NHS waiting lists for patients battling serious heart problems have quintupled in the wake of the pandemic, grim figures show.

More than 163,000 patients in England have suffered treatment delays of at least 18 weeks.

This is up from 32,000 in February 2020 (the month before Covid hit Britain) and double the 87,000 in February 2022.

NHS guidelines state that 92 per cent of patients should be treated within 18 weeks of referral.

Charities say the NHS is suffering its “worst cardiac care crisis in living memory”, and doctors are worried that patients caught in the backlog could suffer heart attacks and strokes while waiting for life-saving treatment.

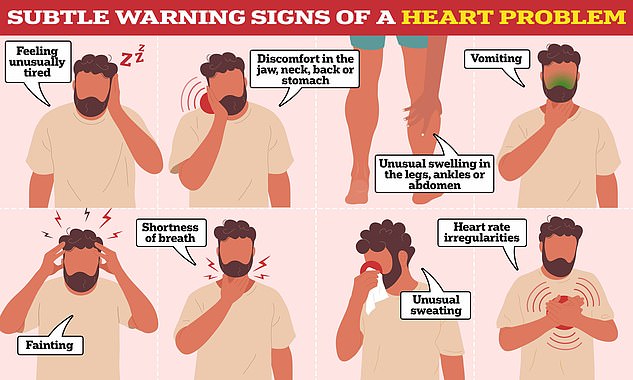

While some warning signs are easy to spot, such as severe chest pain, others are more vague and difficult to identify.

Cardiologists today called the new figures “shocking” and called for “bold action” to prioritize life-saving cardiac care.

The latest health service data shows overall cardiac waiting lists also rose to 408,548 in February.

The record of 409,541 was set in September 2023.

This comes despite the overall waiting list for routine hospital treatment in England falling for the fifth month in a row, due to a technicality.

At the end of February there were more than 7.54 million procedures, such as hip replacements and cataract surgery, waiting to be performed.

Around 4.4 million treatments were booked into the system when the virus arrived in the UK. Queues reached a record 7.8 million in September.

Dr Sonya Babu-Narayan, associate medical director at the British Heart Foundation, said: “It is shocking to see that waiting lists for cardiac care have increased for the third month in a row even though overall waiting lists have decreased.

‘Timely cardiac treatment is not a luxury people can live without.

“Long waits can put people at risk for preventable heart attacks, heart failure and even premature death.”

He added: “Continuing extreme pressures on NHS cardiac care alongside Covid are among several factors that contributed to 39,000 premature deaths related to cardiovascular disease in 2022.

“We need to see bold action to prioritize life-saving NHS cardiac care and end these agonizing waits.”

Patients on the cardiac list are awaiting procedures such as open heart surgery, including bypass and placement of stents or pacemakers.

Some have already suffered a heart attack or stroke and need specialized cardiac care to reduce the risk of further deterioration.

Rishi Sunak admitted yesterday that progress in reducing NHS waiting lists was not as fast “as I would like”.

He added: ‘Today’s figures show that we are making progress towards that goal. “We still have more work to do, but our plan is working.”

But the Prime Minister also argued that an additional 430,000 patients could have been treated if doctors and nurses had decided not to strike for extraordinary pay deals.

The latest NHS data shows that more than 305,000 patients in total had been waiting at least a year for treatment, slightly down from 321,394 the previous month.

The health service had been ordered to eliminate all waits of more than a year by the end of March. This has been delayed until September.

Meanwhile, in February 252 patients had been waiting in line for more than two years, compared to 376 registered a month before.

The NHS was asked to eliminate two-year waits by July 2022, except for those who chose to wait longer, did not want to travel to be seen faster or for very complex cases requiring specialist treatment.

Prime Minister Rishi Sunak admitted yesterday that progress in reducing waiting lists was not as fast “as I would like”. And he added: ‘Today’s figures show that we are moving towards that goal. We still have more work to do, but our plan is working.” But Sunak also argued that an extra 430,000 patients could have been treated if doctors and nurses had decided not to strike over extraordinary pay deals.

