Rightmove has revealed the fastest and slowest property markets, showing how different sellers’ experiences can be in Britain.

The fastest property market is Carluke in Scotland, where it takes an average of just 15 days to find a buyer.

On the other end of the spectrum, home sellers in some areas are finding that they have to wait more than 100 days on average to receive an offer.

According to data from Rightmove, the property market in Scotland as a whole is red hot at the moment.

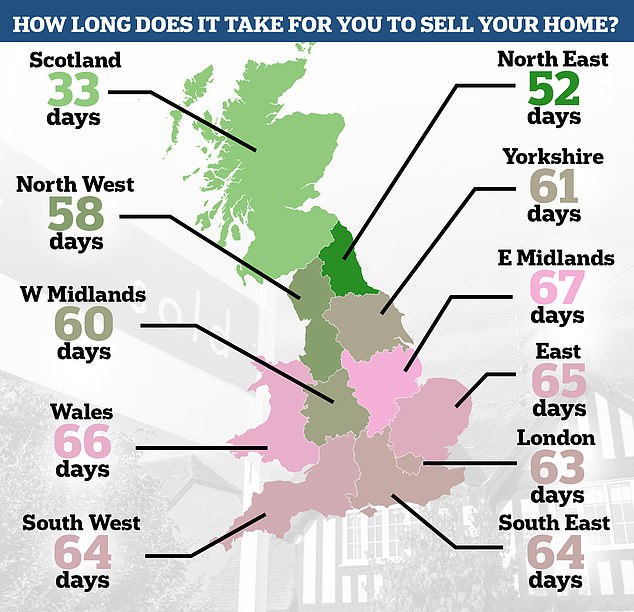

In Britain, it currently takes an average of 60 days to find a buyer.

The average time to find a buyer in Scotland is now 33 days.

Meanwhile, the East Midlands is the slowest market with the average home taking 67 days to come on offer.

Most of Britain’s slowest markets are close to the coast, a hangover from the pandemic property boom.

Many coastal areas fared particularly well during the pandemic, as people rushed to more rural areas, and places along the coast, such as Scotland, Cornwall, Wales, Devon and Northumberland, fared particularly well.

However, a reversal of this trend has resulted in a glut of homes for sale in coastal locations, with not enough buyers wanting to purchase them.

Nine of the ten slowest markets to find a buyer outside of London are coastal cities, according to Rightmove.

It takes an average of 118 days for a property in the Devon coastal town of Brixham to find a buyer. It was in the spotlight earlier this year after water contamination affected supplies.

In Skegness, Lincolnshire, sellers have to wait an average of 115 days and in Sandown, on the Isle of Wight, 109 days.

Falling out of love with the beach: Nine of the ten slowest markets to find a buyer are coastal towns, including Brixham in Devon and Minehead in Somerset.

It’s no surprise that most of Britain’s fastest property markets are in Scotland.

Rightmove says the ten fastest locations to find a buyer are in Scotland, and that all current hotspots are selling faster than a year ago.

Sellers in Carluke in Lanarkshire and Giffnock in Glasgow barely have to wait more than two weeks on average for their home to be purchased.

Douglas Nicol, director of Nicol Estate Agents in Giffnock, says: ‘The local market in Giffnock remains buoyant, with demand often outstripping supply.

‘That’s why when properties come on the market, we find that they sell out very quickly.

“Giffnock is one of Glasgow’s most popular suburbs, with excellent local services, transport links and some of the best performing schools in Scotland.”

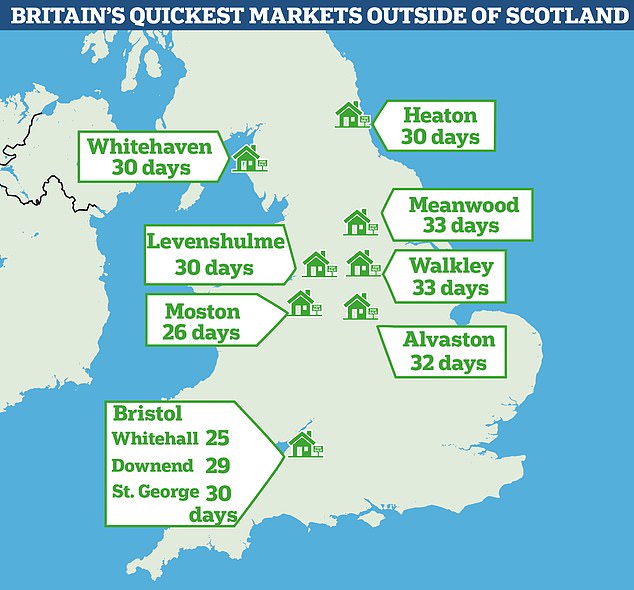

Outside of Scotland, the East Bristol suburb of Whitehall is the fastest housing market with sellers waiting an average of 25 days to find a buyer.

In fact, the suburbs of Bristol are clearly in high demand at the moment. In total, the free districts make up the three fastest property markets outside of Scotland. The other two are Downend and St.George.

The Manchester suburb of Moston also appears to be very hot at the moment, with houses selling in an average of 26 days. That’s 16 days faster than last year.

London: the capital of extremes

Central London towns such as Knightsbridge, Chelsea and Victoria are the slowest London markets to find a buyer this year, according to Rightmove.

A seller in the posh Knightsbridge district, where the average asking price is over £4m, is waiting a whopping 135 days on average.

The housing market in Knightsbridge is slow at best, but still 24 days slower than last year on average.

The Chelsea and Victoria areas of London are also slow, with the average seller waiting 100 days or more to find a buyer.

Again, price is likely to play a role as both areas are premium locations in London with fewer mass market buyers.

London’s fastest markets are further from the centre, with sellers in Walthamstow, Stoke Newington and Dagenham currently finding buyers the quickest.

Sellers in Walthamstow only have to wait an average of 32 days for a buyer, four days less than last year.

Meanwhile, sellers in Stoke Newington are waiting 40 days to accept the offer, compared to an average of 50 days last year.

Tim Bannister, property expert at Rightmove, said: “In London, commuter areas such as Walthamstow and Dagenham are leading the way in finding buyers more quickly, probably driven by well-connected transport links and more affordable prices in comparison. with the central areas.

“By contrast, more exclusive central locations such as Knightsbridge and Chelsea are taking longer to find buyers, as these high-end markets typically move at a different pace.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.