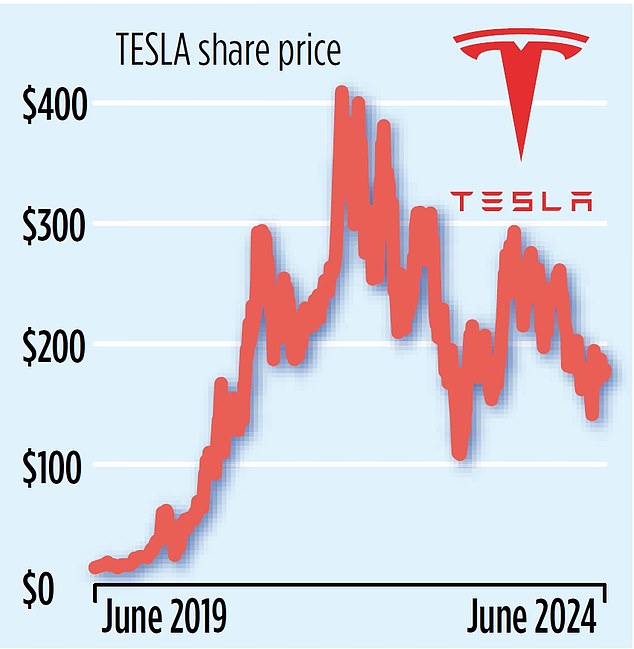

Elon Musk is the richest man in the world and the most talked about business leader on the planet. But has he lost his way? Between 2014 and 2023, investors benefited from a surprising 1,000 percent rise in the shares of his electric car company, Tesla.

But since the beginning of the year, they have fallen 40 percent amid concerns about his increasingly eccentric behavior and questions about whether the maverick is focused enough on the company.

Many private investors in the UK own Tesla shares, either directly or through a fund such as the Scottish Mortgage Investment Trust. So, should they keep them, sell them, or even buy more?

There are several reasons to be afraid:

On Thursday, investors will decide whether to vote in favor of a $56 billion (£44 billion) rewards package for Elon Musk.

Huge salary package

A key test of the tycoon’s credibility will be this Thursday’s annual meeting, where investors will decide whether to vote in favor of his $56bn (£44bn) rewards package.

This is based on Tesla’s market value and the performance of its operations between 2018 and 2023. Its sheer size has led to criticism that it has been overtaken by greed and grandiosity.

Among the objectors is the California Public Employees’ Retirement System, one of the largest pension fund managers in the world.

If shareholders accept it, Musk will increase his fortune to $200 billion and leave far behind his closest wealth rivals: LVMH’s Bernard Arnault, Amazon’s Jeff Bezos and Meta’s Mark Zuckerberg.

Rivals catching up

It has taken time for traditional auto industry giants to wake up to the electric vehicle revolution, but they may soon overtake Tesla.

Musk has promised for years to deliver fully autonomous Teslas, saying his electric car company would be “worth basically zero” if it didn’t prioritize self-driving technology. But his company, critics say, is falling behind on that front.

Rivals like Ford have already introduced hands-free driving systems.

Spread too thin

The tycoon, his critics say, is distracted from Tesla by his eclectic portfolio of other business interests. These include his 2022 purchase of social media site Twitter, now known as X.

This led to a long-running dispute with the US watchdog, the Securities and Exchange Commission, which is investigating whether it violated federal securities laws.

The billionaire has said the SEC is trying to “harass” him with a series of subpoenas, damaging Tesla’s reputation and hurting the company’s stock price.

The broader problem is the scope and variety of your activities, which may mean you don’t spend enough time on Tesla. There’s SpaceX, where he built the world’s most powerful rocket, infrastructure startup The Boring Company, as well as Neuralink, a developer of “interfaces for connecting humans and computers.”

One analyst said: “Musk is trying too hard between his goals of an automobile revolution, a colony on Mars, cyborgs and the world’s ultimate social network.”

Political reaction

The founder of Tesla is an ally of Donald Trump and a model of the American right. He and Trump have spoken several times a month since meeting privately in March at the home of billionaire investor Nelson Peltz. The two have discussed an advisory role for Musk if Trump takes back the White House in November, which could give the Tesla boss influence over economic and border policies.

Asked last year if he was becoming more political, Musk said: “I guess if you consider fighting the awakened mind virus, which I consider a threat to civilization, to be political, then yes.”

China threat

This is the biggest threat of all. The world’s dominant electric car manufacturers are now Chinese.

BYD, an automaker Musk once ridiculed, overtook Tesla late last year as the biggest seller of electric vehicles on the planet.

The situation will get worse for Tesla as Chinese manufacturers continue to flood Western markets, accounting for 25 percent of almost all cars sold.

Musk is well aware of the danger, stating earlier this year that Chinese EV companies will crush their competitors in the absence of trade restrictions.

On the other hand…

Musk still has high-profile backers, notably American fund manager Cathie Wood at Ark, although she herself has struggled lately.

She predicts Tesla shares could hit $2,000 within five years. They are listed at $175 and this is based on the arrival of a more affordable Tesla model, probably in 2026.

But the most powerful of all is Musk’s loyal group of small investors, who own 30 percent of the shares. Many are active on the social media platforms Reddit and X.

Musk has been encouraging these followers to live up to their pay package, running ads and offering private tours of Tesla’s factory in Texas.

Musk’s appeal to his followers is due to his charismatic, often antagonistic behavior and his frequent run-ins with authority.

He has appeared with Joe Rogan, a famous American broadcaster, smoking cannabis. He spoke openly about the benefits he believes he experienced from taking ketamine and frequently clashed with Wall Street regulators.

But there are reasons why a more skeptical investor might consider Tesla stock as a hold or a buy as well.

They offer exposure to two main trends: the move to green energy and artificial intelligence.

Tesla has led the way and its name is almost synonymous with the electric car.

The stock has been volatile – as has Musk himself – but he has often proven his critics wrong.

It has taken time for traditional auto industry giants to wake up to the electric vehicle revolution, but they could soon overtake Tesla.

Still not sure? This is what the experts say

In total, 45 analysts from around the world cover Tesla.

Of them, 16 have a buy rating on the stock, 20 have a hold recommendation and only nine advise their clients to sell.

SELL: JP Morgan American Investment Trust

Manager Felise Agranoff says: ‘We sold it earlier this year. Demand for electric cars in the United States has been disappointing. Yes, Tesla has a strong position in the market, but the market is becoming more competitive and more political.’

HOLD: Deutsche Bank

“Cracking the code on full driverless autonomy is a major technological, regulatory and operational challenge,” says analyst Emmanuel Rosner. “Investors in electric vehicles may start to throw in the towel and be replaced by investors in artificial intelligence technology.”

BUY: Wedbush

Dan Ives, an analyst at US wealth manager Wedbush, says Musk and Tesla are under attack from all directions. But he adds: “We’ve been here several times over the last decade, when skeptics have said that Tesla’s story is over and that electric vehicles are a fad, not a transformative long-term trend that will change the auto industry.” .

How do I buy Tesla shares?

Tesla shares can be purchased through platforms such as Hargreaves Lansdown and AJ Bell. But for those who want to deal with a professional fund manager, the Scottish Mortgage Investment Trust and the Vanguard US index fund offer exposure.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.