Table of Contents

- UK flood warnings increased by 170% last year, reaching 1,578

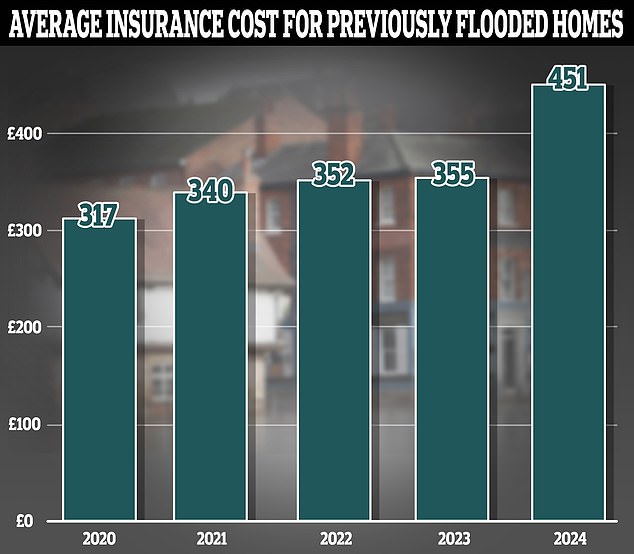

- The cost of insuring a flood-prone home has risen by an average of £99 in the past year

- Government grants are available to improve homes that have flooded before

<!–

<!–

<!– <!–

<!–

<!–

<!–

The cost of insuring a previously flooded property has risen by £99 in just one year as the number of flood warnings issued continues to rise, research claims.

You can expect to pay an average home insurance premium of £451 per year on a property that was previously flooded in January this year, data from Compare the Market shows, up 28 per cent from £352 in January 2023. .

The rise in premiums comes as the number of flood warnings issued in 2023 increased by 170 per cent, reaching 1,578.

This compares with just 584 in 2022 and 871 warnings in 2021, according to Environment Agency data obtained by Compare the Market through a freedom of information request.

Sharp rise: The cost of insuring a flood-prone home has risen by £99 in a year

The increase in flood warnings, according to Compare the Market, was partly due to the UK being hit by storms Agnes, Babet and Ciaran in the final months of the year.

Helen Phipps, director of Compare the Market, said: “With storms and flooding becoming more frequent, it’s a good idea to review your home and check if you live in an area at risk of flooding.

‘The home insurance market has seen a decline in the number of people taking out a policy over the past three years, meaning many households could be left uninsured, and out of pocket, if storms or floods cause damage to their homes.

“The good news is that UK households appear to be taking action – we saw an 80 per cent year-on-year increase in visits to Compare Home Insurance Market after Storm Isha in January.”

How can people living in flood-prone areas get insurance?

For those who own property that is at risk of flooding, the cost of insuring their home will be higher due to the additional risk of doing so.

In some high-risk areas, it may be difficult to find an insurer willing to sell you a policy.

Joint schemes run by the Government and insurance companies, such as Flood Re, can offer those at high risk of flooding capped insurance rates for those whose homes have more than a 1.3 per cent chance of flooding.

Owning property very close to a body of water can also increase the cost of your insurance, even if it has never flooded before.

Can you get coverage? Homes in flood-prone areas can be difficult to insure, and some providers refuse to offer policies due to the high risk of flooding.

According to Environment Agency data, warnings for river flooding, or flooding of waterways such as rivers, have risen to 1,295 in 2023, compared to just 405 the previous year.

Compare the Market said the cost of insuring a property near a body of water rose by 29 per cent, or £48, a year in January, to £204 from just £166 previously.

However, this figure is only six per cent higher than the cost of insuring a property not situated near water: the average cost of home insurance has risen by £48 year-on-year to £204.

It said: ‘Flood cover is usually included as standard on most buildings and contents insurance policies, and will cover your home and its contents against water damage.

‘However, homeowners should be aware that there may be important exclusions depending on your level of cover. For example, most policies do not cover damage to parts of your home such as fences, gates and hedges.

“Comparing policies online could help you better understand the different options available and you may find an offer that is more affordable or better suited to your circumstances.”