Table of Contents

- Peel Hunt cites NIC and living wage rises as food price forecast rises to 3%

UK food inflation could approach 4 per cent by the end of 2025 as supermarkets react to cost pressures arising from Labour’s autumn budget, according to analysts at Peel Hunt.

On Monday, the broker doubled its forecast for food inflation in 2025, from 1.5 percent to 3 percent, reflecting higher employer contributions to national insurance, an increase in the national living wage and the impact of the Bill Employment Law.

However, he said food inflation could grow throughout the year and by the end of 2025 the figure could be closer to 4 percent.

Peel Hunt also cited the UK’s over-reliance on imports from the European Union and the country’s strained relations with the bloc, where “nasty bureaucratic spaghetti” and looming regulatory changes will push prices up further this year.

And while food prices are not a component of the Bank of England’s measure of core consumer price inflation, analysts at Peel Hunt warned that higher food costs could affect authorities’ ability to cut interest rates this year.

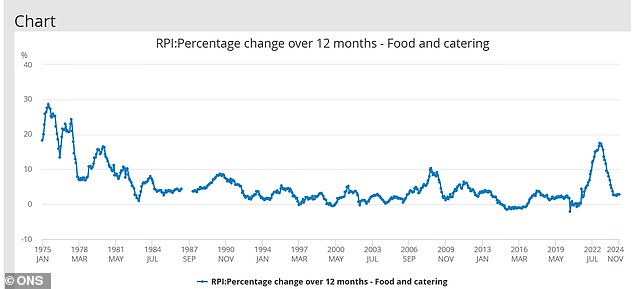

Food inflation in the UK approached 20 per cent in early 2023 following the Russian invasion of Ukraine the previous year.

Peel Hunt has upgraded its UK food inflation forecasts, saying prices could rise by 4% in 2025

The latest data from the Office for National Statistics shows that the 12-month CPI rate for food and non-alcoholic drinks was just 2 per cent in November, although it was higher than 1.9 per cent in October.

Latest data from market researcher Kantar showed annual grocery price inflation was 2.6 percent in the four weeks to December 1, up from 2.3 percent in the previous four-week period. .

Peel Hunt expects price growth to remain relatively stable during the first quarter, but the broker warned that the outlook will “progressively change” from April.

It said: “Cost recovery for the entire UK food system (will become) a new priority, work on which we suspect began the day after the Budget in October.”

Chancellor Rachel Reeves announced in the autumn that employers will pay a 15 per cent National Insurance levy on staff salaries over £5,000, instead of the current 13.8 per cent tax on salaries over £9,100. .

Peel Hunt said the change is “quite massive in annualized terms”, and could cost Tesco just £250m, while key suppliers also face “state-induced labor costs in the tens of millions”.

The broker believes the impact will be equivalent to 0.5 to 1 per cent on ONS food prices.

The national living wage will rise by 6.7 per cent to £12.21 an hour from April, while the minimum wage for 18-20 year olds will rise by 16.3 per cent to £10 an hour.

Peel Hunt said Britain’s major supermarkets already pay “close to or above” the new rate, but could be forced to raise wages anyway to keep up with the rest of the labor market, while the impact will be felt more deeply by suppliers and manufacturers.

He also highlighted the Government’s controversial employment bill.

Peel Hunt said: “It remains to be seen when the bill will come into force and in what form, but for the big workers who employ the UK food system and supermarkets in particular, as such high costs emerge, the impact It is, again, likely to sit on the edge of the shelf.

He added: ‘We expect UK food inflation to rise through 2025, possibly ending the year closer to 4 per cent, given the multitude of largely state- and regulatory-driven costs facing the system. .

‘For now, it is not food products, crude oil or the pound sterling that is causing food inflation in the UK, unlike the UK government’s policies.

“So when you’re asked in 2025 why food prices are rising, send the postcard to 11 Downing Street.”

ONS data shows impact of inflation pressures following Russian invasion of Ukraine in 2022 on retail food prices

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.