Tiffany Fong, a crypto investor and influencer, has said she does not believe disgraced former FTX CEO Sam Bankman-Fried deserves a life sentence.

Not only has she spoken to Bankman-Fried for dozens of hours while he was under house arrest, but Fong is one of the most high-profile victims of another cryptocurrency crash.

Around June 2022, Fong had approximately a quarter of a million dollars in Celsius, a crypto company that was often touted as more secure than banks. In an instant, his money was gone. He declared bankruptcy a month later.

But despite his losses, he believes Bankman-Fried, the head of another failed cryptocurrency, does not deserve to be jailed for life. He is currently awaiting sentencing, scheduled for Thursday in Manhattan court.

“It was a big part of my life savings,” Fong told DailyMail.com. “I felt very emotionally distraught after that and wanted an outlet to vent, so that’s the only reason I started covering these bankruptcies.”

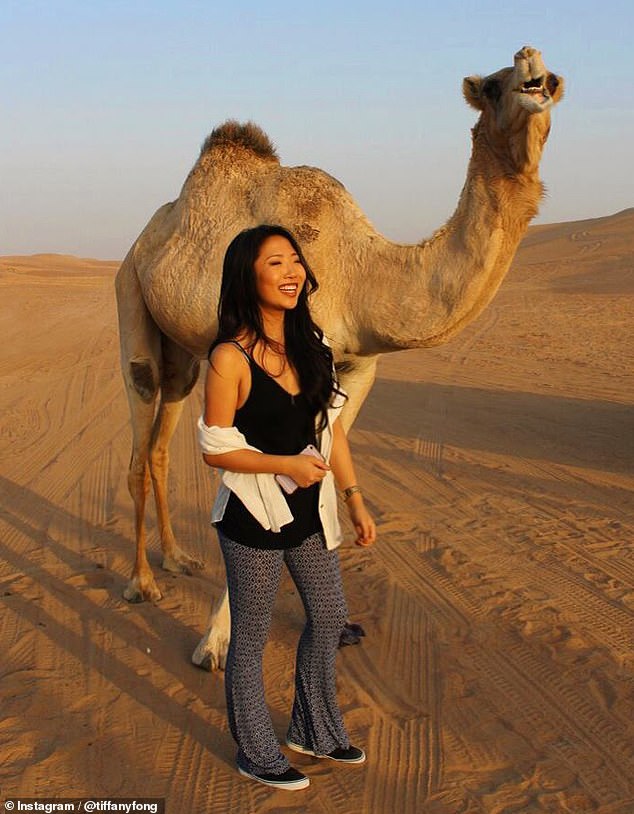

Tiffany Fong talks about her philosophy on how best to punish financial crimes, being a victim of one herself

Sam Bankman-Fried (left) leaves Manhattan federal court in New York. Alex Mashinsky (right), founder and former CEO of Celsius Network Ltd., during a panel session at the Blockchain Week Summit in Paris, France.

Celsius, like FTX, left a long trail of victims in its wake.

His fall from grace, which involved an abrupt halt to withdrawals, came months before FTX went out of business. When founder Alex Mashinsky was arrested in July 2023, the SEC filed a lawsuit calling Celsius’ business model “unsustainable.”

Fong said he took to social media almost immediately after losing his money. She now has approximately 110,000 followers on X and just over 45,000 subscribers on YouTube.

He uses his social platforms to keep people informed about cryptocurrency-related cases.

More than a year later, her work led her to approach Bankman-Fried. Fong said that she is still in contact with him and that she has published lengthy recorded interviews with the cryptocurrency founder in the past.

She was also the first to originally post an image of Bankman-Fried in prison, posing on a wall with other inmates who colloquially call him ‘G Lock’.

Fong visited Bankman-Fried at her parents’ home in Palo Alto, California, in December 2022. They talked about her uncomfortable time in the notoriously brutal Bahamian prison, Fox Hill, where she struggled with a lack of mental stimulation, according to Fong.

