Table of Contents

- The cheapest fixed rate energy deals may not be available again until at least March 2026

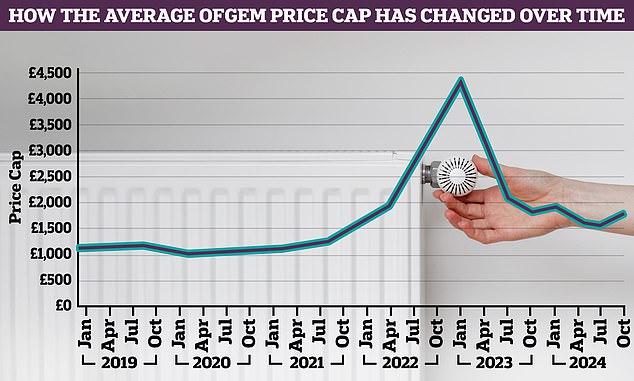

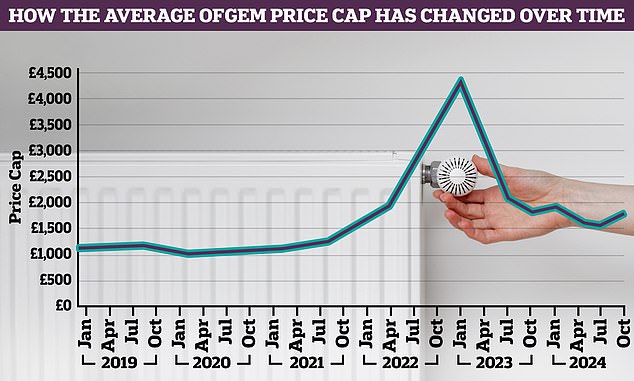

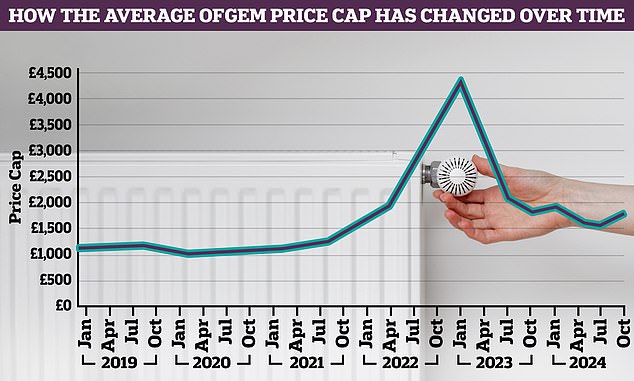

Households face paying higher than expected energy bills until 2026 as regulator Ofgem plans to extend regulations keeping prices high.

Ofgem rules mean energy companies cannot offer cheaper deals to new customers unless they also offer them to existing ones.

The regulator introduced this “procurement-only tariff ban” (BAT) in October 2022 to prevent energy companies from using the classic tactic of undercutting each other to attract new customers as prices rise. they shoot

Double whammy: Not only is Ofgem’s price cap much higher than historical norms, but the number of households applying it is at near record levels due to a lack of cheap fixed energy deals.

The idea was to protect the energy market and prevent a repeat of the widespread collapses of gas and electricity companies in 2021, when 29 went bankrupt.

But BAT is part of the reason energy bills remain high, £1,717 a year for the typical household – Ofgem’s price cap level.

This is because energy companies have no incentive to take back cheaper fixed rate deals and instead rely on more expensive gas and electricity deals, limited by the price cap.

Ofgem originally planned to scrap the BAT in October 2024, then extended it until at least March 31, 2025, and now plans to keep it in place until March 2026, according to its latest plans.

Ofgem wants to maintain the BAT so that customers do not face a “loyalty penalty”, where prices rise unless they abandon the service.

The regulator also said maintaining the BAT was good for indebted customers, who would otherwise be unable to switch but can still access cheaper deals through their current energy company.

But maintaining the BAT means delaying the return of competitive fixed-rate energy deals, which are the main hope of energy bills falling to more “normal” levels.

An Ofgem consultation on the BAT said: ‘We recognize that removing the BAT could reduce prices for active consumers in the short term. Our decision to keep it remains very balanced.’

Richard Neudegg, of Uswitch, said: ‘Ofgem’s own analysis suggests that the BAT softens price competition between providers on those fixed deal options, which risks pushing up fixed deal prices to a higher price. higher than they would otherwise be.

‘Ofgem’s main argument for extending the BAT for a further year is that it will promote greater confidence in the energy market.

‘They seem to think it is worth the risk of fixed deals being more expensive than they would otherwise be if more customers could access them without switching providers.

‘We don’t think Ofgem has found the right balance yet. Even if it feels like protection, it doesn’t help consumers if in practice everyone ends up paying more than they would otherwise.’

Ofgem will make a final decision on what to do with the BAT in November.

SAVE MONEY, MAKE MONEY

3.75% APR Var.

3.75% APR Var.

Chase checking account required*

5.05% solution after one year

5.05% solution after one year

Prosperous momentum for Al Rayan

free stock offer

free stock offer

No account fee and free stock trading

4.84% cash Isa

4.84% cash Isa

Flexible Isa now accepting transfers

Trading Fee Refund

Trading Fee Refund

Get £200 back in trading fees

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence. *Chase: 3.69% gross. T&Cs apply. 18+, UK residents