Perrie Edwards fans went wild when the former Little Mix star released her debut solo single Forget About Us on Friday.

The singer, 30, who collaborated with Ed Sheeran on the song, saw her stunning voice branded the “voice of a generation” when the catchy tune hit No. 1 on UK iTunes within hours of its release. launch.

Perrie has ditched her last name as she embarks on her solo career with her first song, which includes a yet-to-be-released video directed by Beyoncé collaborator Jake Nava, and is already leaving fans “obsessed.”

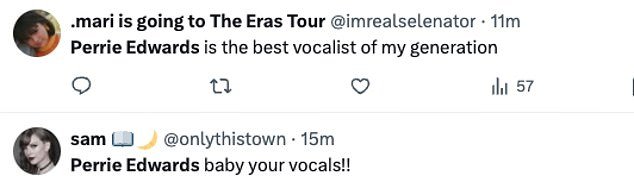

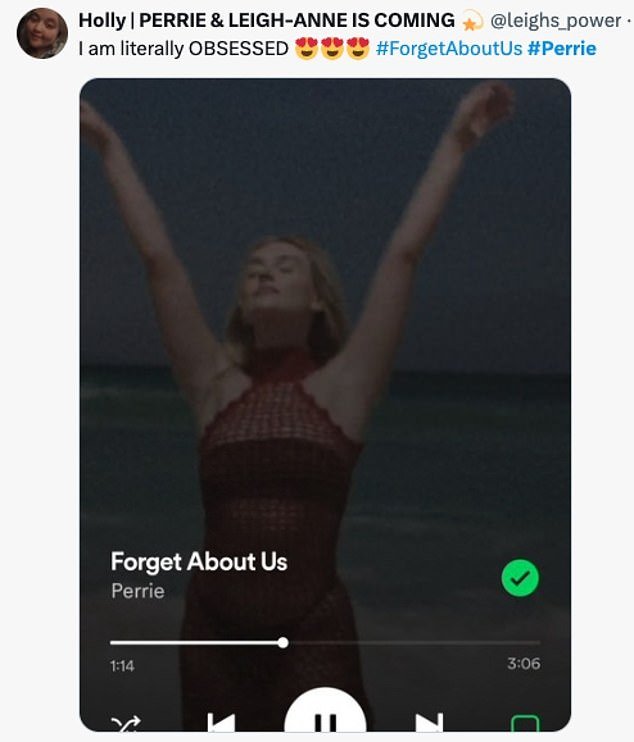

On It’s an early summer bop’: ‘Perrie Edwards is the best vocalist of my generation.’

‘Perrie Edwards really wanted her first single to be a hit! Never in my life have I loved a song for the first time…until now! Oh my god’: ‘Perrie Edwards, your voice, baby!’ : ‘I’m literally obsessed’: ‘THIS SONG IS A MASTERPIECE MY QUEEN’.

Perrie Edwards, 30, fans went wild when the former Little Mix star released her debut solo single Forget About Us on Friday.

The singer who collaborated with Ed Sheeran on the song saw her stunning vocals branded the “voice of a generation” when the catchy tune hit No. 1 on UK iTunes within hours of its release.

‘Wow, Forget About Us is number 1 on iTunes UK and the lyric video is number 2. I’m so proud of you Perry!! Congratulations!!’: ‘This song is SO GOOD, Perrie and Ed Sheeran and whoever else helped write this song did a brilliant job, can’t wait for the next single’: ‘Perrie deserves so, so much!’ ‘So happy for her!!’

Perrie is following in the footsteps of former bandmates Leigh-Anne Pinnock and Jesy Nelson going solo.

And the singer, who was previously engaged to Direction’s Zayn Malik before footballer Alex Oxlade-Chamberlain revealed the new song was inspired by her past, saying: “I look back at past relationships and think happily of those moments.”

‘Do I want to be there now? No. It didn’t work out that way and if it was supposed to, it would have happened. “Relationships have been a big part of my life and have made me who I am today.”

