Property in Sydney has become so expensive that one real estate expert warns there are only two ways for young people to buy a house: have rich parents or be an OnlyFans star.

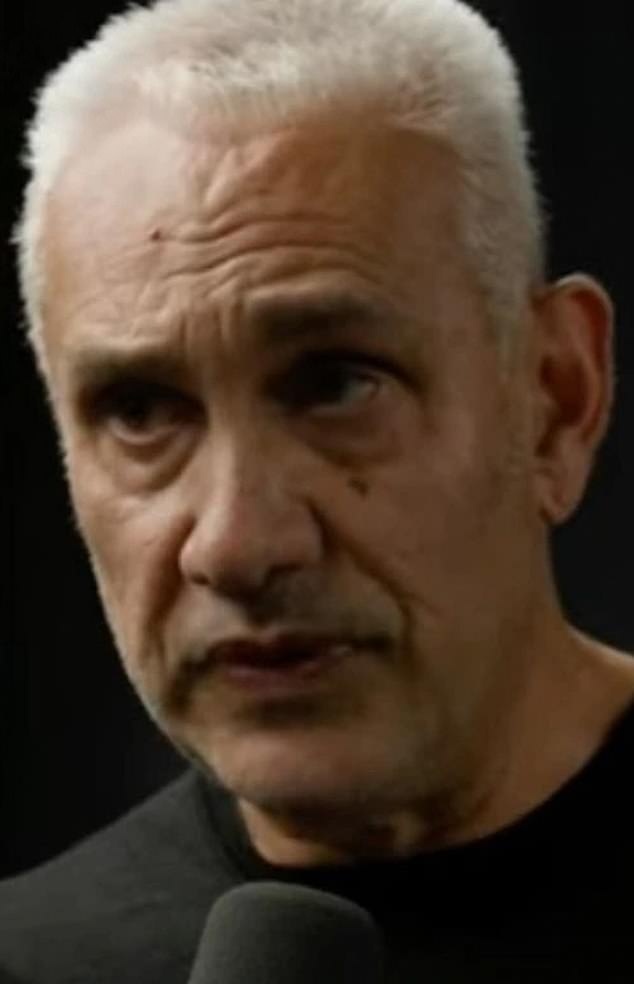

The shocking claim was made by experienced real estate auctioneer and real estate guru Tom Panos.

“It’s uncomfortable for me to say, but young people who buy property have help from their parents, or they’ve been very lucky with some kind of business that has failed,” Panos told Wizard Home Loans founder Mark Bouris.

‘OnlyFans, believe it or not! I know some people who have sold properties and the agent was like, “Dude, she has an Onlyfans account and she’s listing it,” she said on the Yellow Brick Road podcast.

‘Isn’t it interesting, where we are now as a society, to achieve the dream we’ve always been told?’

Property in Sydney has become so expensive that property guru Tom Panos warns there are only two ways for young people to buy a house: have rich parents or be an OnlyFans star (file image)

“I know some people who have sold properties and the agent was like, ‘Dude, she has an Onlyfans account and she’s putting it on a property,'” Panos said on the Yellow Brick Road podcast.

Panos said those who don’t have rich parents, or a successful Onlyfans account, will have to save on average for 20 years just to get a basic deposit for a unit.

“If you are a young person now and you have no money, not even a big dollar in the bank, it will take you 20 years to save up for a deposit (for one unit) that will allow you to buy comfortably in Sydney.” he said.

‘Obviously a little less for Melbourne and Brisbane.

‘A house, if you’re 20 years old. It will take you until age 60 to receive a deposit.

“Before the goal was to have the house paid for by then, not save for a deposit.”

Panos said the average age at which Australians take out home loans shows how bad the problem has become.

In 2009, the average age of those applying for a mortgage loan was 23 years old, but this has now skyrocketed to 32 years old in 2024 and continues to rise as housing demand outstrips supply.

According to him, young buyers at auctions are regularly seen in the company of their parents, since the “bank of mom and dad” is now the only option, given that an income of It now takes $300,000 to comfortably pay a mortgage in Sydney.

In a previous video posted online, Panos used the example of a worker at a coffee shop where he was buying a coffee.

“Look at the guy behind us, I know what he makes…$20 or $30 an hour, he works hard,” he said.

‘If this guy starts saving, he’ll be able to get a deposit on a property when he’s 63.

“Yeah, everyone is worried about Brittany Higgins, and this guy is going to have to work for 45 years just to get a deposit.”

“If you are a young person now and you have no money, not even a big dollar in the bank, it will take you 20 years to save up for a deposit (for one unit) that will allow you to buy comfortably in Sydney.” Panos told Mark Bouris on his podcast (pictured, apartments and houses in Sydney)

Panos (pictured) said “young people who buy property have help from their parents.”

The real estate expert also caught the attention of real estate agents who are now considered big stars because what they sell is very expensive.

‘At some point, the hero went from being the salesperson to the client and the real estate agent decides to become the hero.

‘Including the way they acted, the way they behave, even the way they market it.

‘On some properties, the way they market them, the agent markets themselves more than the actual house. And it is financed by the supplier.