Table of Contents

- Jerome Powell is increasingly confident about the fall in US inflation

- Markets were encouraged by the comments, with London’s FTSE 100 index closing up 0.5%.

- Powell’s speech prompted traders to increase bets on a massive rate cut

US Federal Reserve chief Jerome Powell said yesterday that “the time has come” to cut interest rates, raising speculation that they could fall by as much as half a percentage point next month.

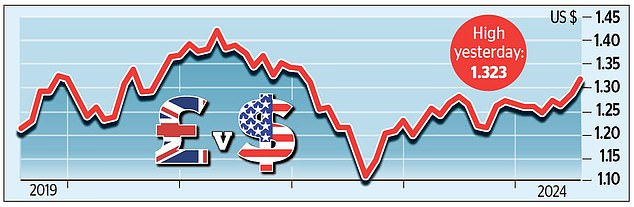

The dollar fell following the comments, helping the pound rise above $1.32 to its highest level since March 2022.

Powell said he was increasingly confident that inflation in the world’s largest economy was “on a sustainable path” back to his 2 percent target.

“The time has come to tighten policy,” Powell told an annual meeting of central bankers in the US state of Wyoming.

‘The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook and the balance of risks.’

Caution: Bank of England chief Andrew Bailey and Federal Reserve chief Jerome Powell in Wyoming

Markets cheered Powell’s remarks: London’s FTSE 100 closed up 0.5 percent, or 39.78 points, at 8,327.78, and New York’s S&P 500 rose 0.9 percent, while the tech-heavy Nasdaq gained 1.3 percent. Powell’s speech prompted traders to increase bets on a massive rate cut at the Fed’s next meeting in September.

Markets now see a one-in-three chance of a half-percentage point cut at the meeting, up from a one-in-four. But a smaller quarter-point cut is still seen as the most likely outcome. It would be the first cut since 2020, when rates were cut to near zero in the face of the economic shock caused by the pandemic.

A subsequent rise in inflation prompted the Federal Reserve and other central banks to embark on an aggressive rate-hiking program.

Now that inflation has fallen, the Bank of England and the European Central Bank have begun to cut rates.

The US inflation rate has proven a bit more persistent, leaving the Fed more indecisive.

But US inflation has now fallen below 3% for the first time since 2021. And recent weaker-than-expected jobs figures have left some concerned that the Federal Reserve may have waited too long to act.

Powell said the Fed had taken note of the “unequivocal” employment trend. “Job gains remain solid but have slowed this year,” he said, adding: “We neither seek nor welcome a further cooling of labor market conditions.”

Guy Stear, head of developed markets strategy at Amundi Investment Institute, said: ‘The Fed chair not only reiterated his belief that inflation is moving towards 2 per cent, but also emphasised that the labour market is slowing and they need to respond, and they have ample room to do so.

‘He firmly announced the start of a cycle of cuts in September, suggesting that he does not want to wait to see unemployment rise.’

Experts said U.S. jobs data, due in two weeks, now look increasingly critical to the decision on the size of the next rate cut. Powell’s comments came as Bank of England Governor Andrew Bailey was also speaking at the Jackson Hole conference, saying inflation fears were fading more quickly than expected.

“The persistent element of inflation is still with us, but it is smaller in magnitude now than we expected a year ago, and considerably less than the kind of persistence seen in the 1970s,” Bailey said.

He said a “soft landing” for the economy was in sight – that is, a reduction in inflation without triggering an economic recession.

But he warned: “It is too early to declare victory.”

Financial markets are expecting two more UK rate cuts this year, but believe there is only a 30 percent chance of the first one coming next month.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.