It’s a tasty fusion of geography and gastronomy.

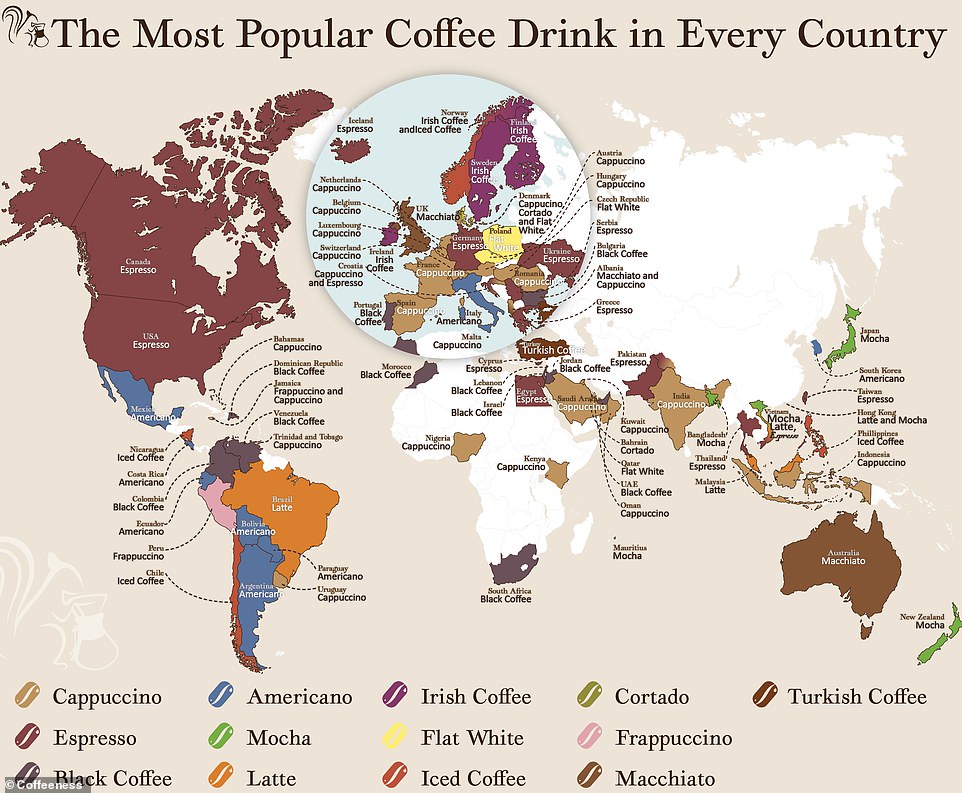

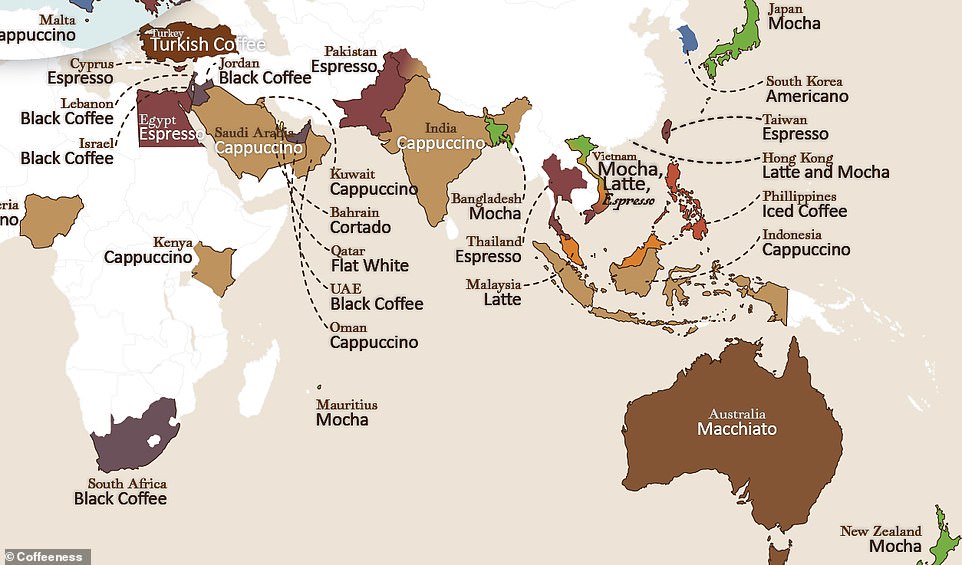

This fascinating world map reveals each country’s favorite way to drink coffee – and cappuccino is #1 overall.

