Table of Contents

- People who speak in a lower tone are more attractive for long-term relationships.

- Men with lower voices are also seen as more formidable among other men.

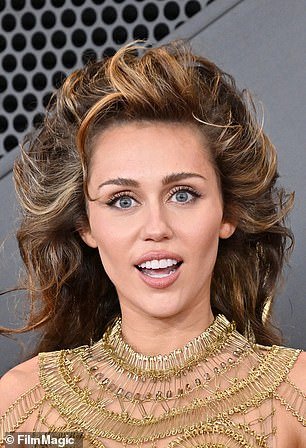

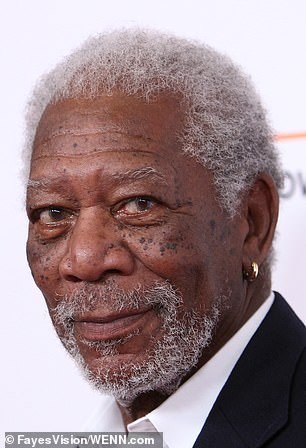

From Miley Cyrus to Morgan Freeman, many of the world’s most famous celebrities are known for their deep voices.

Now, a study suggests that people who speak in a lower tone are more attractive for long-term relationships.

What’s more, men with lower voices are seen as more formidable and prestigious among other men, according to the Penn State University team.

“A low tone of voice exaggerates size,” said study co-author Professor David Puts.

“It makes an organism, whether a person or a non-human primate, appear large and intimidating.”

From Miley Cyrus to Morgan Freeman, many of the world’s most famous celebrities are known for their deep voices. Now, a study suggests that their dulcet tones may also make these stars seem more attractive for long-term relationships.

Vocal communication is known to be one of the most important human characteristics.

And although our accents and tones vary greatly, pitch is the most notable aspect of the voice, according to Professor Puts.

“Understanding how tone of voice influences social perceptions can help us understand social relationships more broadly, how we achieve social status, how we evaluate others based on social status, and how we choose a partner,” he explained.

In their study, the researchers selected two male and two female voice recordings, all repeating the same phrase.

The tone of each clip was then edited, creating a total of 12 clips.

These clips were played to over 3,100 participants from 22 countries, who were asked to answer questions about whose voice sounded most attractive, flirtatious, formidable and prestigious.

The results revealed that male and female participants across cultures preferred lower voices for a long-term relationship.

Meanwhile, lower male voices were rated as more formidable and prestigious.

In contrast, researchers found that women with high-pitched voices were considered more attractive for short-term relationships (file image)

“The findings suggest that deep voices evolved in men because our male ancestors frequently interacted with competitors who were strangers,” Professor Puts said.

“Masculine traits, such as deep voices and beards, are highly socially salient, but this new research shows that the salience of at least one of these traits varies predictably across societies, and suggests that others, such as beards, they do it too”.

In contrast, researchers found that women with high-pitched voices were considered more attractive for short-term relationships.

Overall, the researchers say the findings suggest that tone of voice is relevant to social perceptions in all societies.

“It also shows that the degree of attention we pay to tone of voice when making social attributions varies across societies and responds to relevant sociocultural variables,” Professor Puts added.

“In a society where there is greater relational mobility and there is less direct information about its competitors, people seem to be more attentive to an easily identifiable and recognizable signal such as tone of voice.”