Louise Thompson shared a sweet video of her two-year-old son Leo visiting her in hospital after 12 days apart as she gave him an update on his health.

The former Made In Chelsea star, 33, was rushed to hospital in January after losing “cups of blood” to ulcerative colitis while on holiday in Antigua with Leo and fiancé Ryan Libbey.

Taking to Instagram on Saturday, Louise shared the moment they reunited and how it gave her “the motivation boost she needed” to get home.

She shared a reel on her page along with the words: “I didn’t see this peanut for 12 days.” But one visit was just the motivation boost I needed to speed up my recovery and return home for good.

‘More information about children visiting the hospital in the caption. I’d love to hear your thoughts.’ The Reel was sweetly set to Betty Who’s I Love You Always Forever.

Louise Thompson shared a sweet video of her two-year-old son Leo visiting her in hospital after 12 days apart as she gave him an update on his health.

Taking to Instagram on Saturday, Louise shared the moment they reunited and how it gave her “the motivation boost she needed” to get home.

The former Made In Chelsea star added in a lengthy caption: “One of the strange things about this whole experience has been navigating time spent in hospital with a little one at home.

“When Ryan was young (sort of)…well we’ve now established that he was about 8 years old; he saw his mother in the hospital hooked up to a lot of wires after major back surgery and the memory still hurts to this day.” today.

‘Ryan is not very good with the hospital. I don’t judge him for that. That’s one of the reasons we thought a lot about bringing Leo to visit.

Louise said that during his first seven days in the hospital Leo was not allowed to visit him, but while he was in ITU a doctor recommended that it was a good idea to see Leo when his recovery was more advanced.

“This is going to sound horrible, but when I was, let’s say, in the ‘septic’ post-op, I didn’t think about Leo. I couldn’t think about anything. I couldn’t concentrate. Plus, I was on fentanyl for 5 days, so I was in and out,” continuous.

‘Only when I started to feel a little better was I able to think more rationally and weigh the pros and cons.

“I talked about it on FaceTime one of the days and I got a little upset. I didn’t want to show him too much sadness. I didn’t want to add more confusion.

“I didn’t want to disrupt the challenges Ryan was facing at home: the uncertainty of my health and the change in Leo’s routine.

‘Leo was happy and busy at nursery several days a week. Many family gathered to play with him. Things were really good for him.

Taking to Instagram on Saturday, Louise shared the moment they reunited and how it gave her “the motivation boost she needed” to get home.

Louise said that during her first seven days in the hospital Leo was not allowed to visit her, but while she was in ITU a doctor recommended that it was a good idea for her to see Leo.

Louise also shared an update on Instagram stories. She said: “I wanted to let you know that I’m actually recovering very well at home.”

‘I also reminded myself that some young parents go to work or on holiday with their partners and leave their children behind for a week or so anyway! “That made me feel a lot better.”

Louise also shared an update on Instagram stories. She said: ‘I wanted to let you know that I am actually recovering very well at home. (I keep touching my hair, that is, knocking on wood, every time I say this to anyone who visits me because I am aware that I don’t want to speak too soon and I don’t want to curse anything.)

Sam Thompson’s older sister Louise has faced a series of health problems since Leo-Hunter’s birth in November 2021.

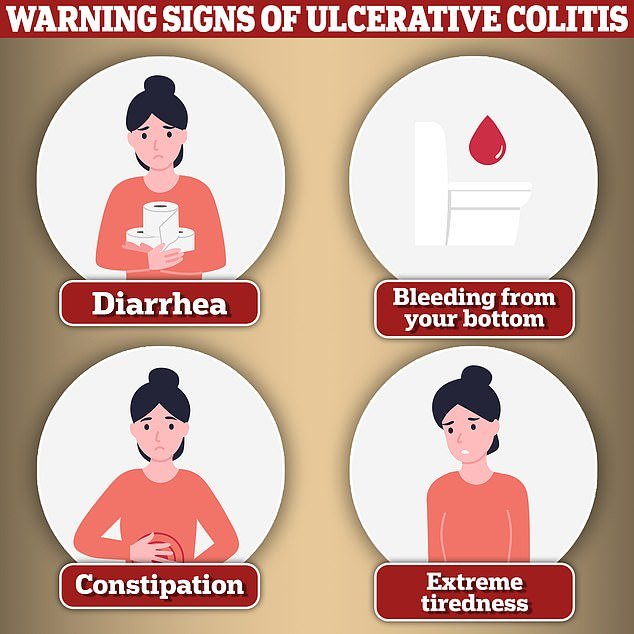

He was diagnosed with ulcerative colitis during his last stint in hospital, which is inflammation of the lower end of the digestive system.

Unfortunately, this condition has no cure, but it can be effectively managed over time.

Louise was in hospital for more than two weeks, from January to February, leaving her fiancé Ryan to care for Leo.

The severity of symptoms can vary depending on which part of the rectum and colon is inflamed. For some people, it can have a significant impact on their daily life, the NHS says.

Louise has faced a series of health problems since the birth of Leo-Hunter in November 2021.

Before Louise’s latest health scare, she was posting photos from her family trip with Ryan, Leo and her dad to Antigua and Barbuda.

A Jan. 28 post featured a carousel of photos of her with little Leo, alongside which she wrote a touching caption about “learning to lean on and be grateful for those imperfect in-between moments because nothing lasts forever.”

Louise revealed some time after welcoming Leo that she and he almost died during the traumatic birth.

On December 23, 2021, Louise announced the birth of her son on her Instagram page and revealed that she had been discharged from the hospital to recover at home.

She said: ‘5 weeks ago I gave birth to my beautiful baby Leo-Hunter Libbey who weighed 7lbs. Unfortunately, it wasn’t the easiest start for either of us. One ended up in the NICU and the other in the ICU.

Louise said Leo recovered quickly but had to deal with “a lot of bad things”, saying: “Dancing with death twice brings a whole new view of the world.”

In December, two years after Leo’s birth, she reflected on the time that had passed since the traumatic series of events.

She said: ‘Here’s a reminder that a lot can change in a year. Many things can change in 6 months. In fact, many things can change in a month, but it is difficult to witness the change until you create considerable distance from it.

‘I’m crying writing this. I feel very excited today. I can’t lie, it feels good to purge my pain. I encourage you to try writing and crying too.

‘Sometimes it helps. But the main reason I’m writing this is because I really want you to know to keep moving forward. Do not give up. Because there will come a time when you will want to wear a pretty party dress again. You will shine again.’

The reality star announced last month that she will release a book, Lucky, telling the story of the near-death experience.