The FTSE 100 hit a record high of 8,393 earlier this week, having risen more than 9 per cent since the start of 2024.

That was the 12th new closing peak for the UK’s main stock index in a month, equaling a record dating back to 1984.

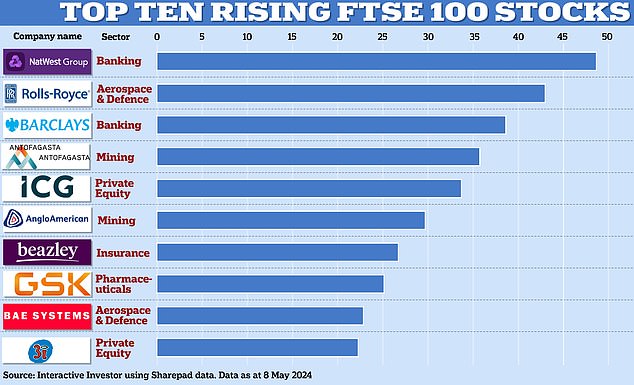

While investors will be encouraged by a 9.3 per cent return in mid-May, some FTSE 100 shares have grown much more: the top three are up 49 per cent, 42 per cent and 39 per cent respectively.

We reveal the ten biggest risers in the FTSE 100 this year and look at why these big blue-chip companies have led the way on the UK stock market.

Biggest risers: NatWest Group is the best-performing blue-chip stock so far this year, followed by aerospace giant Rolls-Royce and banking firm Barclays.

Why are stocks going up?

The FTSE 100’s latest series of all-time highs is due to renewed eexpectations of imminent interest rate cuts.

While the Bank of England did not lower the UK’s base rate last week, the 7-2 vote to leave it in place and boss Andrew Bailey’s dovish tone encouraged financial markets to predict it will cut rates over the summer and will drop to 4.75 percent this year. year.

Lower base rates tend to stimulate stock markets by spurring business investment and consumer spending rather than savings and debt payments.

In contrast, bank stocks have benefited from the high interest rate environment as borrowers are charged more for loans and mortgages.

The ‘Footsie’ is also benefiting from the depreciation of the pound against the dollar because companies in the index tend to have sizeable overseas profits that are worth more when converted back to pounds sterling.

However, as Victoria Scholar, chief investment officer at Interactive Investor, points out: ‘The index is not a barometer of the strength of the UK economy; rather, it is an outward-facing index that largely comprises multinational conglomerates.’

He adds that Footsie is getting a substantial boost from defense and aerospace stocks, which are booming due to geopolitical instability and larger military budgets.

Here are the ten best-performing blue-chip stocks so far this year, with data correct as of May 15, 2024.

After an ‘debanking scandal’ involving former UKIP leader Nigel Farage rocked NatWest last year, the financial services giant has responded strongly.

In February, the company revealed that pre-tax profits soared by a fifth to £6.2bn in 2023, its best result since the global financial crisis and some £200m above analyst forecasts.

Like other commercial banks, NatWest has benefited from the Bank of England raising interest rates further in response to high levels of inflation.

And although its first quarter results showed a significant decline in profits, profits of £1.33 billion still beat expectations.

These results come as the UK Government prepares to sell its outstanding stake in NatWest, having reduced its stake by around 11 percentage points since January to less than 27 per cent.

Will Howlett, financial analyst at Quilter Cheviot, says: “While this represents excess for the share price, it can also be seen as an offsetting event and reduce any further political or regulatory interference in the short term, which will do well. received by investors”. .’

Thanks to a turnaround led by chief executive ‘Turbo Tufan’ Erginbilgic, Rolls-Royce’s annual profits have more than doubled and its cash flow has climbed to record levels.

The continued rebound in air travel has boosted demand for the company’s engines and services, with Turkish Airlines and Air India among airlines that placed huge orders last year.

Recovery: Thanks to a turnaround led by CEO Tufan Erginbilgic (pictured), Rolls-Royce’s annual profits have more than doubled.

At the same time, its defense business has boomed as conflicts in Ukraine and the Middle East and the possibility of China invading Taiwan have led countries to increase military spending.

Rolls-Royce is one of the biggest winners of the AUKUS security partnership, with a deal to build power units for the UK’s nuclear submarines.

Global defense spending is expected to grow in the coming years due to these conflicts, while demand for air travel is expected to double by 2040, according to the International Air Transport Association.

Both factors provide an optimistic long-term outlook for Rolls-Royce, whose shares have already more than quadrupled since its Turkish-born chief executive took over in January 2023.

Although its most recent annual profits were lower, Barclays’ promise to deliver £10bn to investors and undertake a restructuring to save £2bn in costs by 2026 resonated with shareholders.

The company delivered on this promise with forecast-beating profits of £2.3bn in the first quarter despite lower mortgage loans, customer deposits and corporate deals.

Investors have accused Barclays of being too reliant on its investment banking arm, a criticism exacerbated by the decline in M&A deals due to higher interest rates.

Rewards: Shareholders applauded Barclays’ promise to hand over £10bn to investors and undertake a restructuring to save £2bn in costs by 2026.

However, Russ Mould, investment director at AJ Bell, says the size of this division “could make it a key player in any sustained recovery and boom” in the struggling British stock market.

He adds: ‘A rising market could increase interest and boost trading volumes, primary and secondary issuances and M&A activity.

“All of this could drive incremental fees through the investment bank and boost its traditionally cyclical earnings.”

Here’s a rundown of the remaining top ten:

4. antofagasta (36.3/5) – Demand for copper is driving the Anglo-Chilean firm, which plans to increase production of the key metal for the energy transition in 2024 despite the fall in mineral prices.

5. Intermediate capital group (33.3%) – The private equity manager, a new entry in the FTSE 100, has continued to see its assets under management grow, reaching $86.3 billion at the end of December.

6. Anglo-American (33.2%) – The mining group’s share price has soared since it received a mega £31bn offer – later raised to £34bn – from BHP, its much larger Australian rival.

7. beazley (29.6%) – In February, the insurance business raised its full-year profit outlook and declared plans to deliver another $300 million to shareholders.

8. GSK (25%) – The pharmaceutical giant raised its annual profit forecast after first-quarter sales rose 10 per cent to £7.4bn.

9. BAE Systems (22.7%) – Orders have continued to come in for the defense giant amid heightened global tensions, reaching a record order book of £70 billion in 2023.

10. Group 3i (22.5%) – The former owner of Agent Provocateur has enjoyed excellent profits thanks to the rapid growth of Dutch discount chain Action, in which he owns a majority stake.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.