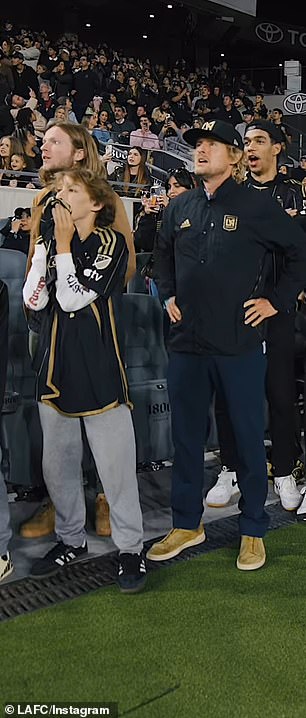

Owen Wilson was spotted on a rare public outing with his sons Ford, 13, and Finn, 10, watching a soccer game in Los Angeles on Saturday.

The Dallas-born actor, 55, and his sons Robert ‘Ford’, 13, and Finn, 10, watched the Los Angeles Football Club’s game against the New York Red Bulls at BMO Stadium in Los Angeles. Wilson is also the father of his five-year-old daughter Lyla.

Wilson, who has appeared in films such as Wedding Crashers, Starsky & Hutch and Meet the Parents, was photographed with his children in a stadium suite and then on the sidelines.

Wilson, who was nominated for a Best Screenplay Oscar in 2002 for his work on The Royal Tenenbaums with Wes Anderson, was seen in a clip the club uploaded after his 2-2 draw against the Red Bulls with the title “Secondary Celebrations”.

Wilson and his children were seen celebrating the team’s comeback in the draw, holding LAFC player Denis Bouanga’s soccer jersey with the number 99 in his hand.

Owen Wilson, 55, was spotted on a rare public outing with his children at a soccer game in Los Angeles on Saturday.

He was joined by his sons Ford, 13, and Finn, 10,

The family were pictured cheering after the striker’s second-half brace gave his team a point following a first-half goal.

Wilson, who previously dated Kate Hudson, supported the home team in a baseball cap and team-branded jacket, navy pants and brown shoes. Both sons wore LAFC-branded clothing.

Wilson is father to Ford with ex-girlfriend Jade Duell, Finn with former personal trainer Caroline Lindqvist and Lyla with Varunie Vongsvirates, whom he had dated.

In June 2017, Wilson spoke about raising her children on The Ellen DeGeneres Show: “Sometimes I feel like I’m already seeing what they’ll be like when they’re teenagers, where they’ll plot against me.”

Wilson said Don in August 2021 that he lives with his two children and that they all ‘get along’ with each other as he took on ‘a single parent schedule.’

Two months later, Vongsvirates told DailyMail.com that Wilson had “never met” his daughter or had any contact with her.

“Unfortunately, he never met her,” Vongsvirates said in an October 11, 2021 interview.

Varunie in November 2019 told DailyMail.com that she had begged the actor to be present for her son. She said that while “he helps out financially… he’s never been about that.”

The Oscar nominee was seen in a clip the club uploaded after the 2-2 draw against the Red Bulls with the caption “Side Celebrations.”

Wilson and his children were seen celebrating LAFC striker Denis Bouanga’s soccer jersey with the number 99 in his hand.

Wilson and his children were seen celebrating the team’s comeback in their draw.

Wilson supported the home team in a baseball cap and team-branded jacket, navy blue pants and brown shoes.

LAFC has attracted several notable stars to its stadium in the Exposition Park neighborhood of Los Angeles, with Wilson being the latest to appear in the photo.

Varunie said: ‘Lyla needs a father. It’s ironic how [Wilson] He still has those father roles… and he’s never met his own daughter.’

Wilson is the latest star to be photographed at LAFC soccer games, as others who have come out to watch the soccer team play include Leonardo DiCaprio, Selena Gomez and Prince Harry.

The stadium, opened in April 2018, is also home to the Angel City Football Club of the National Women’s Soccer League.