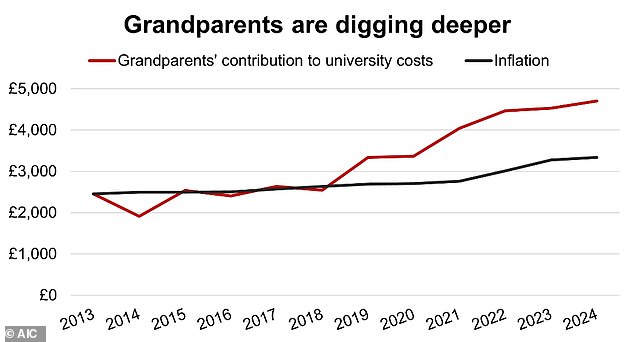

- The amount given by grandparents increases faster than inflation

- Parents prefer cash savings despite higher returns on investment

Grandparents are increasing the amount they contribute to their grandchildren’s college expenses, data shows, while college remains parents’ top financial priority when supporting their children.

A quarter of parents reported that their children’s grandparents are helping to pay for university costs, with those grandparents donating an average of £4,703 a year, according to research by the Association of Investment Companies.

This figure is up from £2,455 in 2013, outpacing inflation, which would have increased it to £3,337 over the period.

At the same time, 71 per cent of parents contribute to their children’s university fees, which amounts to an average of £8,723 a year.

Beating inflation: The amount grandparents contribute to college fees has grown significantly over the past decade

More than three-quarters of parents in the top three social and economic groups, known as ABC1, contribute to their children’s education, donating up to £9,626 a year on average, while 59 per cent of the lowest earners in the C2DE category contribute to university costs, donating £5,639 on average.

Nick Britton, AIC research director, said: “Millions of parents make huge financial sacrifices to send their children to university, and our research shows that many grandparents are making big sacrifices too.”

Nearly half of parents said they prioritize college costs when financially supporting their children, only a third reported a first property is more important and 10 percent focus on paying for a first car.

Britton added: ‘It’s worrying that more parents aren’t using the power of the stock market to help boost their long-term savings.

‘Not everyone can afford to save money, but those who can often turn to savings accounts rather than the stock market.

‘That’s despite the fact that most parents acknowledge that an investment in the stock market will outperform cash over a typical ten-year period.’

The data suggests that 64 percent of parents use cash as their primary way of saving money for their children, only 16 percent use mutual funds, 15 percent use stocks and 10 percent use funds.

When making these contributions, half of parents use part of their cash savings to do so, while 16 percent of parents use all of their savings to support their children in their college studies.

Despite preferring cash, most parents think an investment would generate better returns over a ten-year period.

While these parents would be right, with the average investment fund having returned £2,708 on a £1,000 investment over the past ten years, 37 per cent are concerned that there is too much risk involved, while 28 per cent said they do not have enough money to do so.

More than a fifth said they don’t understand investing or have never even considered doing so instead of using a savings account.

Britton said: ‘While there are many ways to invest in the stock market, investment trusts provide diversified, professionally managed exposure to a variety of investments and can be a good starting point for investors.

‘A £50 a month investment in an average unit trust over the past 18 years would have left investors with £30,668, comfortably covering what a typical parent contributes for three years of university.’