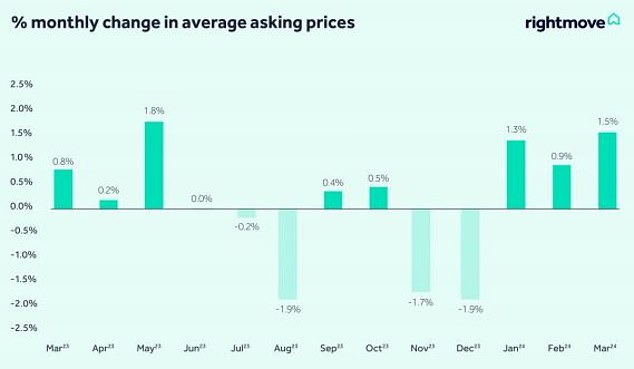

Average house asking prices rose 1.5 per cent in March to £368,118, according to the latest figures from listings site Rightmove.

The data, which looks at the prices of newly listed homes, showed that the typical asking price has increased by £13,000 since December, although average asking prices are still £4,776 lower than their peak in May 2023.

The increase detected this month is the largest increase recorded by Rightmove in 10 months. It’s also much larger than the historical average increase of 1 percent seen in March over the previous 22 years.

Monthly asking prices rose in March, significantly higher than the 22-year average of 1 percent.

