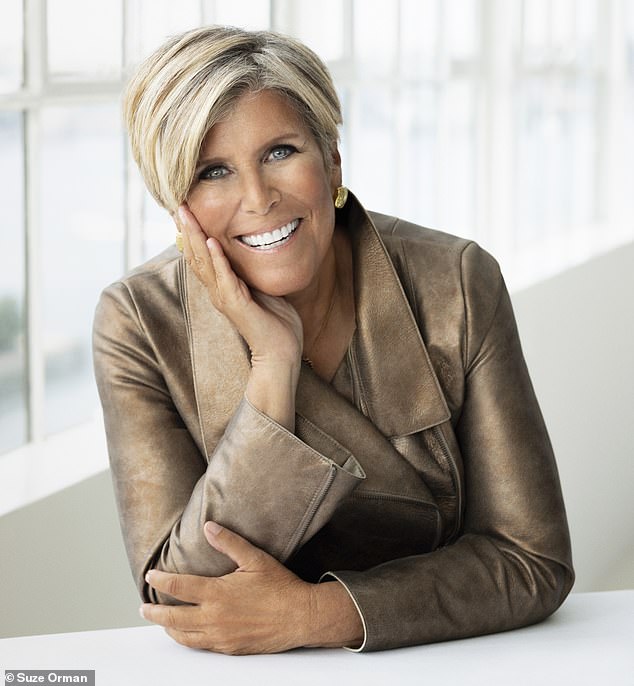

Financial guru Suze Orman has warned that the effect of climate change on rising homeowners insurance premiums is destroying the American dream of home ownership.

The 72-year-old waived coverage on her own 2,100-square-foot oceanfront condo in Florida after her insurer quoted her $28,000 a year.

Orman says Americans will soon have little interest in owning homes as insurance costs make home maintenance too unsustainable. In turn, this could cause real estate prices to fall.

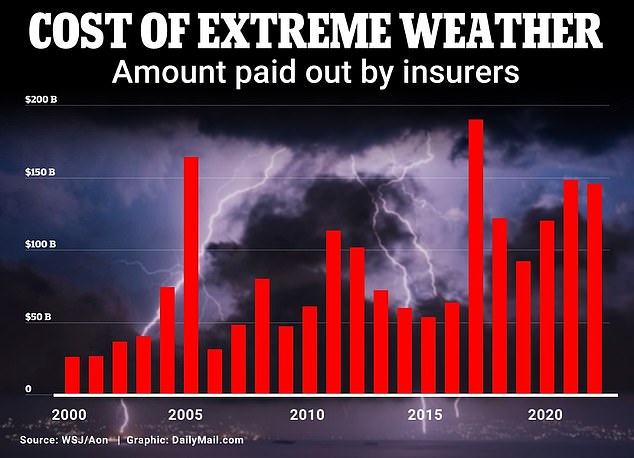

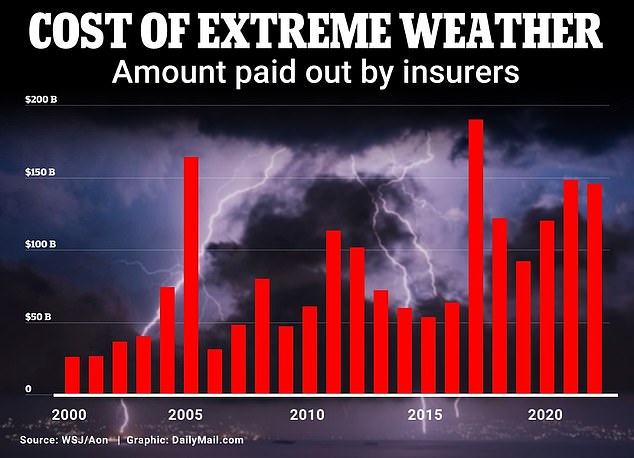

Last year, the United States experienced 28 natural disasters, each costing at least $1 billion, according to the National Oceanic and Atmospheric Administration.

