Table of Contents

High street shops and hospitality businesses are facing a tough rise in business rates after the Chancellor’s “disastrous” failure to tackle the failed tax regime.

Bills will rise sharply in April next year after Rachel Reeves cut much-needed relief and refused to deliver on her promise to “replace” the tax with a fairer system.

The rise in business rates comes on top of other costs including a £25bn raid on national insurance, a 6.7 per cent rise in the minimum wage to combat inflation and a workers’ rights package that It costs businesses £5bn a year.

Balancing act: Chancellor Rachel Reeves (pictured) has been warned she is walking a “tightrope” as she seeks to deliver on her spending promises while avoiding another slump in bond markets.

Kate Nicholls, chief executive of UK Hospitality, said the budget represented just “the latest blow” for the industry and warned that “2025 will be painful”.

He added: “In the short term, the tsunami of labor costs that will occur in April will ultimately do more to hinder growth than encourage it.”

Luke Johnson, chairman of Gail’s Bakery and former boss of Pizza Express, said the business rates system needs “comprehensive reform to protect our towns and cities”.

Labor was elected with a stated commitment to “replace the business rates system so we can raise the same revenue but in a fairer way”.

And ahead of the Budget, businesses asked for a 75 per cent Covid-era discount to be extended to give them breathing room to take on other costs.

But to the industry’s disappointment, Reeves started a “conversation about how the Government can better deliver” on its promise to create a fairer system.

In a blow to thousands of businesses, it also reduced Covid-era business rates relief from 75 per cent to 40 per cent, capping it at £110,000 per organisation.

This means rate bills will more than double overnight, representing a huge £668m increase for shops, restaurants, pubs, cafes, hotels and other High Street businesses, according to property group Altus .

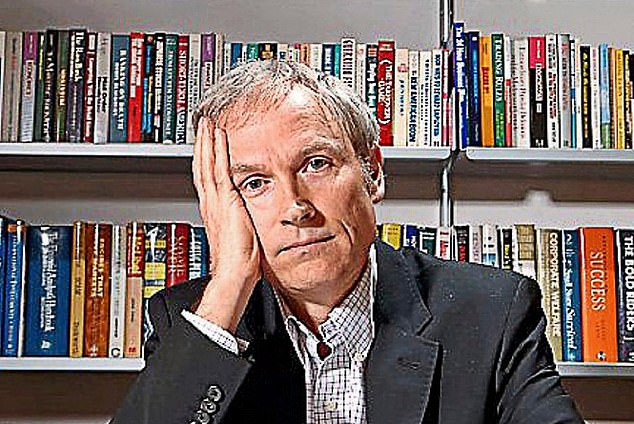

Exasperated: Luke Johnson (pictured), chairman of Gail’s Bakery, said the business rates system needs a “total overhaul”.

It said the average shop’s bill will rise from £3,589 to £8,613, while a typical restaurant’s tax will rise from £5,051 to £12,122.

Simon Green, head of commercial rates at property consultancy Gerald Eve, called this “absolute madness”.

Although Reeves raised the possibility of lower bills for some in the future, he said they would not arrive until April 2026.

More valuable properties – such as department stores used by companies such as Amazon, as well as city center department stores including Harrods – will face higher bills.

John Webber, head of commercial rates at estate agency Colliers, described the package as “desperately disappointing”.

Simon Dodd, the boss of the Young’s pub chain, said: “This urgently needed an overhaul.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.