A popular financial guru gave a woman a dose of reality after she complained about her friends’ more glamorous lifestyles compared to her own “humble” one.

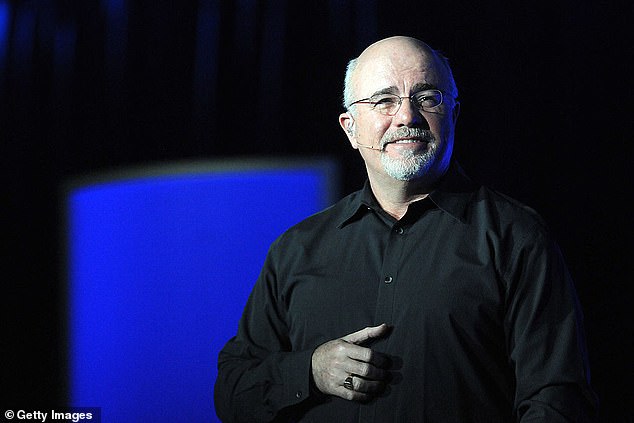

During a recent episode of The Ramsey Show, David Ramsey, an American radio personality known for his ultra-frugal advice, assured a woman named Hillary that she is “doing a great job” managing her money at the age of 33.

The woman, from Salt Lake City, Utah, told Ramsey and his co-host, Dr. John Delony, that she feels like she is “missing out on life,” despite making $60,000 a year (before taxes) as a health educator.

Hillary told financial experts she has no debt beyond a $140,000 mortgage on her home and recently paid for her master’s degree in cash.

“And then with all that money I’ve saved, I think, ‘That could have been for a vacation or a car, I shouldn’t have done that!'” Hillary said.

During a recent episode of The Ramsey Show, David Ramsey assured a woman named Hillary that she is “doing a great job” managing her money at the age of 33.

Hillary told financial experts she has no debts beyond a $140,000 mortgage on her home, and recently paid for her master’s degree in cash, but still feels like she’s missing out on the expensive adventures her friends are taking on. (pictured: Downtown Salt Lake City)

Both Ramsey and Delony immediately took issue with Hillary and let her know that what she is doing is something she can be proud of in the long run.

Ramsey also addressed his main concern about people his age spending money on luxury vacations and high-end cars.

“This is an issue that millennials, their generation, were one of the first to really have to wrestle with,” Ramsey said.

She then referred to one of the books her daughter Rachel Cruze wrote about “the power of social media.”

“We used to say, ‘Don’t try to keep up with the Joneses,'” Ramsey told Hillary.

‘But (in those days) it wasn’t that hard to keep up with the Joneses because they lived next door and you’d see them driving their (nice) car, but you’d also see them having big fights and you knew their kids were in trouble.’

He added that because the Joneses’ lives were visibly imperfect to their neighbors, it wasn’t a big deal “because they somehow knew some of the details, too.”

Compared to today’s social media-dominated society, Ramsey explained that it’s harder to see beyond what people share online.

“On social media, all you see is the best moments video,” he said.

Delony added: “And no one posts the three weeks after the beach holiday and the fight over the credit card bill…”

Ramsey’s co-host, Dr. John Delony, told Hillary that he hopes his daughter will one day find herself in the same situation as her.

“Because we can’t afford food or diapers,” Ramsey said.

Ramsey explained that even “older people” like him can “fall victim” to believing everything they see on social media, “because we’re not seeing reality.”

Delony then asked Hillary where exactly her concern came from and she explained that social media and her coworkers had contributed to her concerns.

“Social media is a big part of this, obviously, you know, with TikTok and Instagram and Facebook, but also, you know, at work, someone says, ‘Oh, I’m going to the Bahamas for two weeks, or check out my new Escalade,'” Hillary said.

Both experts laughed when Delony told him that she hopes her daughter will one day find herself in the same situation as Hillary.

“That would be amazing,” she said. “You’re amazing,” Ramsey added.

“You traded a master’s degree for the Bahamas, it’s a nice trade,” Ramsey added.

Ramsey, who started “from nothing,” had a net worth of just over $1 million when he was 26, according to his website.

He compared his current living situation to Hillary’s and explained that while he didn’t like having to trade in his Jaguar for a hooptie, he knew he was doing the right thing.

At the end of the show, Delony told Hillary to replace the feeling of jealousy she feels when seeing others living fancy lives and instead focus on the “lonely” parts of her life to fill the void.

‘I want you to start creating the opportunity for friends, community, connection and laughter right where you live.

“Start growing that and you’ll get other brilliant things; it’s not a big deal,” Delony added.

On another recent episode of The Ramsey Show, the radio host criticized a woman for her and her partner’s spending habits despite the fact that they earn a combined income of $11,500 a month.

Research of the Journal of happiness studies She found that many people turn to social media when they feel lonely, but observing the lives of others actually makes them feel worse because of the constant comparison.

“When you compare yourself to others, it leads to self-judgment, low self-esteem and a negative sense of self,” said Michael Torres, PsyD, a California-based clinical psychologist at the Kaiser Permanente Mental Health and Wellness Center. saying.

On another recent episode of The Ramsey Show, the radio host criticized a woman for her and her partner’s spending habits despite the fact that they earn a combined income of $11,500 a month.

Ramsey I spoke to one woman, Alyssa, who explained that she and her husband are not contributing anything to their retirement and have only $3,000 saved. They are also $138,000 in debt.

After suggesting Alyssa set aside up to $5,000 each month to help pay off their shared $138,000 debt, she became visibly wary.

“You know what worries me? You make $130,000 a year and you’re broke. That’s what worries me,” Ramsey told Alyssa.

(tags to translate)dailymail