Table of Contents

Freetrade will allow its clients to lend out their most sought-after shares to borrowers for a small fee, This Is Money can reveal.

Share lending, which is a bit like renting shares, is typically used by financial institutions for trading activities and risk hedging.

Some DIY investment platforms like Trading 212 offer it to their clients and it is particularly popular in the US.

However, this carries risks and is often used to short the borrowed shares, which can put downward pressure on their price.

We explain how stock lending works, why people borrow and lend stocks, and some of the risks associated with it.

Stock Lending: Freetrade clients can lend stocks on demand and earn a commission

How does stock lending work?

Stock lending, also known as securities lending, is when shareholders temporarily transfer their shares to a borrower in exchange for a fee.

Typically, lenders are ETFs, pension funds and insurance companies, while borrowers are banks, hedge funds or brokers looking to short stocks or support liquidation.

In this case, the lender will be a Freetrade client, who can choose to have their shares linked to a “high quality” borrower, which can include investment banks, hedge funds and stockbrokers.

All shares, investment trusts and ETFs in GIAs and SIPPs are eligible, but not those held in an ISA. The platform also says it will not lend any ETFs that fund managers rate as low risk.

When there is demand, the shares will be transferred and the borrower will pay a fee. This will usually depend on how much demand there is for that particular share.

Clients will keep half of the commissions earned when lending shares, with the other half held by Freetrade and its partner managing the program.

Freetrade says there will be no changes to the way clients can manage their portfolio and that clients can still sell shares that are on loan as normal.

However, if your shares are on loan, you may not be able to vote if the opportunity arises and may have to withdraw them.

Why do people lend and borrow shares?

Investors may earn some income by lending out their shares, but this will depend entirely on the rates borrowers are willing to pay and the number of shares lent.

This will vary from day to day depending on the demand for the shares you earn and the platform says that on a typical day, most shares are not loaned out.

While Freetrade claims that clients can earn passive income through stock lending, the returns are minimal.

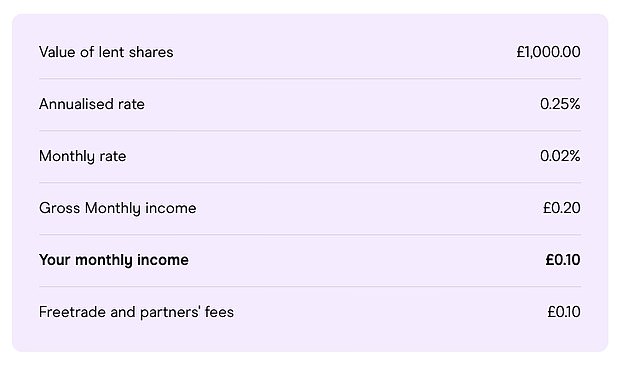

They calculate that if you were to lend £1,000 worth of shares, the monthly rate of 0.02 per cent would generate a gross monthly income of 20p, meaning a client would take home 10p a month.

Monthly Income: Freetrade says clients can supplement their income through loans

Viktor Nebehaj, CEO of Freetrade, said: ‘Our share lending programme opens up a new source of passive income for our clients to grow their wealth over the long term, something that was previously not widely available in the UK market.

“These earnings can improve your portfolio’s returns over time. Retail investors now have the opportunity to participate in such programs if they believe they will help them achieve their long-term financial goals and if they fit within their risk tolerance.”

However, borrowers often borrow shares and then short them, putting downward pressure on the price.

How are investors protected and what are the risks?

Freetrade says that “losses to lenders in securities lending markets are very rare.”

To protect lenders, the borrower will post collateral, so if they fail to return the shares, Freetrade will sell the collateral and buy back the shares.

Freetrade says it only accepts government bonds as collateral because they involve lower risk and are easy to sell quickly to buy replacement shares as quickly as possible.

It also guarantees that the collateral is worth at least 105 percent of the value of the shares loaned.

If the collateral does not cover the amount, Freetrade says it will make up the difference.

“As a regulated firm, we hold capital to protect clients in these scenarios and ultimately the FSCS provides final backstopping for clients,” he says.

Share lending is regulated by the Financial Conduct Authority, with rules requiring hedge funds to disclose their short positions when they reach certain thresholds.

However, stock lending is not without risks, the main one being that the borrower may not return the shares when they are recovered.

This may be due to market liquidity, meaning the borrower cannot buy back the shares, or the borrower may become insolvent and unable to repay the debt.

It may also simply be the result of an administrative error.

Freetrade says: ‘As shares are lent and returns are linked to purchases, settlement becomes dependent on the next stage in the chain.

‘Lenders and borrowers have processes and controls in place to mitigate this from happening and resolve cases quickly.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.