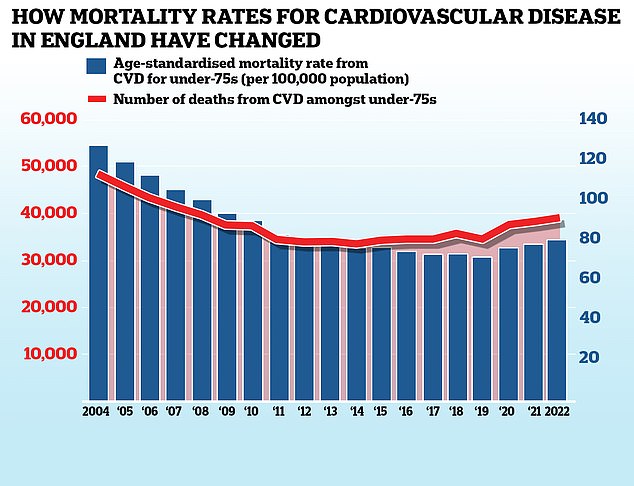

This graph shows the mortality rate from cardiovascular disease in those under 75 years of age in England (blue bars), which is the number of deaths per 100,000 people, as well as the total number of deaths (red line). Medical advances and advanced screening techniques have helped reduce these numbers since 2004, but progress began to stall in the early 2010s before reversing in recent years of data.

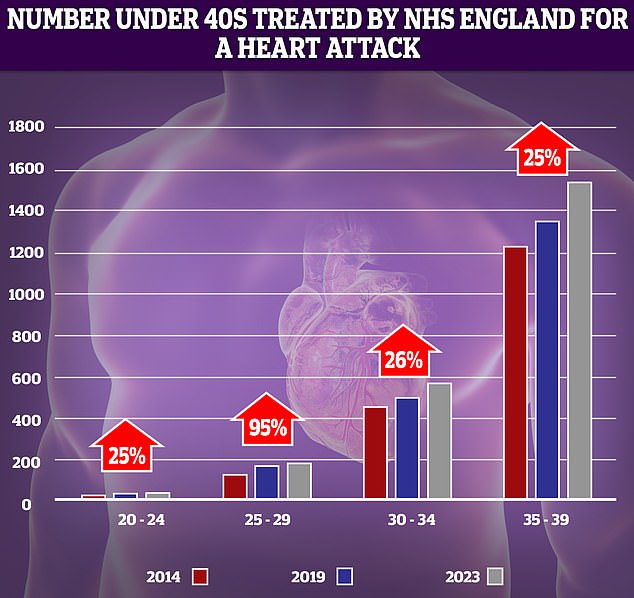

NHS data shows an increase in the number of young adults suffering heart attacks over the last decade. The largest increase (95 percent) was in the 25- to 29-year-old demographic, although as patient numbers are low, even small spikes can seem dramatic.

Earlier this year, alarming data also revealed that premature deaths from cardiovascular problems, such as heart attacks and strokes, have reached their highest level in more than a decade.

MailOnline has previously highlighted how the number of young people under 40 in England being treated for heart attacks by the NHS is increasing.

Cases of heart attacks, heart failure and stroke among those under 75 had fallen since the 1960s thanks to plummeting smoking rates, advanced surgical techniques and advances such as stents and statins.

But rising rates of obesity and its catalog of associated health problems, such as high blood pressure and diabetes, are now believed to be one of the main contributing factors.

Slow ambulance response times for category 2 calls in England, including suspected heart attacks and strokes, as well as long waits for tests and treatments, have also been blamed.

Almost one in six adults aged 25 to 34 in England are now classed as fat, compared to just a quarter in the early 1990s.

Despite anti-vaxxers’ claims, cardiologists say fears that Covid vaccines may have led to a rise in heart problems are wildly misplaced.