Table of Contents

Budget speculation: savers rushed to cover Isa and pensions

Speculation over what the Budget could hold for savers has sparked a huge rush to top up or max out Isas and pensions earlier this year.

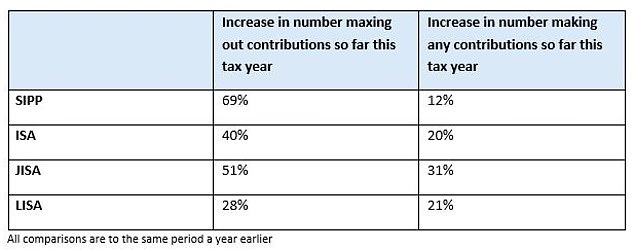

According to Hargreaves Lansdown, the number of customers who have used their entire £20,000 Isa allowance has already increased by 40 per cent on last year.

The investment platform, which offers stocks, shares and cash Isas, is also reporting a 20 per cent increase in customers making at least some contribution to their Isa, while we are still just over halfway through the financial year.

The number of well-off savers maxing out their £60,000 annual pension contribution has also soared by around two-thirds, while 12 per cent more than last year have opted to top up their funds early, the survey says. company.

The annual allowance is the standard amount you can put into your pension each year and qualify for tax relief on what you saved.

> Fall 2024 budget: what will happen – from tax increases to pensions

“The Budget has inspired an unprecedented six months of saving and investing, as people have remembered how valuable their Isa and pension benefits are, and are rushing to make the most of them while knowing where they stand,” says Sarah Coles, Hargreaves’ head of personal finance.

“It is the biggest year in history for the number of people paying into their Self-Invested Personal Pensions (Sipps), Junior Isas and Lifetime Isas, and the second biggest for Isas, after the peak of the pandemic in 2022.”

Hargreaves says there has been a 51 per cent increase in the number of people using the full annual £9,000 Junior Isa allowance for a child since the start of the tax year, and a 31 per cent increase in those doing any of contribution.

It also sees a 19 per cent rise in those contributing exactly £3,600 to their pensions, the maximum a non-working spouse or child can contribute, indicating that families are bolstering pensions across the board.

The number of its customers taking advantage of the full £4,000-a-year Lifetime Isa limit has increased by 28 per cent, while the number holding at least some cash at this point in the year has increased by 21 per cent.

Source: Hargreaves Lansdown

Hargreaves sets out below some of the concerns that have led savers to boost their pensions and Isas ahead of the Budget:

– Speculation about a move towards a fixed rate of tax relief, which would favor basic rate taxpayers but work against higher or additional rate taxpayers, although the Chancellor has reportedly cooled on this idea.

– The prospect of income tax thresholds remaining frozen for longer, making pension contributions appear more advantageous.

– Rumors about possible capital gains tax increases, which has fueled the popularity of Bed & Isa deals, where investments held outside an Isa are sold and bought back into a new or existing one.

– Possible adjustments to Isa allowances, including a lifetime limit.

– The possibility of an inheritance tax review which could involve stricter rules, such as an extension of the seven-year rule (after which gifts over the £3,000 annual allocation are tax-free) to 10 years .

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.