Table of Contents

The Bank of England’s Monetary Policy Committee has published a 90-page report outlining its thoughts on the future of inflation and the economy.

On Thursday, the Bank cut interest rates from 5 percent to 4.75 percent, the lowest level in more than a year.

But it also published its quarterly Monetary Policy Report, an in-depth look at where it sees the UK economy heading and how it plans to use interest rates to control inflation.

According to the Bank, the measures announced by Rachel Reeves in the Budget will contribute to a rise in inflation, while GDP growth is expected to slow as the year progresses.

We pick out five crucial charts you need to see and explain what they mean.

The budget will boost inflation

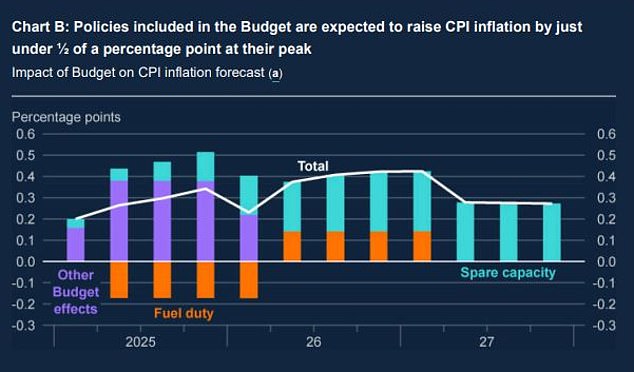

Impact: Bank of England said budget measures will have impact on inflation

Consumer price inflation fell to 1.7 percent in September, but is expected to rise to around 2.5 percent by the end of the year “as weak energy prices move out of control.” annual comparison,” the Bank said in its latest Monetary Policy Report. .

It noted: “The Budget is tentatively expected to boost CPI inflation by just under ½ percentage point at its peak, reflecting both the indirect effects of the lower margin of oversupply and the direct impacts of the Budget measures.”

The Bank added: “The impact of the Budget announcements on inflation will depend on the extent and speed with which these higher costs are passed through to prices, profit margins, wages and employment.”

Looking ahead to 2025, the Bank said: “CPI inflation is expected to rise to around 2¾ per cent by the second half of 2025 as weakness in energy prices falls out of the annual comparison, leading to which reveals more clearly the continued persistence of domestic inflationary pressures.” ‘

Inflation forecasting is vital to understanding what the Bank of England can do about interest rates and how this could impact mortgage and savings rates. These are strongly affected by market expectations about when interest rates will fall.

UK economy to slow down this year

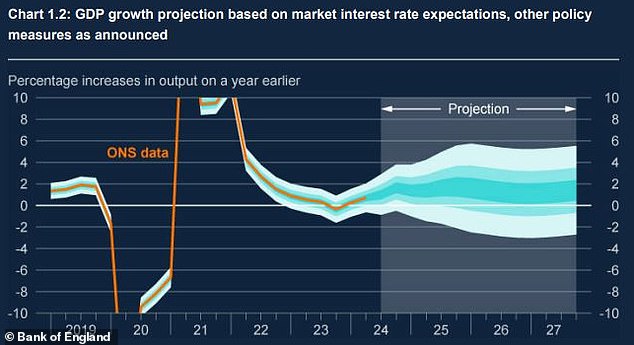

GDP: The Bank said GDP growth appeared to slow in the second half of this year.

The UK economy is expected to slow but will continue to grow and will eventually receive a small boost from the Budget.

The Bank said GDP growth is projected to slow in the second half of this year, to 0.2 percent in the third quarter and 0.3 percent in the fourth quarter.

It said: “Overall GDP growth has been volatile over the past year, with negative growth in 2023 before strong growth in early 2024.”

The Bank added: “GDP growth is projected to be broadly in line with the Bank’s staff estimate of the economy’s underlying momentum in the second half of 2024, of around ¼ per cent per quarter. The latest data from business surveys currently point to growth close to this rate.’

Looking ahead, the Bank said GDP would grow.

It said: “The combined effects of the new measures announced in the autumn 2024 budget, including additional funding for previous spending pressures, are provisionally expected to boost the level of GDP by around ¾ per cent at its peak in a year in relation to the Projections of the August Report.

“This reflects that stronger and relatively concentrated trajectories in government consumption and investment more than offset the growth impact of higher taxes.”

Just after the Budget, the Office for Budget Responsibility raised Britain’s economic growth forecasts for this year and next after the Budget, but downgraded forecasts for the next three years.

The OBR expects the economy to grow by 1.1 per cent this year, up from a previous forecast of 0.8 per cent.

