Table of Contents

- Water bills are already high and will rise even further if water companies have their way

- But households can fight back by cracking down on the water they use.

Households could save £300 on their water bills each year by cutting out waste and water-intensive appliances, and buying a new toilet could save more than £100.

The typical household pays water bills of £473 a year, with many bills estimated to rise by almost 50 per cent by 2030.

But those with water meters could avoid the increases by tackling water waste at home, according to research by the Centre for Economics and Business Research on behalf of B&Q owner Kingfisher.

According to the study, switching from a traditional toilet to a dual-flush toilet saves £109 a year on average, and toilets use 22 per cent of all water used in a home.

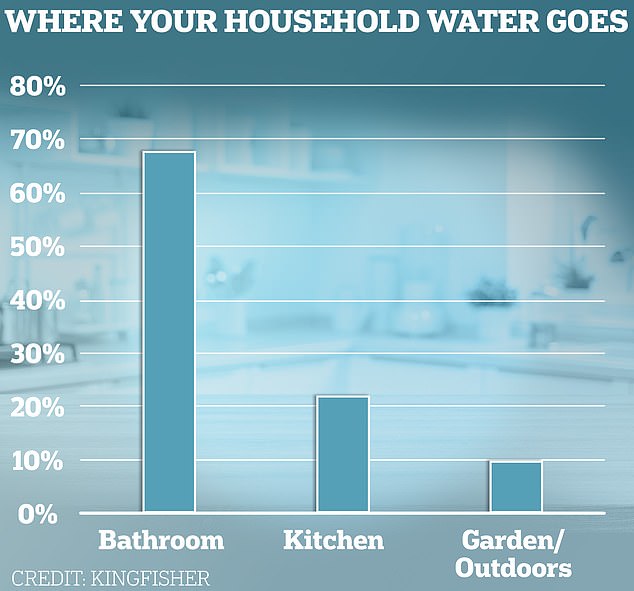

Down the drain: Most of the water used in homes goes to the bathroom, followed by the kitchen.

This could pay for itself in a couple of years – dual flush toilets cost around £80 and installation costs are typically between £100 and £300.

Switching from a standard shower head to an energy-efficient model can save the average household £94 a year, with additional savings on energy bills from heating less water.

Reducing shower time from eight to five minutes saves up to £61 a year, while not leaving the tap on while brushing your teeth saves £37 over the same period.

The CEBR concluded that by using water more efficiently, metered households (around 60 percent of all households) could offset increases in water bills projected to occur by 2030.

Those who do not have a meter have their bills set based on the value of their home.

The survey of 3,000 adults found that 72 per cent of Britons are concerned about the large increases in water bills expected over the next five years.

This is despite the fact that on average they were expecting an increase of only 16 percent, significantly lower than that proposed by most water companies.

Nearly two-thirds (61 percent) of households said higher bills will cause them to reduce their water use and 81 percent said saving water is increasingly important.

However, one in five (19 percent) admit they currently rarely or never think about how much water they are using.

Thierry Garnier, CEO of Kingfisher, said: “Avoiding water waste is not only the right thing to do from an environmental point of view, it is also a way of saving increasingly significant sums of money.

‘By making simple changes at home and being more conscious about how we all use water, it is possible to offset the impact of upcoming bill increases and safeguard this essential resource for the future.’

Why will water bills skyrocket?

Water companies are planning a £96bn investment spree in the UK’s water network and want to introduce bills to fund it.

These improvements will include building 10 new reservoirs and reducing leaky pipes by 25 percent, as well as pumping wastewater into waterways, which has sparked a huge public outcry.

Water companies have submitted their five-year investment plans to water regulator Ofwat, which is due to respond on 11 July.

To pay for these improvements, the average household will end up paying an extra £7 a month in bills by 2025, according to water companies’ plans.

This adds up to £84 a year and will rise again to an additional £13 a month, or £156 a year, by 2030.

SAVE MONEY, EARN MONEY

Boosting investment

Boosting investment

5.09% cash for Isa investors

Cash Isa at 5.17%

Cash Isa at 5.17%

Includes 0.88% bonus for one year

Free stock offer

Free stock offer

No account fees and free stock trading

5.78% savings

5.78% savings

You have 365 days’ notice

Fiber broadband

Fiber broadband

BT £50 Reward Card: £30.99 for 24 months

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.