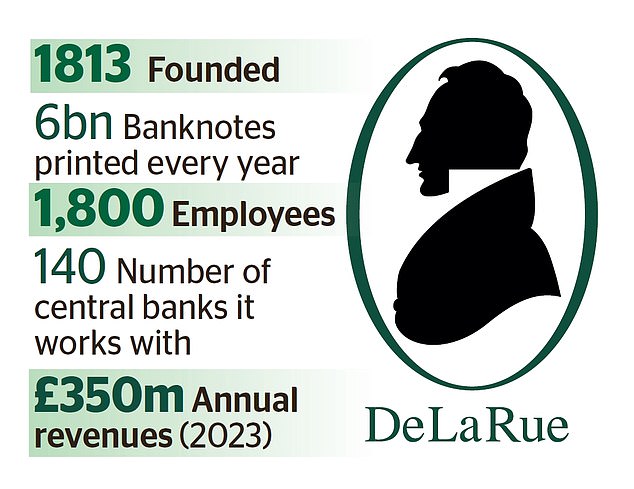

The company behind British banknotes is considering separating its business just a day after Royal Mail fell into the hands of a foreign buyer.

De La Rue, which prints banknotes for the Bank of England and half of the world’s central banks, is delaying its annual results until July while it talks to “various parties”.

It recently collaborated with the Bank of England to create new banknotes featuring the King’s portrait, which will enter circulation next Wednesday.

Chairman Clive Whiley said he was considering “strategic alternatives”, which could mean selling its currency unit and authentication arm.

The money printing business has suffered in recent years as demand for banknotes declines.

De La Rue recently collaborated with the Bank of England on new banknotes featuring the King’s portrait (pictured, held by Governor Andrew Bailey and Chief Cashier Sarah John).

And although bosses have said business is recovering, De La Rue’s announcement sent shockwaves through the city.

It came a day after the board of the company that owns Royal Mail agreed to a £3.6bn takeover by Czech billionaire Daniel Kretinsky, meaning the company may fall into foreign hands for the first time since It was founded by Henry VIII in 1516. .

Dan Coatsworth, investment analyst at AJ Bell, said: “First it was the UK postal service, now it is potentially the country’s banknote production.

The UK is on sale at the right price and everything seems available except the crown jewels.

‘De La Rue has been struggling for years with several headwinds, including a significant drop in foreign exchange demand, prompting a hard look at the business and its future.

“It’s only natural that De La Rue is now considering a breakup, as signs of recovery put it in a better position to get a fair price.”

Last year, the Hampshire company said demand for banknotes worldwide was at its lowest level in 20 years, resulting in a low order book.

De La Rue expects its full-year profits to be in the “low £20m range” and debt of around £90m.

Talks: De La Rue, which prints banknotes for the Bank of England and half of the world’s central banks, has revealed it will delay its annual results until July.

It recently secured extensions on two government contracts to provide a digital tax stamp for alcohol and tobacco.

But despite the apparent resurgence, Richard Bernstein, head of activist investor Crystal Amber, said De La Rue’s breakup “seems inevitable.”

Neil Shah, an analyst at Edison Group, said a takeover bid could come from rivals such as Giesecke + Devrient, a German company that is one of the largest securities printing firms, or Crane Currency, a US rival.

Oberthur Fiduciaire, a competing French company, tried to buy it in 2010.

But a successful bid would follow a series of acquisitions this year with packager DS Smith, telecoms testing firm Spirent Communications and transport firm Wincanton among those falling into the hands of foreign bidders.

But some companies have been fighting back. This week, Australian mining giant BHP abandoned its bid for mining titan Anglo American, while Currys and Direct Line have successfully fended off bids this year.

De La Rue Share rose 0.6 per cent, or 0.6p, to 98.6p.