Table of Contents

The basic component of a portfolio should be a global equity fund. Deposit a lump sum or contribute monthly and own your own share of the world’s most famous companies.

But while this should be a long-term relationship, every new year you should still question your commitment to a fund.

Does it match your goals and the level of risk you can afford to take? Does it promise diversification, but actually deliver the opposite?

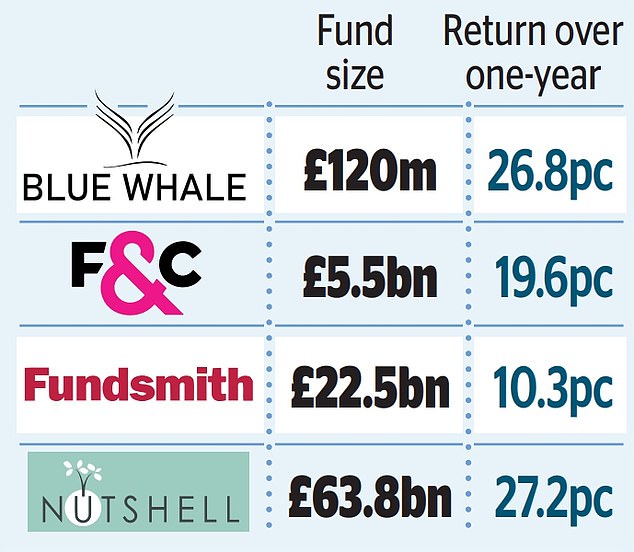

In 2025, the need for this reassessment has been highlighted by the failure last year of the old favourite, the £23.3bn Fundsmith, to match the performance of the interloper, the £63.8m Nutshell Growth fund. Fundsmith, managed by veteran Terry Smith, returned 10.7 percent. Nutshell reached 23.7 percent.

Lord Spencer, chairman of Nutshell Asset Management, placed a £20,000 bet on such an outcome and paid his winnings to the Royal Osteoporosis Society, the charity chosen by The Mail on Sunday.

Since launching in 2010, Fundsmith has returned 619 percent. But its misstep in 2024 should serve as a warning even to this fund’s loyal followers – and to other existing or potential investors in all global funds – that they should examine their priorities.

Money in the bank: the cornerstone of a portfolio should be a global equity fund

These funds can be described as global, but their money is not distributed equally across the planet. Their portfolios include companies from the UK, Europe and Asia, but the companies they back are largely American.

The US S&P 500 index accounts for around 63 percent of the valuation value of the FTSE All-World Index. Additionally, the S&P 500 is dominated by a few massive corporations.

About 35 percent of the index is made up of technology’s all-conquering ‘Magnificent Seven’: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla, whose shares soar in 2024, thanks to artificial intelligence generative (AI). excitement.

Alphabet is the parent company of Google. Meta owns Facebook, Instagram and Whats App. Generative AI is considered crucial for its future expansion.

Some fear that a bubble is forming in this technology sector. But elsewhere there is also a conviction that these stocks will still be sought after in 2025.

If you’re optimistic about this level of US exposure, here are your global fund options. A combination of funds may suit you.

In financial relationships, variety adds flavor.

BLUE WHALE

This £120m fund is a “one-stop shop for navigating the markets”, as its lead manager Stephen Yiu puts it. The objective is to take advantage

“idiosyncratic megatrends”, such as the West’s quest to reduce its dependence on Far Eastern microchip makers.

Yiu and his team have been lowering the stakes on the Magnificent Seven, arguing (controversially, some believe) that these titans may be spending too much on AI.

Among the fund’s other holdings are Sartorius, the German scientific equipment maker, and payments giant Visa. This is a fund to consider if Magnificent Seven stock is already high in your portfolio.

F&C

This £5.5bn investment trust is a way to back the Magnificent Seven, which are its biggest bets. iPhone maker Apple, the trust’s third-largest holding company, is now valued at around $3.7 trillion.

Its share price rose 31 percent in 2024 to $251. In late December, brokerage Wedbush raised its stock price target to $350 based on the view that “a golden era of growth is on the horizon in 2025 for Apple.”

Another holding company in the top 10 is Eli Lilly, the pharmaceutical giant behind obesity drugs Mounjaro and Zepbound. By early next decade, annual global sales of these and other weight-loss drugs are expected to reach $150 billion.

Stellar track record: Terry Smith

F&C is one of broker Interactive Investor’s top two global fund buys. It is also one of my global fund options.

BACKGROUND

One reason Fundsmith’s stellar track record has taken a hit in 2024 is manager Terry Smith’s skeptical stance on the fortunes that could emerge from generative AI.

Fundsmith only owns Meta and Microsoft. Smith has stepped away from semiconductor giant Nvidia, whose shares have risen nearly 27,000 percent over the past decade.

Others may consider this a mistake. But there are no signs that Smith (pictured) is deviating from his normal course, which is to buy “quality” businesses of various types. Current picks include beauty conglomerate L’Oreal and hotel group Marriott.

Alex Watt, a fund analyst at Interactive Investor, argues that Smith’s stock-picking system may gain support this year as investors around the world diversify away from the Magnificent Seven. For this reason, I stay loyal to Fundsmith, which is one of FundCalibre’s elite funds in this category.

WALNUT SHELL GROWTH

Terry Smith may like to buy and hold, but Nutshell manager Mark Ellis prefers “agile rebalancing” – making frequent trades for maximum profit, ensuring the fund is rebalanced regularly. Currently, 60 percent of the portfolio is invested in US stocks such as Meta, Microsoft, Arista Networks, a software group, and auto parts retailer AutoZone.

But Europe is represented through Novo Nordisk, the weight-loss pharmaceutical company Ozempic, and Hermes International, the maker of Kelly and Birkin bags.

Late last year, Nutshell was included on FundCalibre’s list of funds that could be eligible for full “elite” status.

The FundCalibre team calls Ellis’ strategy “innovative and original.”

INDEX FUND

The simplest and cheapest option may be a “passive” fund in which the portfolio mimics the composition of an index.

Interactive Investor’s best buy in this category is the iShares Core World ETF (exchange-traded fund) that tracks the MSCI World Index.

Some of his key constituents are, unsurprisingly, members of the Magnificent Seven, as well as American banking leviathan JP Morgan Chase.

Whether you select the passive or active approach, it’s worth checking if your existing fund appears on Bestinvest’s (bestinvest.co.uk) list of “dog” or underperforming funds. At last count, around £26bn of savings were hidden in such funds, mostly disappointing because they avoided the Magnificent Seven.

It would be foolish to trust all your money to these companies, but ignoring them would also be a mistake, no matter what happens in 2025.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.