- Country Life Publishing was founded by TED Talks curator Chris Anderson.

- Future’s pre-tax profits fell 30% in the six months to March

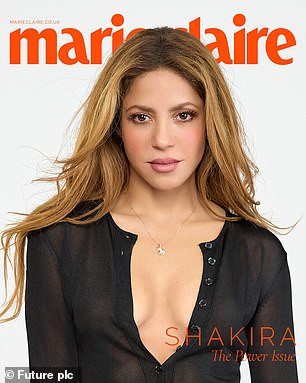

Buyback: Future, the British publisher of Marie Claire, has presented a new share buyback plan

Future actions surged by almost a fifth on Thursday after the magazine company announced plans for another £45m share buyback.

Shares in the Bath-based company soared 19.4 per cent to £10.39 late on Thursday afternoon, taking its gains since the start of the year to around a third.

British publisher Country Life and Marie Claire, founded by TED Talks curator Chris Anderson, recently completed a similarly sized share buyback plan that was launched last August.

It announced the buyback alongside results showing its pre-tax profits fell 30 per cent to £46.6 million in the six months to March.

It blamed the drop on investment related to the “growth acceleration strategy” – a two-year plan aimed at boosting media sales – and an “adverse revenue mix”.

Total turnover decreased 3 per cent to £391.5m due to adverse currency fluctuations, a tougher digital advertising market and lower subscriptions to print magazines.

However, organic revenue increased by an equivalent percentage in the UK thanks in part to strong demand for car insurance among GoCompare customers.

Future’s overall organic sales also rebounded and grew in the second quarter, even as affiliate product purchases in the U.S. continued to be affected by weakening consumer confidence.

Jon Steinberg, who replaced Zillah Byng-Thorne as CEO in April 2023, noted that this progress continued in the third quarter.

He added: “Our focus for the remainder of the year is the continued implementation of the growth acceleration strategy, with a focus on optimizing the portfolio and accelerating value creation for shareholders.”

Under the strategy, Future is investing between £25m and £30m to ensure it is “well positioned to capitalize on future opportunities in its attractive and growing markets”.

The program has three fundamental pillars: increase the company’s audience, diversify and increase revenue per user, and optimize its portfolio.

Future operates more than 230 brands, from MoneyWeek and Total Film magazines to discount platform MyVoucherCodes and price comparison website GoCompare.

Analysts at Deutsche Bank said: “We continue to view the futures stock as a strong value, feel the business is under cyclical, not structural, pressure, and will benefit from both significant self-help and a macro recovery in the UK and USA”.