Table of Contents

Rachel Reeves’ £40bn tax bonanza will impact the financial wellbeing of millions of households for years to come.

The impact of the Chancellor’s raid will be felt by all age groups, from young workers to retirees. Here’s how last week’s Budget could affect you and your finances.

young workers

First-time buyers could face paying thousands more in stamp duty after Rachel Reeves lowered key thresholds.

Next April, the threshold at which first-time buyers will start paying stamp duty will fall from £425,000 to £300,000.

Those who rent are also likely to feel the consequences. Experts have warned that an increase in stamp duty for second home buyers could mean there will be fewer properties available to rent in the future.

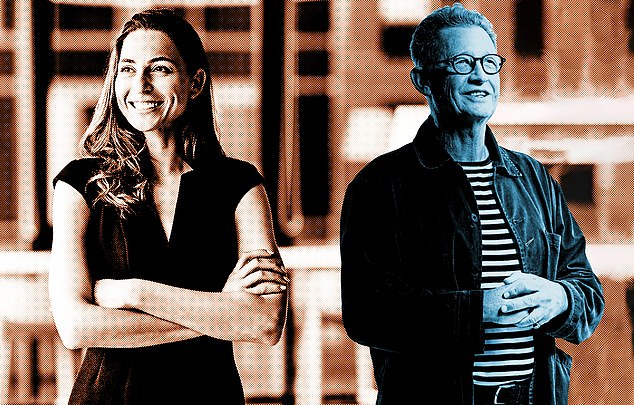

Smash and grab: Rachel Reeves’ £40bn tax bonanza will hit the financial wellbeing of millions of households for years to come

This could worsen an existing housing shortage in the rental market that has led to dramatic rent increases in recent years – the average rent has risen 40 percent since June 2020, according to rental agency HomeLet.

In the workplace, anyone starting their career on the minimum wage will receive a 6.7 per cent rise, with the national minimum wage rising to £12.21 an hour from April. The minimum wage for 18- to 20-year-olds will increase by £1.40 an hour.

However, unfortunately the effect will be more than mitigated by the economic impact that the increase in National Insurance proposed by the Chancellor will have on employers, experts warn. This could translate into fewer jobs, advancement opportunities and salary increases.

Sarah Coles, head of personal finance at stockbroker Hargreaves Lansdown, says: “The impact of higher National Insurance contributions for employers will be reflected in business finances and is likely to mean lower pay rises in the future.”

She recommends that workers create an emergency safety net by putting some money away by direct debit to a savings account each payday. As a general rule, you should set aside three to six months of your regular salary as an emergency fund.

Families

Workers will continue to lose out due to the continued sneaky tax raid on their income. Reeves has said that income tax thresholds are scheduled to be frozen until 2028. This means already tight household budgets will be squeezed even further, due to an effect known as “fiscal drag”, which occurs when wages increase but tax thresholds do not. Therefore, the tax collector gets a larger proportion of your income than he would otherwise.

As a result of the freeze until 2028, four million more workers will be forced to pay an additional tax rate (45 percent), bringing the total number to more than 40 million for the first time, according to official forecasts.

Rachael Griffin, tax and financial planning expert at Quilter, said: “By choosing to maintain the freeze, the Government has ensured that the tax burden continues to rise for millions of people, despite its promise to the contrary.”

Rachel Springall of Moneyfacts, who analyzes savings rates, says one consequence will be that families will find it harder to save money for their children. ‘If things are already difficult, how can people save?’ she says.

Buried in the budget was other bad news for families. Reeves has abandoned plans to assess child benefit based on household income, rather than the income of the highest earner, as he warned it would cost too much. It means the current system, which penalizes single-income families, will remain unchanged.

And those with young children might be disappointed. Released alongside Reeves’ budget was the latest forecast from the Office for Budget Responsibility (OBR), which warned that plans to give working parents 30 hours of free childcare a week could fail. It said: “There is a risk of a shortfall in the supply of funded places and staff for the September 2025 expansion, which will be the largest yet.”

Parents with children in private schools will be affected after the Chancellor pressed ahead with a plan to impose a 20 per cent VAT on fees from January 1. To what extent this will affect the fees paid by parents will depend on the decision of each school.

There are fears mortgage rates could rise once again following the Chancellor’s £162bn borrowing overhang and the OBR predicts they could rise by almost a percentage point to 4.5 per cent over the next three years.

Pensioners

Pensioners may be forced to rethink their inheritance plans after the Chancellor imposed a new inheritance tax on pension funds.

Pensions left to family members will be included in inheritance tax (IHT) net from April 2027. In its first three years, this tax take is expected to affect 8 per cent of inheritances. By contrast, only 4 per cent of estates are currently subject to IHT, which is charged at 40 per cent.

Karen Barrett, chief executive of financial consultancy Unbiased, said Reeves’ attack on pensions means there is a need to review the estate planning people have already done.

She says: “If your estate planning is based on the current IHT rules, it is a good idea to review them and consider making changes with the help of a financial adviser.”

Former Pensions Minister Baroness Altmann has warned that by subjecting pensions to IHT, Reeves could inadvertently increase pensioner poverty by giving retirees “an obvious incentive” to raid their retirement funds, which could leave them shorts in the future.

‘People may think why not take all the money they’ve saved and spend it?’ she said.

Some good news is that the Chancellor confirmed that state pensions will increase in line with average earnings, by 4.1 per cent next April. Anyone who reached state pension age after April 2016 will see their weekly earnings increase by £9.05 to £230.25 a week, an increase of £472 a year. Older pensioners receiving the basic state pension will receive a rise of £6.95 to £176.45 a week, an increase of £363 a year compared to now.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.