An unfiltered Michael van Gerwen hit Luke Littler again after beating the teenager in the Premier Darts League night 11 final in Birmingham.

Littler was hoping to achieve his third consecutive victory in the competition (and would have been the first person to do so if he had achieved it), but he crashed out of the final, losing 6-3 to his Dutch rival.

The 17-year-old had beaten world champion Luke Humphries again in a rematch of the world final earlier this year, beating his fellow Briton 6-5 in a thrilling semi-final.

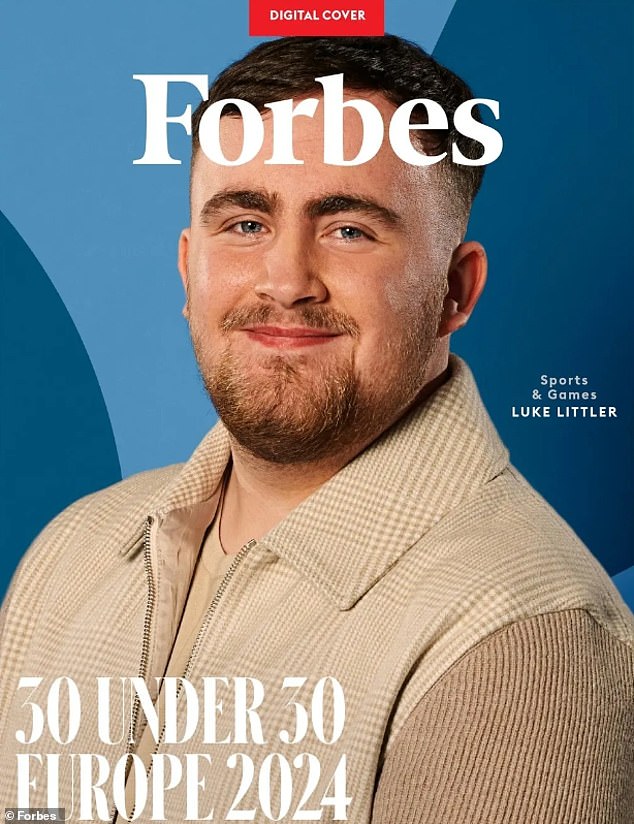

Also beating Rob Cross in his first game of the night, it looked like Littler would go on a rampage again to further extend his lead at the top of the table days after appearing on the cover of Forbes’ 30 under 30, but a resilient Van Gerwen pulled out. stood in his way of securing his fourth nightly victory of the competition.

After the night’s match, the Dutchman and seven-time Premier League champion, who had previously said the teenager’s performances were “not convincing”, took aim at Littler, insisting he is still the opponent to beat despite his indifferent recent form.

Luke Littler (pictured) was criticized by Michael van Gerwen following the pair’s Premier League match on Thursday.

Littler was named to the Forbes 30 Under 30 list in the Europe Sports & Games class of 2024

Van Gerwen said Littler played ‘c**p’ and that he will ‘wait for me to catch up’ in the world of darts.

“He played shit tonight and I beat him, that’s the reality,” the 34-year-old said. SportsBoom.com. “I’m happy with the victory and we move on to the next one.

“He’s obviously done sensational things for the sport, but he’s always going to be the one chasing me.” He’s about 150 tournaments behind me. I’ll wait for it to catch up to me.

Littler burst onto the scene with his World Championship run and has since won the Bahrain Darts Masters, the Belgian Darts Masters and a PDC Players Championship.

Despite being called a celebrity and “not a darts player” by Nathan Aspinall, Littler has changed the darts scene and has been regarded as the most exciting young prodigy since Van Gerwen himself.

Littler was named to Forbes 30 Under 30 in the Europe Sports & Games class of 2024 a few days ago, which includes young athletes, game developers and entrepreneurs making a name for themselves.

His efforts have taken the sport of darts to new levels, but Van Gerwen was left frustrated with his new rival’s recognition of his recent success.

“With all due respect, he hasn’t won anything yet,” Van Gerwen added. ‘If people haven’t won anything yet, should they get into Forbes?’

The 17-year-old was trying to win his third night in a row, but was stopped by the Dutchman (right) in the final.

He remains at the top of the Premier League table, four points ahead of Van Gerwen and two ahead of Luke Humphires.

Next week’s edition of the Premier League will take place in Rotterdam, where Van Gerwen will have the strong support of his home crowd to claim another victory each night.

He will first face basement caretaker Peter Wright after Littler takes on Michael Smith, and the two could face each other again in the future if they win their initial matchups.

In the table, Little remains the leader with two points ahead of Humphries, who occupies second place, and Van Gerwen two more behind. All three will qualify for the play-offs later this year.