The international security firm from which thieves stole $30 million in an Easter Sunday heist is facing new questions as a series of allegations of money loss, data breaches and poor security standards resurface.

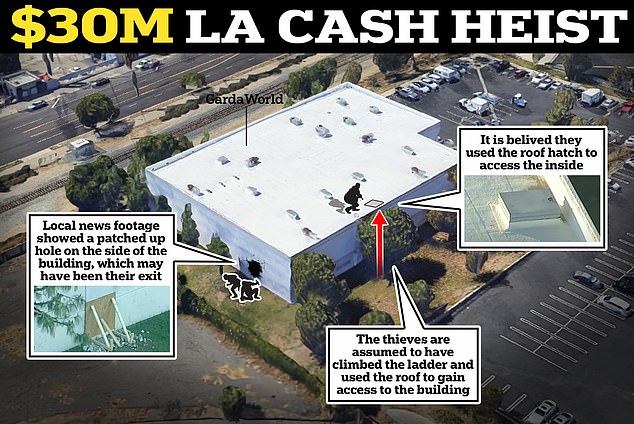

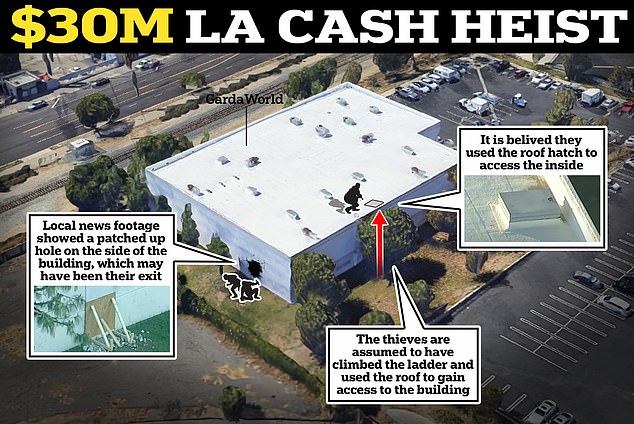

Brazen thieves stole $30 million under cover of darkness from the cash vaults at the GardaWorld facility in the San Fernando Valley, near Los Angeles, in one of the biggest heists in the city’s history on Sunday.

The security giant stores and transports money for America’s largest banks at facilities across the country, in addition to holding major government and diplomatic contracts and managing event security.

Following the robbery, serious questions were raised about the security of their sites after thieves managed to gain entry and no-one realized the cash was missing until the next day.

A series of historic scandals surrounding the multinational company have now resurfaced with reports of millions of dollars in money losses, data breaches and cover-up schemes.

GardaWorld facilities in the Sylmar area of the San Fernando Valley were broken into by thieves on Easter Sunday

It has raised serious questions about the security of the company’s sites and operations.

Historical reports of money loss, data breaches and poor security standards have resurfaced.

In 2020, Tampa Bay Times published an extensive investigation into a pattern of accidents and losses at GardaWorld facilities.

The Times alleged that “Garda lost track of millions of dollars inside its vaults and then hid the missing money from the banks that were its clients.”

At the time, they stored money for at least five of the country’s largest banks: JPMorgan Chase, Bank of America, Wells Fargo, PNC Bank and TD Bank. They also store money for the federal reserve.

According to the company, there are 425 branches in 45 countries, with 132,000 security professionals.

Most major cities in the United States have a Garda vault and some of the largest stores over $100 million. The vaults are filled with metal fences, plastic bags and boxes full of bills and coins.

“Court records and interviews describe some of the vaults as chaotic places where employees routinely ignored protocol and lost money,” the Times wrote.

“Some were plagued by unsolved burglaries and lacked basic safeguards such as high-quality security cameras.”

According to his interview with a former GardaWorld branch manager, Brian Newell, the branches were ordered to move thousands of dollars between them so that the bank’s auditors would not notice missing sums when they visited them.

In total, the Times estimated that $9 million was missing.

Another branch manager, Jammie Bolton, confirmed to the newspaper that employees rushed to move money between bank accounts when auditors arrived so they could show them the amount they expected.

Newell said: “They would practically fool the auditors, when in reality they have no idea where the money is.”