The map was drawn up by Coffee, a blog dedicated to “all things coffee,” which examined Google search volume for 21 types of coffee in countries around the world over the past 12 months. This includes searches carried out in both English and the native language of each respective country.

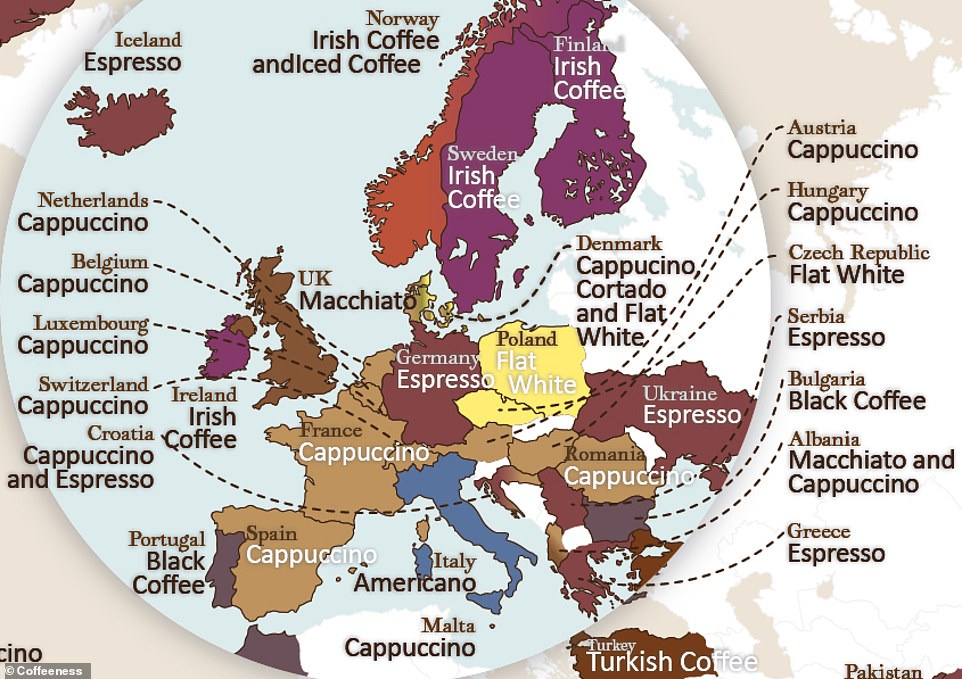

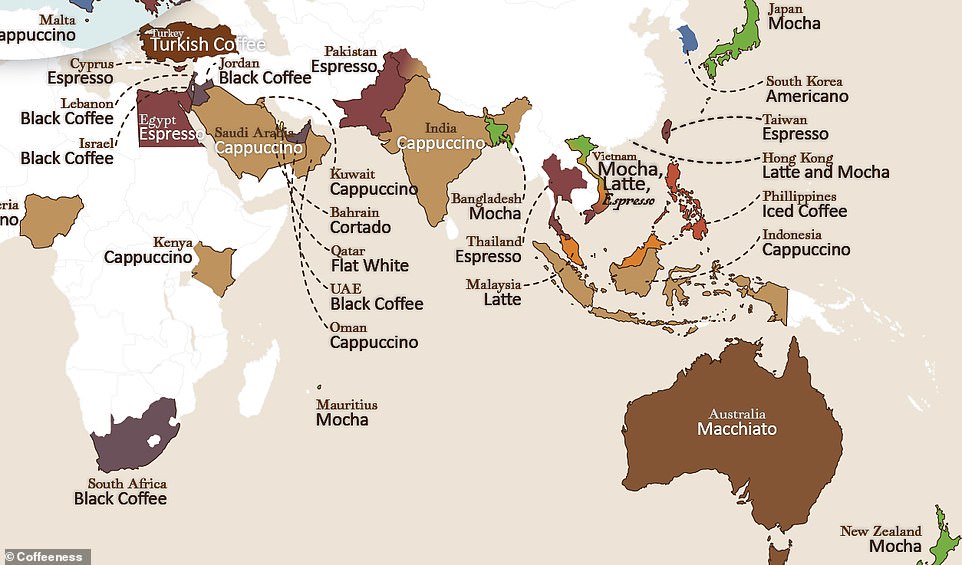

Cappuccino – espresso mixed with steamed milk and foam – tops the rankings in 24 countries, including Belgium, France, Netherlands, Spain, India, Arabia Saudi Arabia and Kenya.

