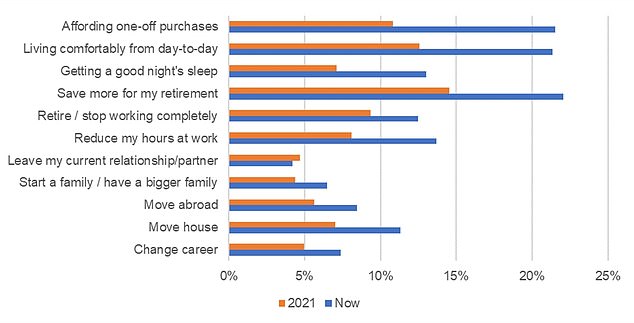

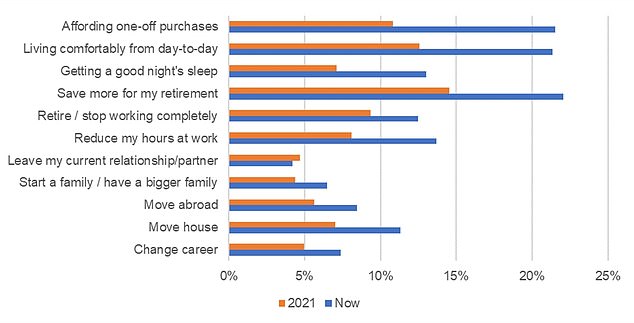

More than a fifth of mortgaged homeowners say their payments are preventing them from saving more for retirement, according to a new study.

The findings come from a study of the financial attitudes and experiences of 5,000 UK adults, commissioned by the Equity Release Council and Canada Life.

An estimated 22 percent of homeowners with mortgages, about 2.8 million people, find their retirement savings inhibited by mortgage costs.

This figure has skyrocketed since 2021, when only 14 percent of homeowners said their mortgage was preventing them from saving more for retirement.

Modified plans: an estimated 2.8 million people find that mortgages prevent them from saving more for the future

The average two-year fixed-rate mortgage rose from a low of 2.22 per cent in 2021 to a high of 6.86 per cent in the summer of last year, according to Moneyfacts.

On a £200,000 mortgage repaid over 25 years, that’s the difference between paying £869 a month and £1,396 a month.

Although the average two-year fix has fallen back to 5.74 percent since rates peaked last summer, homeowners nearing the end of their fixed-rate mortgages still face a significant financial shock .

Among those over 55 who still had mortgages, 18 percent said the payments were preventing them from saving more for retirement.

This group’s mortgage payments are likely to be lower because they will be closer to the end of the term.

But nearly one in six of this older group said their mortgage debt burden was preventing them from fully retiring, while one in ten said their loan was preventing them from reducing their working hours.

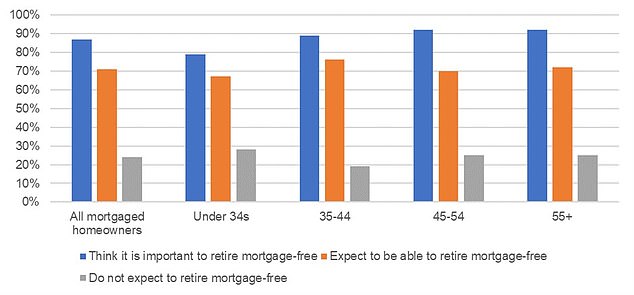

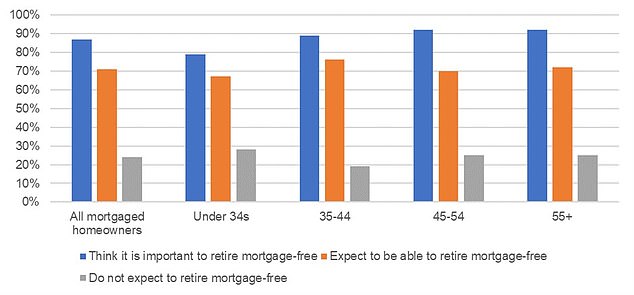

The study also showed that 90 percent of homeowners believe it is important to be mortgage-free when they retire.

A mortgage for life: One in five respondents does not expect to retire without a mortgage, while a further 19% are unsure

However, the reality is likely to be very different: Only two-thirds of those with mortgages believe they will pay them off before they retire, and only 60 percent of those who are 55 or older.

Among people 55 and older, one in five mortgaged homeowners does not expect to retire without a mortgage, while another 19 percent are unsure.

Younger generations of mortgaged homeowners are also less likely to feel it is important to retire mortgage-free.

The report also shows how the stress of managing mortgages – often involving larger sums and longer terms than previous generations – is having a significant impact on people’s wellbeing today.

Among all homeowners with a mortgage, 21 percent said their home loan debt prevented them from affording a comfortable day-to-day lifestyle, up from 13 percent in 2021.

Change in sentiment: Homeowners are finding that their mortgage is negatively affecting their lives much more than in 2021

Mortgage worries also keep 13 percent of people awake at night, preventing 11 percent from moving house and leading 7 percent to put their family plans on hold.

Jim Boyd, chief executive of the Equity Release Council, said: “With higher interest rates driving up many people’s monthly mortgage payments, this harsh reality is making it difficult for homeowners to prioritize retirement savings along with your mortgage and your broader bills.

‘While this might be something they can manage in the short term, the real concern with this rise in mortgage costs is the pressure it puts on people’s long-term financial resilience.

‘It is truly alarming that mortgage debt has become so inconvenient that people are having to postpone starting a family, ending a relationship or changing careers.

“Having to push back key milestones and life moments like this is not only discouraging but could ultimately be detrimental to society as a whole.”

Tom Evans, CEO of Retirement at Canada Life, says: “Retirement seems like a distant dream for many, and having worked hard all your life, it is logical to expect or even expect to be mortgage-free when this milestone is reached.” .

‘However, as recent years have shown us, unexpected changes can occur and plans can be turned upside down.

“Therefore, many of us will face the possibility of having to adjust the way we live in retirement.”

Older homeowners turn to equity release

Over the last five years, people aged 55 and over have taken out 201,575 new equity release plans to support their finances in the future, according to the Equity Release Council.

This level of activity represents an increase of 30 percent compared to the previous five years, when 155,082 new plans were contracted between 2014-2018.

Equity release allows homeowners aged 55 and over to access some of the money tied up in their property, tax-free.

This can be used to increase income, pay for care, fund home improvements, or for other purposes.

Borrowers get a loan secured against their home, typically up to 49 percent of its value. With the most popular type of plan, a lifetime mortgage, they remain the sole owner.

The money released, plus accrued interest, is returned after the patient dies or enters a long-term care facility, although some plans have the option to return some of the money sooner, subject to certain limits. Early repayment charges above a stated value may apply.

The study found that almost one in three homeowners believe that accessing property wealth in old age can improve their finances and increase their retirement income – a significant increase from 25 per cent in 2021.

More than one in four now believe that a retirement mortgage could be a useful way to boost retirement income, an increase of five percentage points from 2021, when 21 per cent felt that way.

Canada Life’s Tom Evans added: “For those considering releasing equity, it’s important to do a lot of research, discuss it with your family first, and then hire a professional financial advisor.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.