Other former employees told the outlet that they were surprised by how little the company did to keep track of the cash in its care and that there were too many losses to make a series of mistakes.

Former managers told the Times that employees had “ample opportunity” to steal and that thefts sometimes went undetected until customers pointed out that money was missing.

The boarded up hole in the building.

The gang is believed to have broken through a trapdoor in the roof and somehow circumnavigated the security systems to access the vaults and escape without raising an alarm, before escaping through a hole in the south-east side of the building.

As well as storing money, the Garda manages a network of armored trucks which they use to transport cash between banks, businesses and their premises.

But a separate Times investigation in 2020 alleged that the trucks are poorly maintained and lack brakes, seat belts and sometimes even reliable seats.

They discovered that hundreds of people had been injured in Garda accidents and at least 19 had died at the time.

On the Garda website, they say that “government and diplomatic contracts are part of the lifeblood of GardaWorld” and boast of operations with the British and American governments in Iraq, Afghanistan, Yemen and Libya.

The security of those operations has been called into question following Sunday’s theft and recent reports of serious data breaches at the company.

On March 22, 2024, GardaWorld Cash filed a data breach notice with the California Attorney General and weeks later, on April 17, it filed another notice with Maine regulators for a data breach.

They had discovered that they had been subject to a breach in November 2023, in which an unauthorized person was able to access customer names, social security numbers, insurance and medical information.

In the Maine attack, the Attorney General said 39,928 people were affected.

DailyMail.com has contacted GardaWorld for comment.

In addition to money storage and security, GardaWorld has been contracted to establish and manage migrant shelters in major cities across the United States.

They were hired by Chicago Mayor Brandon Johnson under a $29 million contract to build tents (a project that has now been canceled over environmental concerns) and also in Denver.

The Denver project was canceled after community organizers pointed out the Garda’s poor record in building shelters in Canada and Texas.

In Texas, the company built a center at Fort Bliss in El Paso, which the U.S. Department of Health and Human Services flagged for poor living conditions and insufficient staff training.

TO BBC investigation Upon entering the facility, allegations of child sexual abuse, lice outbreaks, and poor nutrition were discovered.

In a statement at the time, GardaWorld said they were not responsible for “case management” at the site.

Sunday’s robbery raised more serious questions about security at the company’s facilities.

The gang is believed to have broken through a trapdoor in the ceiling and somehow circumnavigated the security systems to access the vaults and escape without raising the alarm.

While there did not appear to be any damage to the roof, local news footage showed a repaired hole on the southeast side of the building.

There was debris around it, although it is unclear what it may have been used for or if it was related to Sunday’s robbery.

LAPD Commander Elain Morales said the facility holds cash for businesses throughout the region.

The business’s operators, whom police did not identify, did not discover the massive theft until they opened the vault on Monday.

Law enforcement sources told the LA Times that very few people would have known about the huge amounts of cash stored in the stolen safe.

Los Angeles police said they are working with the FBI to solve the GardaWorld case. Authorities believe a team was responsible for the theft, although no information was immediately available about possible suspects.

The robbery is one of the largest cash heists in Los Angeles history.

The next biggest case was the Dunbar Armored robbery in 1997, in which six men robbed a facility similar to GardaWorld.

The GardaWorld facility in the San Fernando Valley on Thursday

Local media reported that thieves targeted the GardaWorld facility in Sylmar (pictured).

Police are still searching for the gang that stole the money

The six men took the equivalent of $36.5 million in 2024 from the Dunbar Armored facility on Mateo Street in downtown Los Angeles.

The theft comes nearly two years after up to $100 million in jewelry and other valuables were stolen. stolen from a Brink’s big truck at a Southern California truck stop.

The cargo trailer was headed to a jewelry display in Pasadena and the driver decided to stop at a rest stop before someone broke in and stole the cargo.

To this day, the thief or thieves have still not been caught.

Across the pond, the Sylmar thief has been compared to the 2015 Hatton Garden heist, in which up to $23.4 million was stolen from a security facility in London’s exclusive Hatton Garden district.

The thieves punched holes in the 20-inch-thick vault walls over the Easter weekend, a public holiday in the United Kingdom.

The thieves then made off with millions of dollars worth of valuables in wheelie bins.