“People love cappuccino because it delivers a balanced amount of each component in every sip,” says Coffeeness.

This fascinating world map reveals each country’s favorite way to consume coffee – and cappuccino is #1 overall.

Espresso is the second most popular coffee drink on the planet. This strong, concentrated brew is favored in 14 countries around the world, including Germany, Greece, Iceland, Pakistan, Egypt and the United States.

In third place is black coffee, prepared only with coffee grounds and water. It is the preferred choice in 12 countries, including Bulgaria, Portugal, Israel, United Arab Emirates, South Africa and Colombia.

The Americano, made by mixing espresso with hot water, ranked fourth, topping the list in 10 countries including Italy, South Korea and Argentina.

Moka completes the top five in fifth position. The milk-based espresso drink, flavored with chocolate powder or syrup and usually topped with whipped cream and chocolate shavings, is the number one drink in six countries, including Bangladesh, Hong Kong, Japan and China. New Zealand.

Other popular coffee drinks include latte, Irish Coffee, Flat White, Macchiato and iced coffee, all of which are tied for sixth place.

Espresso is the second most popular coffee drink on the planet. This strong, concentrated brew is favored in 14 countries around the world, including Germany, Greece and Iceland.

Mocha is the fifth most popular type of coffee, favored in six countries, including New Zealand. Macchiato, tied for sixth, is the first choice in four countries, including the United Kingdom and Australia.

The latte, consisting of one or two espressos mixed with steamed milk and a thick layer of milk foam, is most popular in Hong Kong, Malaysia, Vietnam and Brazil.

Irish coffee is enjoyed in Ireland and, perhaps more surprisingly, in Finland, Norway and Sweden.

South America has a mix of coffee tastes

“It’s a curious twist on coffee because it’s spiked with whiskey, sweetened with a little sugar, and topped with a layer of whipped cream,” says Coffeeness.

Flat White, obtained by mixing two espressos with steamed milk and without foam, is the essential coffee in the Czech Republic, Denmark, Poland and Denmark.

While the macchiato, served in an espresso cup with a coffee-to-milk ratio of one to two, is No.1 in the UK, Albania, Honduras and Australia.

“This is ideal for people who find a cappuccino too weak but an espresso too bitter,” according to Coffeeness.

Iced coffee – “simply your favorite coffee drink served over ice and (sometimes) mixed with sweeteners and milk” – is the beverage of choice in Nicaragua, Chile, Norway and the Philippines.

Coffeeness notes that it is “different from cold brew coffee in that cold brew coffee has a bolder flavor and takes more time to brew.”

The bottom of the rankings included Cortado (No. 1 in Bahrain, equal parts espresso and steamed milk); frappuccino (the best in Peru, made with coffee, ice and syrups) and Turkish coffee (the best in Turkey, brewed in a copper pot called cezve with ground coffee and sweetened to taste).

A separate map for the United States reveals the most popular coffee shop in each state.

Reigning supreme, espresso holds the top spot in 28 states, from Alaska, Washington and Oregon in the west to Maine, New York and South Carolina in the east. It’s also a first in California, with the cappuccino.

A separate map for the United States reveals the most popular drink in each state, with espresso being the No. 1 choice.

In second place is latte, favored in 14 states, including Wisconsin, Illinois, Ohio and Kentucky.

The bronze medal goes to cappuccino, which is the favorite coffee drink in 11 states, including Texas, Mississippi, Pennsylvania and Florida.

Louisiana is the only state that prefers café au lait, a French coffee drink made from equal parts black coffee and steamed milk, with no foam.

Caffeine lovers in Hawaii and Connecticut, meanwhile, are big fans of affogato, which typically comes in the form of a scoop of milk or vanilla ice cream topped with a shot of hot espresso.