- The North East of England has the highest percentage of homeowners in arrears in the UK

Homeowners in some parts of the north of England are more than twice as likely to be behind on their mortgage payments than those in the south, new research has revealed.

With interest rates rising sharply from record lows in recent years, mortgage arrears have risen steadily, according to analysis of Financial Conduct Authority data by long-term lender April Mortgages.

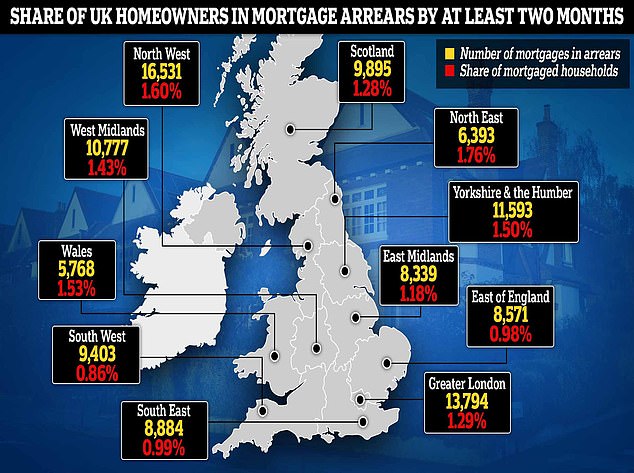

According to FCA figures, there are more than 115,000 borrowers in the UK who are at least two months behind on their monthly payments.

North-south divide: New analysis of FCA data from April Mortgages reveals a clear north-south divide with the lowest levels of arrears in the south west

It showed that the North East has the highest proportion of borrowers who have defaulted on at least their last two mortgage payments.

Up to 1.76 percent of all mortgage borrowers in the region are in default. Next is the Northwest, where 1.6 percent of borrowers are in default.

Mortgage arrears occur when people fall behind on their mortgage payments.

Total arrears rose to £21.9bn, according to Bank of England figures published last month, up 32 per cent on a year ago and the highest recorded since 2014.

In the south of England, mortgage arrears are much lower, according to FCA figures.

This is despite the average property price being higher, which in turn leads to larger mortgages.

For example, the average new mortgage amount for a property in the north of England is currently just £160,000, according to UK Finance.

In the South West the average new mortgage is just shy of £230,000 and in London £400,000.

Falling behind: More than 115,000 mortgages at least two months in arrears, according to analysis of FCA data by long-term lender April Mortgages

“The number of UK homeowners in default is rising and these latest figures show clear evidence of a north-south divide,” said Rachel Hunnisett, director of mortgage distribution at April Mortgages.

“Homeowners in some areas of northern England and Wales appear to have been disproportionately affected by the combination of rising costs of living and higher mortgage rates.”

“Although inflation has fallen this year, the cost of living continues to rise and households without disposable income or significant savings to fall back on are finding it harder to maintain their mortgage payments.”

While the lowest mortgage rates are currently just below 4 percent, mortgage rates skyrocketed last year, meaning some unlucky borrowers will have rates above 6 percent today.

Even now, many people who buy or remortgage will find themselves getting rates of around 5 percent or more, particularly those with lower credit scores.

In fact, the average five-year fixed mortgage rate across the market is currently 5.09 per cent, according to Moneyfacts, and the average two-year fixed rate is 5.41 per cent.

This means that the typical borrower who sets a five-year term with a 25-year repayment term can afford monthly payments of £1,180 a month.

Rachel Hunnisett, of April Mortgages, adds: ‘Interest rates may have passed their peak, but many homeowners are paying more on their mortgage than in recent years and this is causing greater stress for borrowers.

‘If you are worried about rising interest rates, opting for a longer-term fixed rate mortgage can offer peace of mind and financial stability.

Locking in for longer means your monthly payments will remain predictable, regardless of how the market fluctuates.

“If someone is finding it difficult to keep up with their payments, talk to their lender as soon as possible about the options available to them to reduce the risk of falling into arrears.”