At the time, Fong said Bankman-Fried’s strategy for dealing with a possible life in prison was not to think about it too much.

Fong said: “He is aware of the possibility of going to prison, but he doesn’t seem to want to give much thought to the worst-case scenario: a life sentence in prison.”

Tiffany Fong doesn’t want Bankman-Fried to receive zero prison time, but she thinks “anything even close to life is too far away.”

She was also the first to originally post an image of Bankman-Fried in prison, posing on a wall with other inmates who colloquially call him ‘G Lock’.

Speaking about the sentences Bankman-Fried and Celsius’ Mashinsky should receive, he told DailyMail.com: “I understand that most people have the impulse to want to see them in prison for life.

‘I understand that seems to be the general feeling among the public, but I guess I’m personally not a very vengeful or vengeful person.

“So I personally focused more on how much money I could actually get back.”

Fong doesn’t want Bankman-Fried or Mashinsky to get away with it. He said he has never advocated a zero prison sentence for Bankman-Fried.

At the same time, he does not believe that nonviolent criminals, such as white-collar criminals, deserve life sentences.

“To me, the main goal of a long prison sentence should be to keep the public safe… so the people I want to see sentenced to life in prison are violent criminals like rapists, pedophiles, murderers, etc., just to keep everyone safe.” safe,” Fong told DailyMail.com.

However, he believes Bankman-Fried and offenders like him should probably be banned from engaging in financial services again.

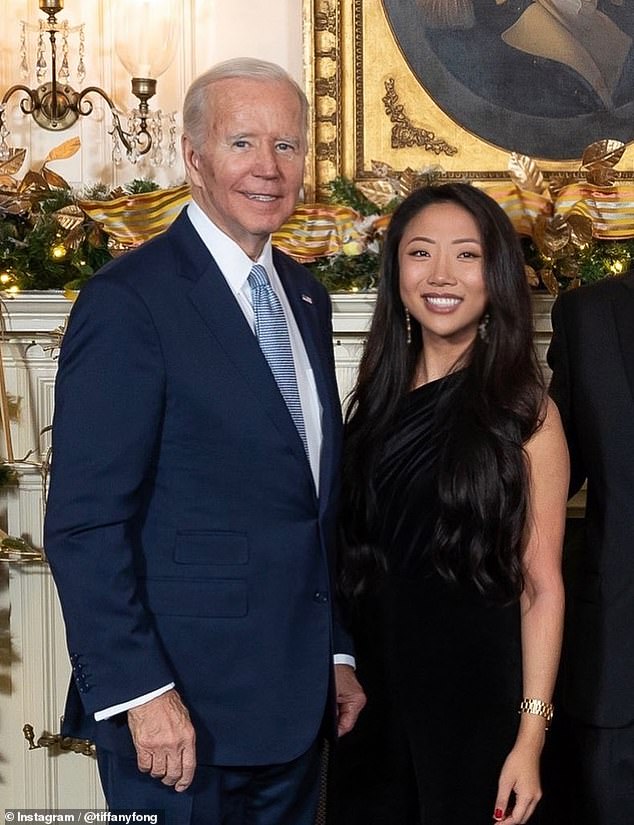

Tiffany Fong posing with President Joe Biden in December 2022

Fong visited Bankman-Fried at her parents’ home in Palo Alto, California, in December 2022.

Fong said part of his sympathetic view of the sentencing comes from his own mental health issues.

“I understand that some people argue that these are violent crimes, obviously because maybe some people could have taken their own lives, and I’m very empathetic to that point of view.”

Sentiments similar to Fong’s were present in the series of victim impact statements received by the court last week.

A considerable number of people did not even mention Bankman-Fried by name. Rather, many of them listed the assets they had in FTX, how much money they estimated they had lost in the collapse, and urged the court to determine a fair restitution amount.

One person wrote: ‘I invested all of my hard-earned life savings in bitcoins on the FTX platform, hoping to secure a better future for my family and me.

‘However, the actions of SBF and FTX have shattered those hopes. “The scam has caused immense emotional distress.”