As a result, the national average price for home insurance has soared 23 percent to $1,759 a year between January 2023 and 2024, Bankrate figures show.

Financial guru Suze Orman (pictured) has warned that the effect of climate change on rising homeowners insurance premiums is destroying the American dream of home ownership.

The amount of money insurance companies pay to cover damage caused by extreme weather conditions, such as wildfires and hurricanes, has increased steadily since 2000.

A view shows a house on fire during the Fairview Fire near Hemet, California, U.S., September 5, 2022. The wildfires have raised costs for insurers, which have increased premiums.

Orman told DailyMail.com: ‘Climate change will make a big difference to people’s desire to own their own home.

‘Look what’s happening in Southern California. Look at the devastating hurricanes that are reaching places where they were not so frequent before. I think people are starting to get a little discouraged, especially now that mortgage interest rates are where they are.

He added: ‘The real estate sector is unpredictable. It would never have occurred to me to advise home buyers, “Oh, you better make sure you can afford to quadruple your homeowner’s insurance in the future.”

In the United States, buyers cannot obtain a mortgage without also purchasing home insurance.

But Orman owns her Florida condo outright, meaning she was able to give up the cover.

She said: ‘I’m not going to pay $28,000 a year when the insurer will probably contest any claim they receive anyway. Luckily I have money to self-insure.

‘$28,000 for a 2,100 square foot condo. Are you kidding me?’

Marta Cross had to pay more than $4,000 a year for home insurance in Los Angeles

Extreme weather events, such as hurricanes, floods, and tornadoes, have become increasingly common in the United States. Data from the US Census Bureau shows that such events forced about 2.5 million people from their homes.

Higher construction costs have also made repairs more expensive, causing insurance premiums to skyrocket.

And some insurers are withdrawing from disaster-prone areas altogether.

Last year, State Farm, the largest home and auto insurance company in the United States, announced it would no longer insure homes in California, saying the risk of wildfires was too great and the cost of rebuilding too high.

According S&P GlobalState Farm reported a loss rate of 84 percent in the first nine months of 2023, more than 20 percent higher than in 2022.

Insurers pulling out of California hit actress Marta Cross and her musician boyfriend, who faced huge home insurance bills last summer when they bought a home in Los Angeles.

The purchase almost fell through when he was unable to obtain coverage from any of the private sector companies. W.Since there was no private insurer willing to provide coverage, he had to turn to the state insurer as a last resort. All of this amounted to $4,000.

Jewell Baggett, 51, sits in a bathtub in the rubble of her home in Horseshoe Beach, Florida, which Hurricane Idalia reduced to rubble in August. Bad weather has affected insurance premiums

Orman owns her Florida condo outright, meaning she was able to give up the cover.

Your browser does not support iframes.

A recent Bankrate study exposed America’s home insurance lottery, meaning residents in some states have to pay twice as much as those in others.

Their findings showed that homeowners in Nebraska, Oklahoma and Kansas faced the highest bills, while Louisiana suffered from the fastest-rising premiums.

Louisiana has been hit by hurricanes, severe storms and flooding in recent years.

According to Bankrate, Americans can reduce the cost of their home insurance by bundling their auto and home policies, understanding the different types of home coverage, and finding the right one.

Improving your credit score can also help, and it might be worth simply asking your provider for a discount, for example, if you’ve installed a new home security system.

Another option is to increase your home insurance deductible, but experts warn that this method carries risks.

Your deductible is the amount of a claim you are willing to pay out of pocket. Most homeowners insurance policies have a minimum deductible of $1,000.

The higher your deductible, the lower your premium, but the more you will pay out of pocket if you file a claim.

“Deductibles have become a very big issue,” Charles Nyce, associate professor of Risk Management and Insurance at Florida State University’s College of Business, told DailyMail.com.

“But it is dangerous, there will be people who will have losses that they cannot afford to suffer.”