Optimistic home sellers added almost £3,000 to average asking prices after the Bank of England cut interest rates.

Rightmove said sellers are gaining confidence in the autumn property market, with the average price of newly listed homes increasing by £2,974 to £370,759.

The property listing giant said the 0.8 percent monthly jump in sales prices was double the long-term average for September.

But Rightmove has warned sellers should not overstate their ambitions, with the average time it takes to sell a home standing at 60 days, three days longer than a year ago.

Moving forward: Average sales prices have begun to rise again with sellers encouraged by falling mortgage rates

However, Rightmove said there were clear signs of improvement in the property market, with falling mortgage rates encouraging buyers and a 27 per cent rise in home sales compared with the same month last year.

Mortgage rates have continued to fall after the Bank of England cut the base rate in early August. The Bank’s rate-setters meet again this week and economists are divided on whether interest rates will fall again.

Tim Bannister of Rightmove said: ‘Autumn action got off to an early start with a strong pick-up in activity from both buyers and sellers compared to the subdued market this time last year, continuing the momentum from the better-than-expected summer market.

‘The certainty of a new government followed by the first cut in bank rates in four years has energised the market, opening a window of opportunity for players to act.

“Some of this will be pent-up demand from those who have had to hit the pause button until now. However, windows of opportunity tend to need a boost from good news to stay open, and there are still uncertainties ahead that could cause some of the current market activity to unwind.”

Sales prices rose 1.2 percent year-on-year, Rightmove said.

This burst of energy in the housing market comes ahead of the Autumn Budget on October 30, which Chancellor Rachel Reeves and Prime Minister Keir Starmer have set up to be a gloomy affair.

After Labour made a manifesto pledge not to raise income tax, national insurance, VAT or corporation tax rates, pundits fear a wave of tax increases elsewhere, with rumours of possible raids on capital gains, inheritances and pensions.

An overly gloomy budget is likely to weigh on the property market and first-time buyers also face the threat of a stamp duty hike as their exemption for homes under £425,000 expires in April next year.

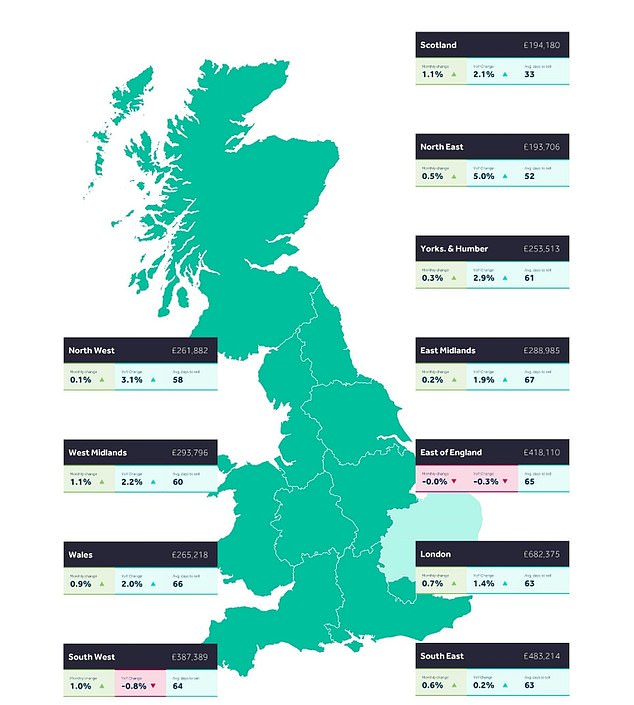

Asking prices rose in all areas of the UK covered by the Rightmove report, except in the East of England, where they remained stable last month.

Mr Bannister said: ‘Those who move in early autumn, act quickly and take advantage of the best market conditions, are choosing quality homes for sale.

Homeowners thinking of coming to market soon should not let increased activity make them overly optimistic and should price their listings competitively.

‘With affordability still very limited for many, discerning buyers are taking their time to explore the growing number of homes for sale and find the perfect home at the right price.

‘There are questions about how the fall release announcements will impact the market, but until then we expect market momentum to continue as the fall action progresses.’

Property inflation: Over the past five years, average sales prices have risen from just over £300,000 to £370,000