California’s largest insurer has issued a grim update for homeowners and businesses amid a growing crisis in the state.

State Farm says its fund used to cover claims in California will be depleted by 2028 unless it can charge up to 52 percent more to insure properties.

That would mean the company would not be able to pay for repairs in the event of another wildfire in the state like those in recent years. In fact, the company says such an event would lead to bankruptcy.

The grim warning came in filings submitted to the California Department of Insurance on Sept. 10, as part of a standoff between State Farm and the regulator. State Farm insures 3.1 million homes there.

Earlier this summer, State Farm bosses gave the department an ultimatum: Let them raise home insurance rates for millions of citizens, or they’ll eliminate coverage entirely.

Given that State Farm writes one-fifth of the policies, this would be a blow. It’s not simply a matter of Californians switching suppliers: their rivals are doing the same.

Several insurers, including Allstate, Farmers Direct and State Farm in a previous move, have limited coverage or stopped operating entirely in the Golden State.

State Farm has asked California to allow it to raise its home insurance prices once again

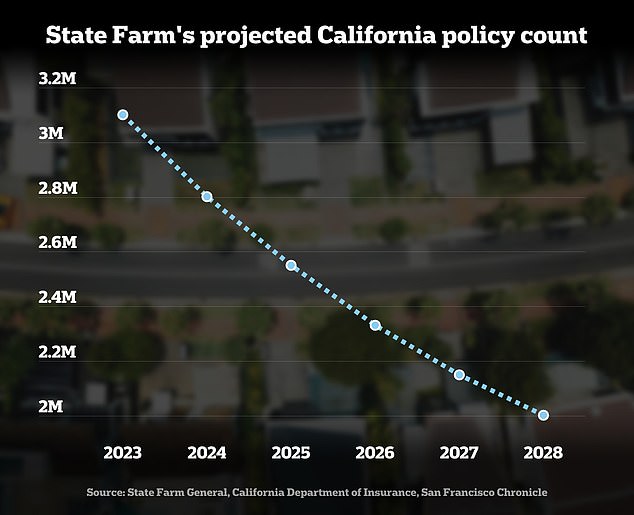

In the same presentation, State Farm showed how the number of properties it covers will decrease in the coming years.

The company insures 3.1 million homes and tens of thousands of businesses in the state, but warned that number could drop to just two million by 2028.

State Farm stopped writing new homeowners insurance in the state in May of last year as part of its battle to raise prices.

Then, this summer, it refused to renew tens of thousands of policies in California.

Together, these factors mean that the number of Californians it covers will decline steadily and rapidly.

The latest figure projections have been calculated assuming that the company will lose policies at a similar rate to what it is currently losing, even for customers who chose to leave or were cut off for non-compliance.

In an attempt to avoid insolvency, State Farm says it wants to raise prices by 30 percent for homeowners, 36 percent for condo owners and 52 percent for renters.

If granted, the sharp increase in premiums would allow State Farm to collect about $1.6 billion over five years, restoring its claims-paying surplus to 2017 levels. the San Francisco Chronicle reported.

The company’s surplus was hit hard by the wildfires that devastated California in 2017 and 2018, forcing it to pay millions to customers.

As climate change increases the likelihood of wildfires, floods and other natural disasters, the insurer argues it needs to raise premiums to keep up with claims.

If it is not allowed to raise its premiums, the insurer says its surplus will fall to less than $200 million in 2028, a decline of $2.2 billion over ten years.

The company said in its filings that a wildfire season like 2017, which collectively cost insurance companies $12 billion, would put it out of business.

On this basis, it asks the State to sanction it by increasing its rates by 30 percent for homeowners, 36 percent for condominium owners and 52 percent for rental housing.

This year alone it raised its rates by an average of 20 percent for homeowners across the state.

Declining State Farm insurance customers in California will hit its surplus

State Farm has cited increased wildfires as a need to increase premiums (Blue Ridge Fire in 2020)

The California Department of Insurance is currently evaluating State Farm’s financial health, which it will use to determine whether or not to grant the increase.

The earliest an increase would appear on State Farm customers’ bills would be 2025, according to the filings.

State Farm was expected to have an approximate net worth of $143.2 billion in 2021.

At the time, the company was generating about $87.6 billion in annual revenue, and last February it issued a statement saying its net income for the previous year was an impressive $1.2 billion.

That was more than 100 percent more than the previous year, when the Illinois-based insurance provider earned $588 million in revenue.

More than half of Californians say they have been affected by property growth or had their insurer cancel them in the last year. Because there are so few companies offering coverage, they can’t simply switch providers.

State Farm did not respond to DailyMail.com.