He has been friends with King Charles for years – but interior designer Laurence Llewelyn-Bowen has said he has been ignored by the monarch since his coronation.

Talking about My Dirty Laundry podcastLaurence, 58, said he was not into the “purple pyjamas” Charles wore on his big day last May and believes he has made Westminster Abbey look like a “nursing home”.

He said: ‘I haven’t seen Charles since the coronation. I think he might be cold shouldering me. I was a little rude with his purple pajamas and I’m not sure, I think I just lost my knighthood.

‘But you know I think the purple pajama jibe was justified. I stand by it.’

Asked what the problem was with the ensemble, Laurence said: ‘They had the wrong shade of purple. Now I just want to say that.’

Laurence Llewelyn-Bowen, (centre) has said he has been getting the ‘cold shoulder’ from his friend King Charles since the coronation last May – pictured together in 2012

He said: ‘I haven’t seen Charles since the coronation. I think he might be cold shouldering me. I was a little rude with his purple pajamas and I’m not sure, I think I just lost my knighthood.

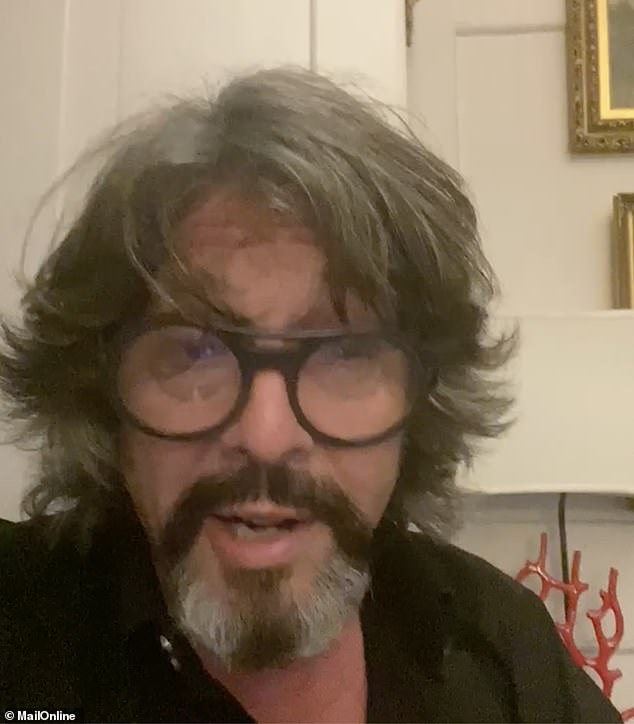

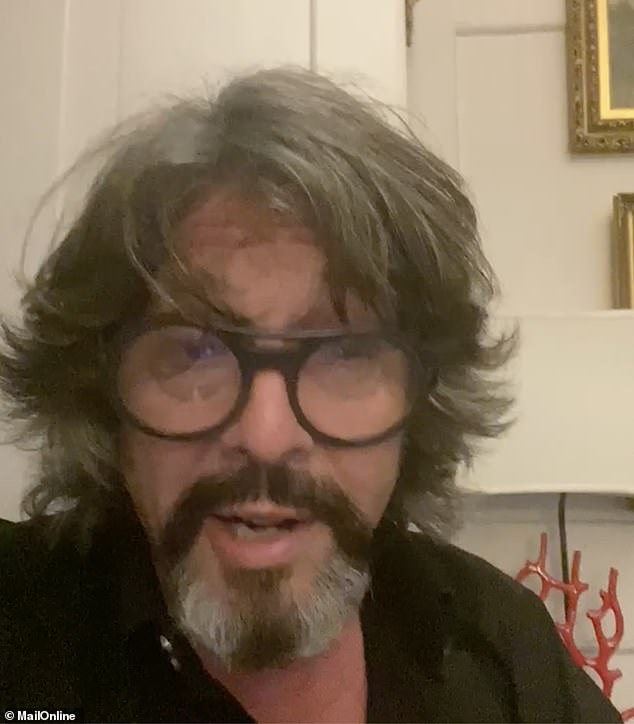

Speaking on the My Dirty Laundry podcast (pictured), Laurence claimed King Charles has made Westminster Abbey look like a ‘nursing home’

‘They were Pantone 739. They must be Pantone in 742. No, I just think the thing is, the crown was amazing. You know, the whole thing. Nice, nice, nice’.

‘Let’s see what happens around Christmas. If we get the Christmas card, I know I’ll be back in the fold.’

Adding insult to injury, he said: ‘My big thing at the moment with all these big royal events is that Westminster Abbey is just very, very overlit. I think, you know, it looks like a nursing home.

‘It looks like the cleaners have left the fluorescent lights on, and actually it’s supposed to be beautiful and romantic and kind of candlelit and powerful and timeless and timeless.

“And at the moment, you know, there’s something of the mall in it. You know, it just looks a little too retail park-like.’

He continued: ‘If I’m still at the next royal engagement, you know, can we turn the lights down a bit? As Creative Curator of Blackpool Illuminations I think I should be involved.

‘I think we need a bit more Blackpool in the coronation don’t we? I can just imagine Palace picking up the phone and saying: “You were right. We’re going for more Blackpool”.’

Laurence once bought a 10,000 sq ft barn conversion from Charles and he owns a £1.6m manor in Gloucestershire as well as a holiday home in Cornwall.

He said: ‘Westminster Abbey is just very, very overlit. I think, you know, it looks like a nursing home. It looks like the cleaners have left fluorescent lights on, and actually it’s supposed to be beautiful and romantic and kind of candlelit and powerful’

Back in 2022, Laurence appeared on This Morning and recalled designing the floors of Buckingham Palace in his early career, which the late Prince Philip ‘hated’ (pictured in 2010)

He said the king used to write to him at his home in Gloucestershire, but not all his family members were unimpressed.

‘We got a letter from him years ago. I showed my young grandson Albion… from when King Charles was Prince of Wales.

And he was very unimpressed with his handwriting. I like that. You know, you know, forget all that kind of seal and flunkie judgment and you know, the real, this is a historical document that didn’t like his handwriting, it was very messy.

“Look, I reckon if King Charles hadn’t been King Charles, probably would have been a GP. As far as I’m concerned, there could be 50 grams of diazepam in that letter, you don’t know, it could be what any time and make enemas.’

Back in 2022, Laurence appeared on This Morning and recalled designing the floors at Buckingham Palace in his early career, which the late Prince Philip ‘hated’.

He said: ‘I helped create this floor and it was an amazingly fine moment and then 10 or 15 years later, when I was involved with the Cutty Stark Trust, I met Prince Philip.

“I said to him (Prince Philip), ‘the floor we’re standing on, I designed it,’ and he rocked back and forth on his feet and said, ‘I never liked that,'” the designer laughed.

In 2018, Laurence told The Daily Telegraph that his neighbours, Charles and Camilla, were ‘forever popping in to borrow more gin’.

And it seems the connections go way back. Laurence’s wife Jackie used to plan parties for Princess Diana.

Laurence regularly bumped into Prince Harry and his daughters attended the same school – Marlborough – as Kate Middleton.

My Dirty Laundry Podcast is out now. Visit @mydirtylaundrypodcast for more information.