Table of Contents

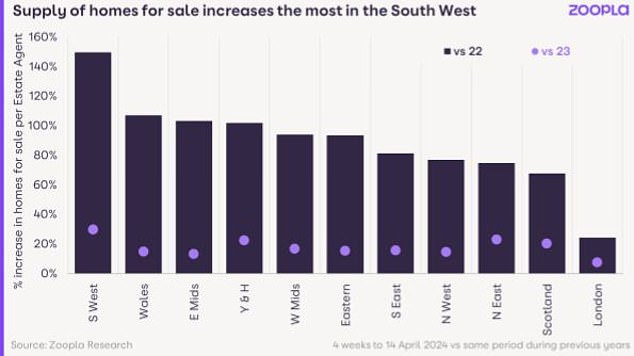

According to Zoopla, the number of homes for sale is at its highest level in five years, raising questions about whether house prices could fall further.

The real estate portal revealed that there are 20 percent more homes on the market than a year ago at this same time.

Zoopla said it marked a “huge increase” in supply and was double what was available at the same time in 2022.

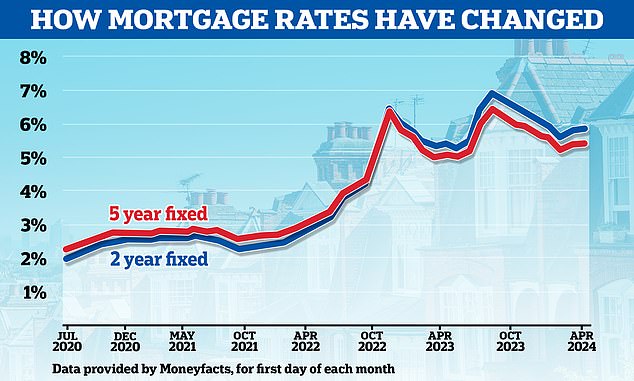

However, as more homes hit the market, mortgage rates have risen again, meaning some buyers may be forced to postpone their plans.

Some experts suggest this will cause housing supply to exceed demand and could cause prices to fall in some areas.

Overstocked Listings: Supply is highest in the Southwest, where agents have 2.5 times as many homes for sale compared to spring 2022.

Jonathan Hopper, chief executive of buying agents Garrington Property Finders, said: ‘Falling interest rates are no longer helping buyers, but an increase in the number of homes for sale is.

‘Shoppers now have a much wider range of stock to choose from than just a few months ago.

‘The delicate balance between supply and demand is the most important factor affecting house prices and, in many areas, this mismatch is large and growing.

“Many real estate agents now report that the number of homes coming on the market is four or even five times greater than the number of potential buyers showing interest.”

Izabella Lubowicka, senior property researcher at Zoopla, added: “The current surge in supply on the market during spring is giving potential buyers more choice than ever, but affordability continues to impact budgets.

“Sellers putting their homes on the market should keep this in mind and ensure they price their property realistically to achieve the sale.”

Higher mortgage rates dampen demand

At the beginning of the year, it seemed that the only way out was to lower mortgage rates. However, since the beginning of February mortgage rates have risen again.

Financial markets have backtracked on earlier predictions of interest rate cuts, with a “higher for longer” scenario now looking more likely.

Earlier this year, markets were predicting as many as six or seven base rate cuts in 2024. Now that number has dropped to just two or three.

Mortgage lenders have responded by adjusting their prices upward. Today, Barclays, HSBC, NatWest, Accord and Leeds Building Society have all increased mortgage rates.

Peter Stimson of MPowered Mortgages believes excess supply is likely to keep prices low until interest rates start to fall again.

Peter Stimson, head of product at mortgage lender MPowered, believes current mortgage rates could drive down house prices.

“The rise in house prices in January now seems as forgotten as most people’s New Year’s resolutions,” Stimpson said.

‘The avalanche of mortgage rate cuts seen earlier in the year boosted both demand and supply as the housing market woke up from its 2023 slumber.

‘But interest rate cuts have not only stopped, but in many cases have been reversed. As a result, mortgage costs remain high and this is cooling demand for housing.

‘With thousands more properties coming onto the market, buyers can be more selective, especially in areas where supply exceeds demand.

‘Consequently, we are increasingly seeing a confrontation in Mexico between buyers and sellers. Realistically priced properties are selling quickly, but there are less desirable and optimistically priced homes out there.

