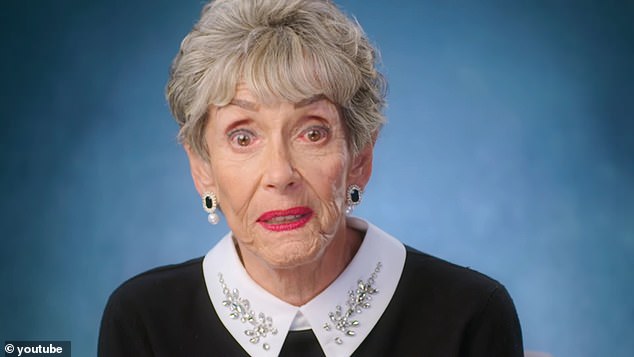

Legendary TV judge Judy Sheindlin says she will sue In Touch Weekly for defamation of character after they claimed she is on a ‘quest’ to save the Menendez brothers.

Erik, now 53, and his brother Lyle, 56, are serving life sentences without parole for fatally shooting their parents, Jose and Kitty Menendez, in 1989 in the study of their Beverly Hills mansion.

In Touch Weekly, a celebrity gossip magazine, on Wednesday published a story titled ‘Inside Judge Judy’s quest to save the Menendez brothers nearly 35 years after their parents were murdered,’ citing what they claimed: were his quotes in a Fox Nation documentary about the infamous case.

Sheindlin doesn’t even appear in the documentary, her rep and a Fox News spokesperson confirmed, and she is outraged by the story, telling DailyMail.com that she is willing to take the outlet to court to protect its sterling reputation.

“I have spent 60 years building a reputation in the judicial system, as a judge and as a successful television personality,” he said in a statement.

Legendary TV judge Judy Sheindlin says she will sue In Touch Weekly for defamation of character after they claimed she was on a ‘quest’ to save the Menendez brothers.

Erik, now 53, and his brother Lyle, 56, are serving life in prison without parole for fatally shooting their parents, Jose and Kitty Menendez, in 1989 in the study of their Beverly Hills mansion.

In Touch Weekly cited what it claimed were his quotes in a Fox Nation documentary about the infamous case.

‘In just a moment, In Touch Weekly and everyone else who has republished this ridiculous article damaged that reputation.

“Therefore there will be consequences and this will be the subject of a judicial process,” he added.

She confirmed that attorney Eric George will represent her in the lawsuit.

In Touch and its parent company, a360media, did not immediately respond to DailyMail.com’s requests for comment. Shortly before DailyMail.com published this article, the In Touch story was removed from the site.

However, Sheindlin still intends to take legal action.

The In Touch story claimed that Sheindlin, at one point in the documentary, calls the trial “rigged” and participated in the couple’s second trial.

At one point in the trailer for the four-part series, Judi Zamos, an alternate juror in the brothers’ first murder trial, claims that the trial is “rigged.”

The story also claims that Sheindlin said Superior Court Judge Stanley M. Weisberg wanted to conduct the second trial in a “very, very different” way from the first, while pleading with defense attorney Leslie Abramson to demand that Weisberg stand down. abstained

However, Sheindlin is absent throughout the series.

Sheindlin doesn’t even appear in the documentary, her spokesperson confirmed, and she is outraged by the story, telling DailyMail.com she is willing to take the outlet to court to protect its excellent reputation.

The story claims that Sheindlin at one point in the documentary calls the trial “rigged” and participated in the couple’s second trial. At one point in the trailer for the four-part series, Judi Zamos, an alternate juror in the brothers’ first murder trial, claims that the trial is rigged.

Lyle, then 21, and Erik, then 18, admitted they shot and killed their father and mother, an entertainment executive, but said they feared their parents were about to kill them to prevent the sexual abuse from being revealed. in the long term of the father. by Eric.

During their televised trial, the brothers claimed that both parents had sexually abused them for years. Prosecutors maintained there was no evidence of any sexual abuse.

They said the children were seeking their parents’ multimillion-dollar estate, and jurors rejected the death sentence in favor of life in prison without parole.

The television special titled ‘Menendez Brothers: Victims or Villains’ challenges the conventional narrative around the murders that saw the couple portrayed as ‘greedy rich kids’ and callous killers.

‘If they [the brothers] “If they were ‘the sisters,’ they wouldn’t have done that,” said their attorney Mark Geragos, referring to the media mockery. ‘They would never do that today.

‘It’s ridiculous. They already lived in the lap of luxury. It wasn’t that luxury or wealth were aspirations, because they were already rich. “There is no one richer than Beverly Hills,” Geragos continued.

‘People have strong opinions and yet they are not based on real facts. They are based on his recollections of the press and the narrative that was published, which was that “rich kids in Beverly Hills kill their parents for money,” added his post-conviction attorney, Cliff Gardner.

The Menendez brothers, who are serving life sentences for murdering their parents in 1989, say media coverage painted them as criminals rather than victims of abuse. Lyle, left, and Erik, right, appear in recent mugshots from 2023.

The brothers were moved to the same housing unit at the Richard J. Donovan Correctional Center in San Diego in 2018.

During the trial, there was limited testimony regarding allegations of sexual abuse.

Jurors were only allowed to vote on murder charges rather than manslaughter.

Last year, the brothers filed court papers seeking to overturn their convictions based on new evidence, including a letter written to the brothers’ cousin, Andy Cano.

Cano claimed that Erik had confided in him that his father had abused him, long before they were shot to death.

‘I’ve been trying to avoid dad. It keeps happening, Andy, but now it’s worse for me,” reads a letter written by Eric. ‘Every night I stay awake thinking he might come in… I’m scared… He’s crazy. He’s warned me hundreds of times Don’t tell anyone, especially Lyle.

Both attorneys, Gardner and Geragos, filed a habeas corpus petition last May citing the letter that stated the brothers’ convictions should be overturned.

Los Angeles County District Attorney George Gascon now has until April 11 to respond to the petition.

If the brothers’ convictions are overturned, the Los Angeles County District Attorney’s Office will have to decide whether to retry the case.