Before adding: “I think it’s a nice feeling to be honest and it’s very relatable.”

Perrie, who shares her two-year-old son Axel with her fiancé Alex, said her next album would also include rock and roll, country and disco influences.

“Going to solo sessions now and being able to say what I want and feel is the most incredible experience.”

She continued, “I’ve never had the confidence to do that before, but this process has allowed me to believe in myself and explore all of my different emotions and different parts of my life.”

Most of the album was recorded at their north London home after Alex suggested they convert their disused dining room into a home studio.

Perrie has ditched her last name as she embarks on her solo career with her first single, which includes a yet-to-be-released video directed by Beyoncé collaborator Jake Nava, and is already leaving fans “obsessed.”

Fans took to social media after the song’s long-awaited release.

She confessed: ‘I am very proud of what I have done and created. I wanted it to be fun more than anything else and showcase my singing through ballads and big vocal numbers.

Before revealing his plans to tour with a live band: ‘Having people singing your songs is the best natural high in the world. “I’m really excited to see how fans react to my music now.”

While the musician co-wrote Forget About Us with Ed, 33, he also announced that the duo had collaborated for a second song.

Perrie explained: ‘I feel like all the collaborations happened organically. With Ed Sheeran, he had a song, he called me and we discussed the concept.”

She continued, “I loved the melody, I loved the vibe; I admire him so much that I think he’s one of the most talented human beings out there.”

“She’s also such a nice, genuine person, so I felt comfortable saying, ‘I love it, but conceptually it’s not me. I’m not at that stage in my life right now. Would you be okay if I modified the lyrics to fit me and my life?”

And he said, “Of course!” He wanted me to have full ownership of it, so I went and did it.

While the musician co-wrote Forget About Us with Ed, 33, he also announced that the duo had collaborated for a second song.

For another heart-filled hit, he recruited six-time BRIT Award winner RAYE.

Most of the album was recorded at her north London home after her fiancé Alex Oxlade-Chamberlain suggested turning her disused dining room into a home studio (pictured with her two-year-old son Axel).

For another heart-filled hit, he recruited six-time BRIT Award winner RAYE.

‘Going into the studio with her was ridiculous, she just oozes stardom, I can’t explain it; I think she is one of the best artists of our generation.

“I’ve been very lucky that it’s been really nice to work with the people I’ve idolized; there haven’t been any big egos or intimidating moments, I think that’s what made the experience so special for me.”

Formed on The X Factor in 2010, Little Mix enjoyed enormous success throughout their 11-year recording career before announcing their split in December 2021.

But the bandmates have suffered mixed fortunes since confirming their decision to leave the band to pasture.

Former member Jesy, who left the band in 2020 to prioritize her mental health, originally signed a solo deal with Polydor Records.

The two parted ways with the label in 2022 following a lukewarm response to their debut single, Boyz.

Formed on The X Factor in 2011, Little Mix enjoyed huge success throughout their 11-year recording career before announcing their hiatus in December 2022.

But the bandmates have suffered mixed fortunes since the split as Jesy, who left the band in 2020, parted ways with her label in 2022 following a lukewarm response to her debut single, Boyz.

The singer later released his second solo single, Bad Thing, independently, but the song failed to enter the UK Top 100 Singles Chart.

Jesy has since scrapped her plans to release third single Cried Out in favor of a “quick banger” which she says is “me in a nutshell”, according to sources.

Speaking to The Mirror, a source said: ‘Jesy has been listening to her critics. She’s desperate to give fans something epic and she’s doing her best to find her authentic sound, but the sudden change has destabilized her side.

“Last year, it was believed that most of her debut album was finished – even the artwork was in place – but since then Jesy has made a big U-turn and everything is being reworked, even the aesthetics, as she doesn’t matches their new album. -tempo direction.’

In 2022, Leigh-Anne signed her own solo deal with Warner Records and released the debut single Don’t Say Love in June 2023.