A wealth expert who runs seminars for the wealthy has revealed the six key traits that differentiate wealthy people from everyone else.

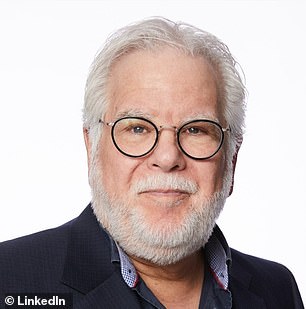

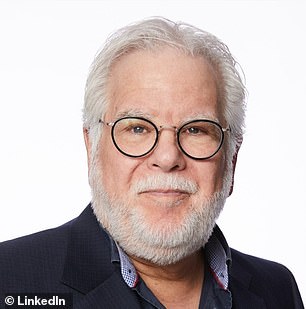

Michael Yardney, director of Metropole Property Strategists, said wealthy people have a different mindset and are more inclined to take financial risks and learn from mistakes.

1. See challenges as opportunities

“Wealthy people have a growth mindset, meaning they see challenges as opportunities for growth rather than obstacles,” he said.

“They are not afraid of failure and embrace the lessons that come from setbacks.”

House prices are now at record levels in Brisbane, Adelaide and Perth, as is the Australian stock market despite interest rates being at a 12-year high of 4.35 per cent.

This occurs in the midst of a cost of living crisis, with inflation still at high levels.

A wealth expert who teaches seminars for the rich has revealed the traits that differentiate wealthy people from others (photo is a stock image)

2. Have multiple sources of income

But Yardney, who founded his real estate consulting group in 1979 and hosts a podcast, said the wealthy had multiple sources of income to weather economic downturns or hardships.

“Rich people don’t depend on a single source of income,” he said.

“They diversify their investments and create multiple streams of income, allowing them to continue building wealth even during economic downturns.”

3. Think long term

Yardney said the rich also took a long-term perspective, rather than focusing on instant gratification.

Michael Yardney, director of Metropole Property Strategists, said the wealthy had a different mindset and were more inclined to take financial risks and learn from mistakes.

“Wealthy people plan for the future and make decisions based on long-term goals rather than short-term gains,” he said.

“They are patient and understand that building wealth takes time and perseverance.”

He quoted Warren Buffett, the 93-year-old chairman of Berkshire Hathaway, who famously said: “The stock market is a device for transferring money from the impatient to the patient.”

4. Partner with other investors

Yardney also noted that wealthy people recognize the potential of pooling their money with other investors if they don’t have enough themselves.

“The rich know how to delegate tasks and use the skills of others to help them achieve their goals,” he said.

“They also understand the power of leveraging other people’s money through investments and partnerships.”

5. Understand the tax system

Yardney noted that the rich also understood the tax system, from the negative gearing of a property to the 50 percent discount on capital gains tax.

“They are financially fluent and understand the rules of money, taxes and the law, and use them to their advantage,” he said.

6. Status of investments

Investors who bet at the start of the pandemic, when the stock market crashed in March 2020, are much better off now.

The Australian Stock Exchange’s benchmark S&P/ASX200 index has soared 63 percent over the past four years to hit a record high of 7,847 points this month.

House prices are now at record levels in Brisbane, Adelaide and Perth, as is the Australian stock market despite interest rates being at a 12-year high of 4.35 per cent (in photo, a Sydney auction in 2021).

This was even more dramatic than the 32.5 per cent rise in Australian property prices to $765,762, adding $188,000 to average property investment between March 2020 and February 2024, CoreLogic data showed.

Cryptocurrencies are also recovering: Last week, Bitcoin hit an all-time high of $110,000, quadrupling since hitting a low of $24,367 in November 2022, when inflation was at a 32-year high of 7.8 percent. hundred.

But Yardney focuses his advice on “investment grade” homes in the mid-suburbs of Australia’s major capital cities, where the bottom of the price cycle was reached last year.

“It’s not that I’m suggesting you try to time the market, this is too difficult and you haven’t really hit the bottom, which happened in early 2023,” he said.

‘But if the market offers you an opportunity like this, why not take advantage of it?

“So instead of trying to look for a bargain, focus on buying an investment grade property in a Grade A location, because these types of properties are in short supply but still selling at reasonably good prices.”

Yardney said record immigration levels presented an opportunity for property investment, after a net 518,000 people moved to Australia in 2022-23.

“Going forward, demand will outstrip supply for some time as we experience record levels of immigration at a time when we are not building as many properties as we need,” he said.

“The trick is to have a 20 per cent mortgage deposit and be able to get a home loan to benefit from rising house prices.”