Flats with service fees under £1,000 a year are on the brink of extinction, experts warn.

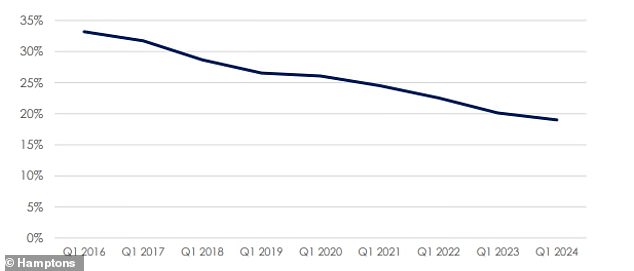

At the end of March this year, according to estate agency Hamptons, only 19 per cent of flats had a service charge of less than £1,000, down from a third of flats in 2016.

Service charges are used to pay for things such as maintenance of common hallways and gardens, lift repairs, and the cost of hiring maintenance and janitorial staff, if any.

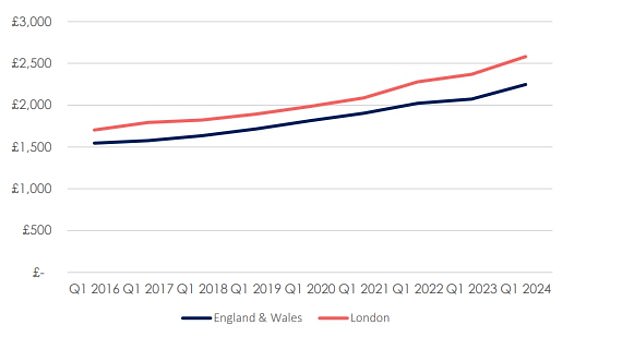

The average service charge for a flat in England and Wales stood at £2,247 a year, up 31 per cent on the first quarter of 2019.

All charges must be clearly reasonable, and if you suspect they are not (and have done your research), there are ways to effectively challenge any increase.

Service charges paid by flat owners have soared in recent years, up 8.4 per cent or £174 a year between the first three months of 2023 and the first quarter of 2024.

It’s twice the rate of inflation and marks the fastest annual growth rate since records compiled by Hamptons real estate agents began in 2016.

In London, where property prices and service charges tend to be higher, only 14 per cent of flats have an annual service charge of less than £1,000.

According to Hamptons, based on its current track record, there are unlikely to be flats offering a service charge of less than £1,000 a year within a decade.

Service charges have risen in recent years as the Government begins to clamp down on other sources of income for property owners and developers, such as ground rentals.

Service charges are a proven way for property investors to make money.

As the sector is largely unregulated, it is not uncommon for some property managers to charge service fees of over 10 per cent to oversee any major work on a development. This can add to residents’ annual service charge bills.

There is also the issue of cladding and fire safety which has hit the sector, with some flat owners facing six-figure bills to repair their properties.

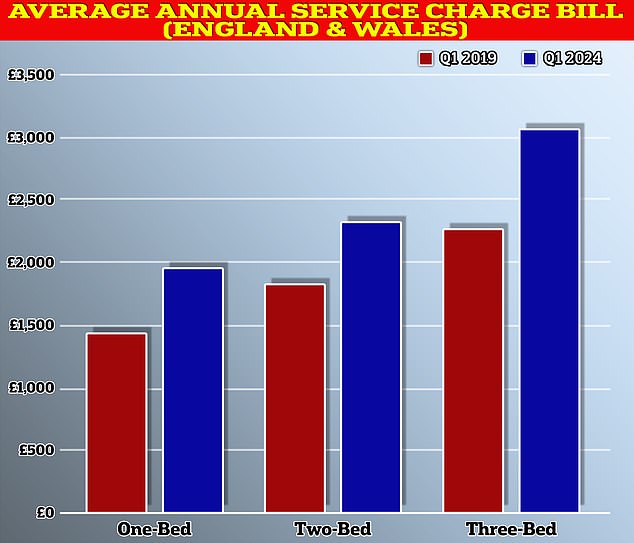

The amount a flat owner pays in service charges tends to increase in line with the additional number of rooms his property has.

Going down: Hamptons has revealed the proportion of flats with an annual service charge under £1,000 in England and Wales

Hamptons research found the service charge for a one-bedroom apartment in England and Wales was typically £1,940 at the end of the first quarter of this year, with three quarters of apartment owners paying more than £1,000 a year .

At the same time, the average service charge for a two-bedroom apartment was £2,311, with 84 per cent paying more than £1,000 a year.

And the average charge for three bedrooms stood at £3,044, which is the first time the annual charge has surpassed the £3,000 mark.

Virtually all three-bedroom renters (89 per cent) pay more than £1,000 a year.

The typical annual service charge has increased in recent years for apartments of all sizes.

Taking a look at England and Wales, there are five in 10 regions with average service charges now over £2,000 a year.

This is in stark contrast to five years ago, in 2019, when no region had average service charges above this level.

There has been little evidence that service charges have been reduced in recent years, with 81 per cent of the changes occurring northbound.

A total of 5 per cent of tenants now pay more than £5,000 a year in service charges.

Hamptons has analyzed the average annual utility bill for a flat in England and Wales

Can service charges be disputed?

Service charges must be reasonable and can be disputed if you suspect they are not.

It is worth trying to get the support of as many tenant neighbors as possible, perhaps even creating a neighborhood association.

The government financed Lease advisory service will give free telephone advice to tenants with a tenancy agreement of more than 21 years, although only for 15 minutes.

When appropriate, look up some quotes for jobs that you think other contractors have overcharged and see if their price is lower than what you paid.

And download the free service charge residential management code issued by the Royal Institution of Chartered Surveyors, which sets out best practice for landlords and their managing agents to follow.

You can start disputing the service charges by sending a letter or email to the owner or managing agents. Scroll down to see a template you can use.

Rising service charges mean buyers are increasingly wary of the ongoing additional cost of purchasing their home.

The key is to research the service charges for your apartment, and preferably before purchasing the property.

Hamptons’ David Fell explains: ‘Increasing service charges mean buyers are increasingly cautious about the ongoing additional cost of purchasing their home and are carefully weighing the value for money they offer.

‘Higher mortgage rates have already put financial pressure on many would-be flat buyers, and the fact that higher service charges are also incurred often limits how much they can borrow from the bank.

‘As buyers review service charge accounts with an increasingly fine-toothed comb, they are more informed than ever about how much they will pay each month and what they will receive in return.

‘This means that the value of apartments where the price of the service is disproportionate to the services offered is put under downward pressure.

‘Service charges are generally based on expected running costs for the coming year. But inflation has been pushing these costs higher than expected, meaning today’s higher bills reflect inflation that has been rising for much of the past 18 months.

“In addition, the first generation of city center flats are now thirty years old and starting to show their age, often approaching the point where they need a cash injection.”