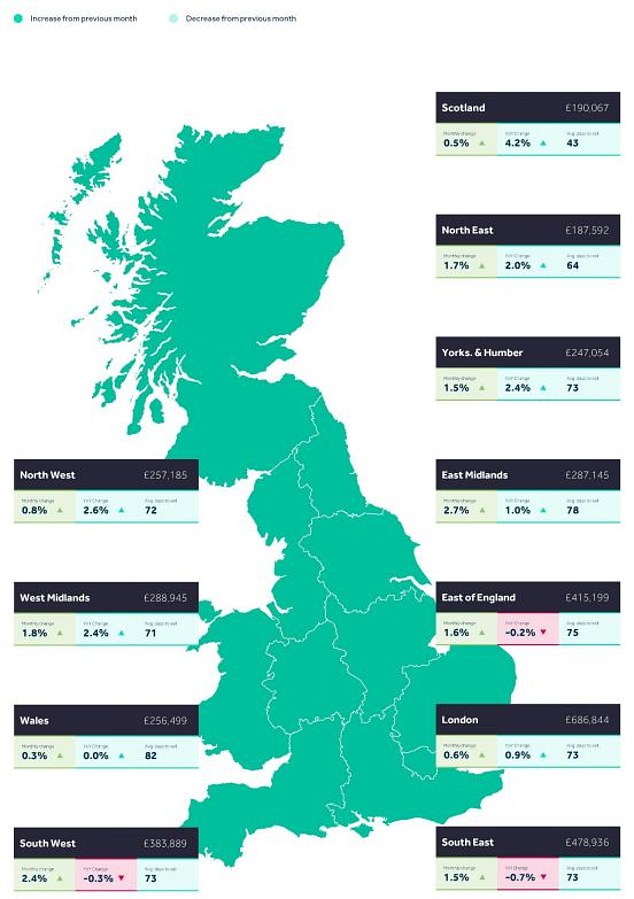

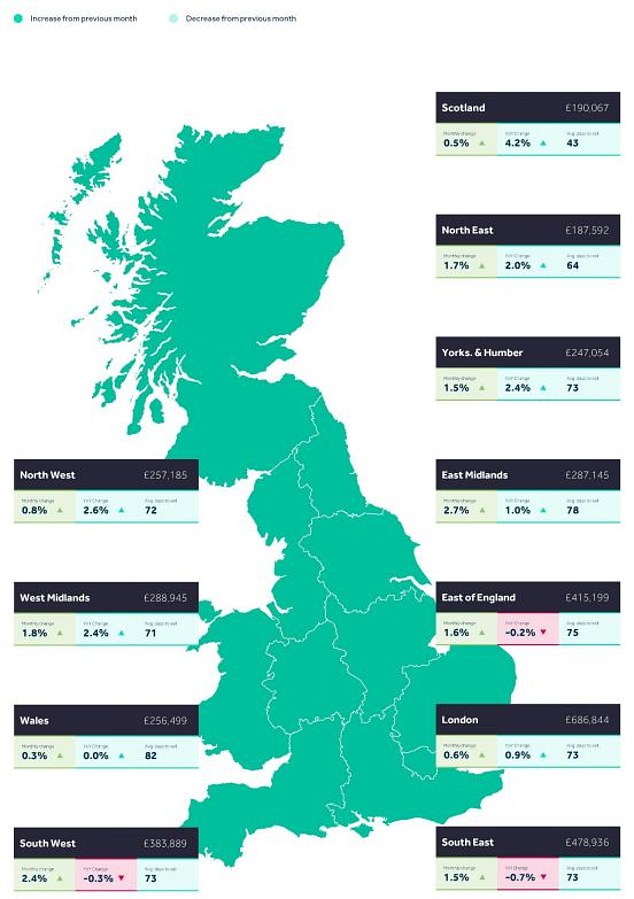

It said all areas of the UK saw asking prices rise in March, and there are now only three areas where asking prices are lower than they were at the same time in March. ‘last year.

The change is due to more home buyers and sellers entering the market, according to the real estate website.

Rightmove has recorded an increase in buyer demand, measured by people sending inquiries to estate agents, and higher sales figures than a year ago.

This, alongside the traditional spring rise in the property market, has put upward pressure on prices, according to Tim Bannister, property analyst at Rightmove.

“The first three months of the year have been positive for the market and better than many expected,” Bannister said.

“But despite above-average price increases in the first three months of the year, asking prices are still below their May 2023 peak.

“For those who can afford to buy and have not yet taken steps to move this year, this could provide a window of opportunity to buy, as we now appear to have passed the bottom of the market.”

Signs of recovery: March’s 1.5% rise is biggest increase in 10 months

More buyer inquiries

Since the start of March, Rightmove said the number of completed sales was 13 per cent higher than the same period last year.

This is driven by larger, more expensive homes, with agreed sales now 18 per cent higher than last year.

So far in March, buyer inquiries for larger properties have been 12 percent higher than the same period last year, the property website said, compared with an overall rise of 8 percent. percent for all property types.

London saw the biggest year-on-year increase in buyer inquiries, which Rightmove says is due to people returning to the office, pay rises, stable house prices and the slowdown in inflation.

Marc von Grundherr, director of estate agents Benham and Reeves, said: “While mortgage affordability remains an issue, this has certainly not dampened the appetite of London buyers and we have continued to see a high level of activity at all price thresholds, but in particular on the superprime market.

“Buyers at the very top of the ladder are acting with great confidence, with the higher cost of borrowing not presenting the same barrier as the average homeowner.”

It’s still a long time to sell

Even though real estate agents are receiving more and more inquiries, sellers still often have to wait months for the right buyer to come along.

The average time to find a buyer is now 71 days, which is the longest for this time of year since 2019. However, this figure is down from the average of 78 days recorded in January.

Buyers are taking their time: the average time to find a buyer is now 71 days, the longest at this time of year since 2019.

Agents report that buyers quickly select attractively priced properties, while overpriced properties take much longer, increasing the average time to find a buyer.

North London estate agent Jeremy Leaf added: “More listings mean buyers are often spoiled for choice, so they aren’t rushing to take the plunge.

“Some held back from making offers in anticipation of budgetary giveaways or further mortgage rate cuts that didn’t really materialize.

“On the other hand, as the market remains price sensitive, only realistically priced properties attract attention.

“Sellers who understand that if they receive inquiries within the first days of marketing, they have a much greater chance of finding a buyer, benefit the most from the increase in demand.”

Regional breakdown: All regions saw asking prices increase in March. Only in the East of England, South East and South West do asking prices remain down year on year.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. This helps us fund This Is Money and keep it free. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.