Americans are once again facing the prospect of a Trump presidency – but what does this mean for their economy?

Money is likely to be a key issue in the election. A Gallup poll found that one-third of voters believe economic problems are the most important issue facing the country.

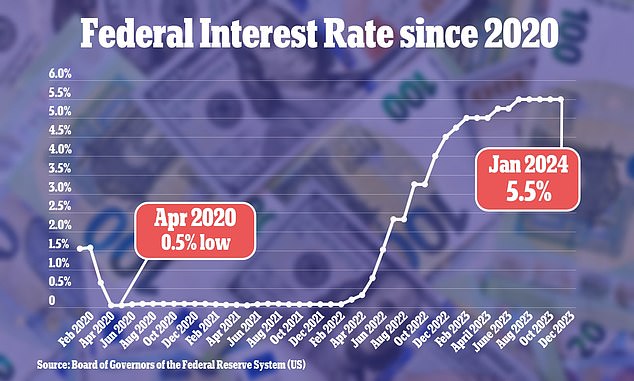

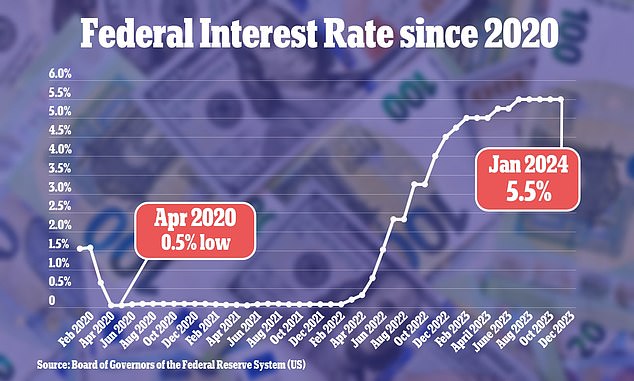

With inflation still hot and interest rates at a 22-year high, household finances have been a contentious issue for Biden. By comparison, a recent survey by CBS News and YouGov found that nearly two-thirds of registered voters thought the economy under Trump was good.

Here, DailyMail.com looks at what another Trump term could mean for the average American household…

Americans are once again facing the prospect of a Trump presidency – but what does this mean for their economy?

With inflation still hot and interest rates at 22-year highs, this is proving to be a weakness for Biden and a strength for Trump

Extension of tax relief and jobs act 2017

Trump made sweeping changes to the tax landscape through the Tax Cuts and Jobs Act (TCJA) in 2017.

This included lowering individual income tax rates, nearly doubling the standard deduction, and raising the federal estate tax exemption. It also lowered the corporate tax rate to 21 percent – the lowest level since 1993.

However, these cuts are due to expire on January 1, 2026 – a date called “Sunset Day” by economic planners.

CPA Tom Wheelwright said anyone with a 401(K) will be affected by increases in the corporate tax

As a result, the income tax bracket could return to pre-2017 levels – which were almost 3 percent higher. For example, the current top tax rate is 37 percent, but this would increase to 39.5 percent if the law is not extended.

Those cuts saved the average American household $1,600 each, according to estimates from Tax Policy Center.

Trump has not confirmed whether or not he will extend the TCJA, and experts disagree on whether he will. A research note from Capital Economics said there is little “opportunity” for Trump to be so generous.

However, financial planners told DailyMail.com they expected the former president to stick to his flagship policy.

It is also possible that Biden will extend many of the cuts, but he has made it clear that he plans to raise the corporate tax rate to 28 percent.

Chartered accountant Tom Wheelwright told DailyMail.com: ‘The corporate income tax affects all small businesses and even anyone with a 401(K) because higher taxes will hurt corporate profitability and hit stocks as a result.

‘So anyone investing in the stock market will benefit from Trump sticking to low corporate taxes.’

New Jersey financial planner Marissa Reale added: ‘We’ve seen in the last few years that Biden is much less business-minded than Trump. So it will be the small businesses that win if Trump is back in power.”

The law also doubled the lifetime estate tax credit from the 2017 value of $5.49 million for individuals up to $11.18 million — and this has continued to increase in the years since.

Under current rules, an individual can pass on $12.92 million and a married couple can pass on $25.84 million to heirs before being hit with federal estate taxes.

If the TCJA is repealed, the exemption could effectively be cut in half, leaving a person with a taxable estate worth more than approximately $7 million subject to federal estate taxes if they don’t plan ahead.

Rebound in inflation – and higher for longer interest rates

Trump made international tariffs central to his first term, and he promises to do the same again.

Between 2017 and 2021, his administration implemented levier on, among others, China, Mexico and the EU. Biden has maintained some of those tariffs.

Speaking to CNBC on Monday, Trump told reporters: ‘I’m a big believer in tariffs.’

He has proposed a base tariff of 10 percent on all US imports and a tax of 60 percent or higher on Chinese goods.

The latest data puts the Fed in a sticky position as to when to start cutting interest rates – which are currently at their highest level since 2001

Inflation rose slightly to 3.2 percent in February as prices were pushed up by housing costs and gas

However, researchers at Capital Economics warned that this would only make goods more expensive for Americans – triggering a rebound in inflation. The annual inflation rate was 3.2 percent in February, down from a peak of 9.1 percent in June 2022.

Rising prices, in turn, will keep interest rates high, which has a knock-on effect on mortgage and credit card interest rates. Currently, the Fed’s benchmark interest rate is between 5.25 and 5.5 percent – the highest rate since 2001.

The Capital Economics note said: “His tariff proposal would likely trigger a rebound in inflation that could persuade the Federal Open Market Committee to raise interest rates.”

Dollar stronger for longer

An unexpected benefit of high interest rates is that they often strengthen the US dollar.

This is because higher yields attract investment from investors abroad who seek higher yields on bonds.

If, as experts predict, Trump’s foreign tariff policy pushes up inflation and keeps the Fed in its tightening cycle, then the dollar will remain ‘stronger for longer’ or ‘even ‘rise significantly’, Capital Economics said.

Paxton Driscoll, of Florida Financial Advisors, said: “From a financial perspective, I don’t see very many ordinary people losing out on a Trump presidency”

Strong stock market

Regardless of who wins the election, economists generally agree that the stock market will remain strong.

The S&P 500 ended 2023 with a 24 percent gain and a record high. These gains have been fueled by a boom in AI and technology stocks.

The so-called ‘Magnificent Seven’ stocks – which include Meta, Google, Amazon and Tesla – saw their values rise 107 percent last year.

Economists predict that stocks will continue to rise this year, regardless of who is in power. Researchers at Capital Economics said there were no risks associated with a Trump presidency that are “significant enough to burst this bubble.”

Paxton Driscoll, of Florida Financial Advisorssaid: ‘From a financial perspective, I don’t see very many ordinary people losing out on a Trump presidency.’