Interest rates at 3.6% in three years

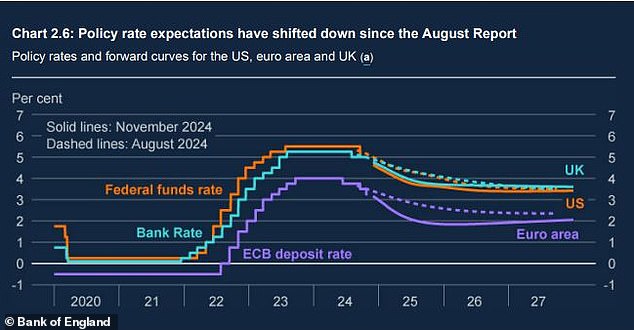

Global rates: the Bank established global policy rate projections

The Bank said UK interest rates would likely be set at 3.6 percent within three years, stagnant since around the end of next year.

In terms of what lies ahead in the short and medium term for UK interest rates, the Bank said: ‘Based on evolving evidence, a gradual approach to removing policy constraints remains appropriate.

“Monetary policy will need to remain restrictive for long enough until the risks of inflation sustainably returning to the 2 percent target over the medium term have further dissipated.”

Regarding global rates, the Bank added: “Since the August report, the decline in inflationary pressures in the US, as well as communications from the Federal Reserve, have been associated with a downward shift in The market-implied path for US policy rates is around 30 basis points on average over the next three years.

The impact on mortgages and savings rates

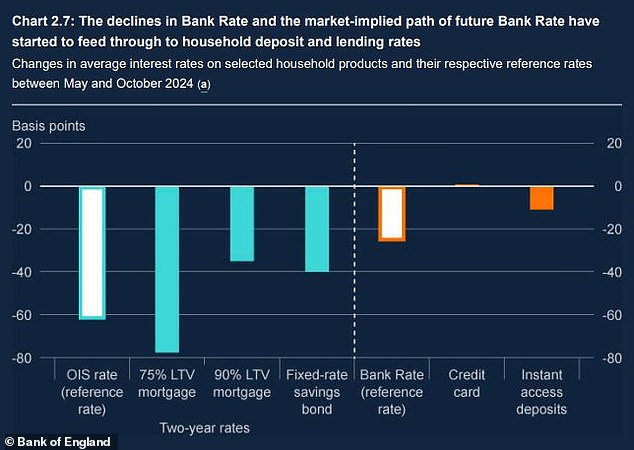

Flowing: Bank outlined impact of lower rates on mortgages and savings

Savers and borrowers are watching the Bank of England’s decisions and rate forecasts closely to see what comes next, particularly those with large fixed-rate mortgages that are about to run out.

The lower interest rates “have been reflected in household lending and deposit rates,” the Bank said.

He added: “So far, the transfer appears to be progressing in line with expectations, with interest rates for some retail products slow to fall, reflecting typical lags between changes in benchmark rates and changes in rates. of the products”.

Instant access deposit rates have fallen, on average, 11 basis points in October, a little less than half the reduction in interest rates.

On mortgages, the Bank said: “However, interest rates for those with variable rate mortgages have fallen and a growing number of those already paying higher rates will be able to refinance at a lower rate in the coming years.” two years.”

About 800,000 fixed-rate mortgages that currently have an interest rate of 3 percent or less are expected to be refinanced each year, he added.

The Bank also noted that some mortgage holders had begun to reduce their spending in anticipation of rising mortgage costs.

> Mortgage Rate Cut Calculator: How will falling rates affect you?

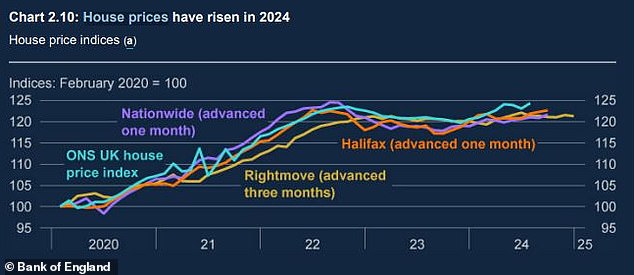

House prices: a housing market recovery

House prices: Bank said house prices had risen amid lower mortgage rates

Amid lower mortgage rates and a recovery in mortgage approvals, home prices have continued to rise, the Bank said.

He added: “The recovery in house prices partly reflects a waning drag from previous interest rate increases, consistent with the impact of higher interest rates having materialized more quickly than in the past.”

The Bank added: ‘The recovery in property market activity has led to a small change in the growth rate of secured loans to households.

“However, secured credit growth to households remains weak in real terms and has been negative since late 2021. A continued rebound in property market activity should lead to a strengthening of secured credit growth.”

The OBR expects house price growth to falter next year.

After the Budget last week he said: “In our central forecast, we expect house price growth to retreat slightly from 1.7 per cent in 2024 to 1.1 per cent in 2025, as the effective mortgage rate average continues to increase.

Data from the Office for National Statistics in September showed average house prices rose 2.8 per cent to £293,000 in the year to August, up from 1.8 per cent in the year to July.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.