“While the increase in supply is welcome (it is critical for a free-flowing market), it is likely to keep prices low until interest rates begin to fall again.”

Which areas have the most homes for sale?

Supply is highest in the southwest, where agents have 2.5 times more homes for sale than in spring 2022, according to Zoopla.

Cornwall has also seen the number of available homes increase by 159 per cent compared to spring 2022.

In North Kesteven, Lincolnshire, the number of homes available has increased by 155 per cent, while in Bournemouth, Christchurch and Poole there are 146 per cent more homes available on the market.

Unsurprisingly, it is taking longer to sell homes in these locations than in other parts of the country.

For example, it takes an average of 20 days longer to sell a property in Cornwall compared to spring 2022, and 23 days longer in Bournemouth, Christchurch and Poole, compared to a national average of 16 days.

On the rise again: mortgage rates have been rising since the beginning of February

Sam Turner, director of Kivells estate agency in Cornwall, said: “There has been a huge increase in the number of new properties coming to the market, which is giving buyers more choice.”

“This also helps the moving process for our suppliers as they have more choice in their subsequent purchases.”

Wales and the East Midlands are also seeing an increase in the number of homes available for sale, according to Zoopla.

In these locations, more than 60 percent of the stocks currently on the market are priced above the regional average, indicating a potential mismatch between what buyers can afford and what is available to purchase.

In the East Midlands, the increase in supply is most pronounced in more rural areas such as south Lincolnshire and Derbyshire, including the Peak District. These areas also have prices above the regional average.

This indicates that the stock of homes for sale in higher value markets is moving more slowly, as affordability remains a greater challenge for potential buyers in areas where larger budgets are required.

Increase in larger homes coming to market

The average agent outside London now has twice as many homes with four bedrooms or more available compared to February 2022, according to Zoopla.

The selection of three-bedroom homes has also improved, with 25 per cent more on offer compared to this time last year.

“At the top end of the market, behind the increase in the number of sellers there are usually two ‘D’s: debt and downsizing,” says buying agent Jonathan Hopper.

Jonathan Hopper, chief executive of buying agency Garrington Property Finders, says the balance between supply and demand is the most important factor affecting house prices and the gap is growing.

‘Every month, thousands of homeowners with a large mortgage see their monthly payments increase by hundreds or even thousands of pounds when they remortgage.

‘For some, the increase in cost is too much to bear and they have to move to a smaller place just to keep their monthly expenses the same.

‘We are also seeing a steady increase in the number of baby boomers moving to smaller properties, partly to reduce their expenses, but also to free up retirement savings.

‘Millions of Brits consider their property to be their pension, and some are starting to cash in on those years of accumulated capital.

“Meanwhile, the high cost of borrowing means getting the home they want remains difficult for some buyers, but better availability should keep the housing market humming and cap prices while we wait for interest rates to start falling again in the future. second half of the year.’

He adds: ‘For buyers, that extra choice gives them power. With supply outstripping demand in some areas, price increases have faded and viable buyers with their financing may find themselves in a very strong negotiating position.

‘As a result, sellers may need to rein in their price aspirations, especially those trying to sell larger homes outside London, for which supply is especially strong.

Could house prices continue to rise from now on?

It would seem that house prices are more likely to fall rather than rise in the coming months.

However, there are those who will argue that the increase in housing supply means that house prices will likely stagnate, rather than fall.

“It’s important to keep the increase in homes for sale in perspective.” said Andrew Wishart, senior economist at Capital Economics.

‘The survey carried out by Rics shows that the number of homes for sale remains very low compared to historical standards.

‘And with unemployment still very low, the biggest increases in mortgage costs already behind us and lenders offering generous options for borrowers struggling to meet their payments, I don’t expect an increase in the number of homeowners being forced to sell their houses.

“Instead, we believe that interest rate cuts beginning later this year will revitalize the housing market in 2025, allowing demand to recover and an increase in house prices of 5 percent.”

Simon Gerrard, managing director of Martyn Gerrard Estate Agents, said that rather than supply outstripping demand, they are seeing the opposite in their offices.

‘These figures may show an increase in supply in property markets outside London and other major UK cities, but we are certainly not seeing any significant or sustained increase in the supply of available housing in urban areas.

‘There may be a small seasonal increase in the number of homes on the market, which would be expected given we are approaching spring.

“Overall, however, the market remains trapped in a vicious cycle of high demand, low supply, and the hope of owning a home is out of reach for many.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.