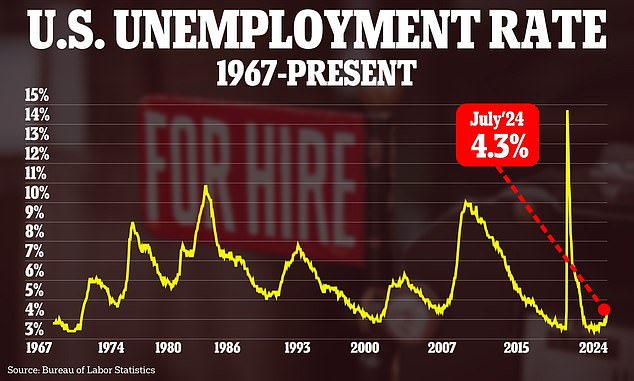

A legendary economist says the slumping job market is the ultimate indicator that the U.S. economy is headed for a recession.

David Rosenberg, who predicted the 2008 crisis while he was chief economist at Merrill Lynch, recently told clients that the revelation that the U.S. economy created 818,000 fewer jobs over the past year than originally reported was the biggest downward revision since the Great Recession.

The Bureau of Labor Statistics said its job growth data from March 2023 to March 2024 was actually 30 percent lower than its initial figure of 2.9 million, a devastating blow that Rosenberg said could spell doom in the near future.

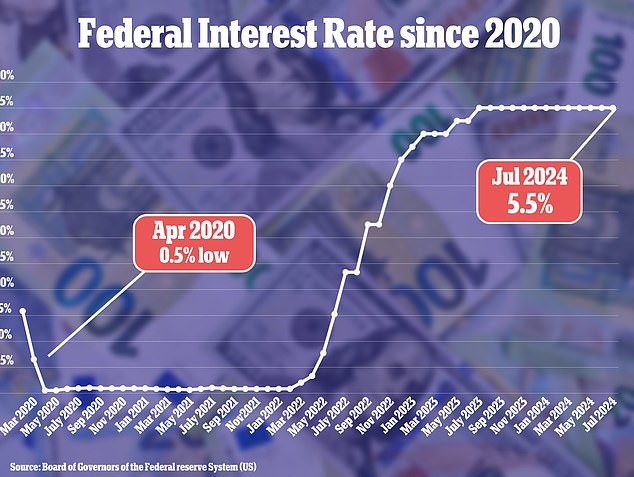

Rosenberg, founder of financial information firm Rosenberg Research, also directed his ire at the Federal Reserve for stubbornly refusing to ease interest rates from July 2023.

Federal Reserve policy “has been too tight for too long to avoid causing an economic downturn,” he wrote last week in a note circulated to clients obtained by Business information.

David Rosenberg has been warning that the US is on the brink of recession for the past few years, but he has been especially vocal about his fears in 2024.

He also attacked the Fed for raising interest rates as high as it did, something Fed Chair Jerome Powell committed to doing for 11 consecutive meetings from March 2022 to July 2023.

The current federal funds rate is at 5.5 percent, its highest level in 23 years.

This rate is reflected in consumer lending, and when it is high, mortgage rates and credit card APRs rise simultaneously.

The Federal Reserve was forced to raise interest rates to rein in consumer spending and control inflation, which fell to 2.9 percent in July.

The Federal Reserve continues to target a 2 percent inflation rate.

“Incredibly, the Fed raised rates 500 basis points under a false assumption — by more than a million people — about how strong the labor market was,” Rosenberg wrote.

Rosenberg has been warning that the US is on the brink of recession for the past few years, but he has been especially vocal about his fears in 2024.

Despite 206,000 jobs added to the economy in the June nonfarm payrolls report, Rosenberg noted that full-time employment was down 1.2 percent from the beginning of the year.

In May, when it became known that 63,000 fewer jobs had been created in April, Rosenberg even warned the Fed about upcoming revisions to the employment figures.

“It will be a shock to the Federal Reserve and also to the markets,” Rosenberg said at the time.

Rosenberg predicts the U.S. economy is headed for another recession, with a slumping labor market as the catalyst. Pictured here, a Lehman Brothers employee leaves the office on Sept. 15, 2008, the day the bankrupt financial services firm filed for bankruptcy.

Following the news of the downward revision of 818,000 jobs, major indexes (including the S&P 500 and the Dow Jones) briefly gave up gains before fully recovering by the close of the stock market on Friday.

But Rosenberg points to two models that he says paint a grim picture for the longer-term future of the economy as a whole.

The aim is to improve the yield curve (a tool used to measure the risk appetite of bond investors) and turn it into an indicator of recession.

The model takes into account the ability of U.S. companies to repay debt, also known as corporate bonds, and the Federal Reserve. National financial situation indexa weighted average of a myriad of factors thought to assess the tightness or looseness of the economy.

This combined measure currently shows a 57 percent chance of a recession occurring.

Unemployment rose to 4.3 percent in July, the highest level in almost three years

The Federal Reserve kept interest rates between 5.25 and 5.5 percent at its last meeting

The other model Rosenberg points to was developed by economists Pascal Michaillat and Emmanuel Saez. It focuses on the number of job vacancies.

It shows that the United States is in “possible recession” territory, and the chart is trending toward “certain recession.”

However, there are some dissenting voices who say that last week’s downward revision to the employment index is not all it seemed.

Ian Shepherdson, chief economist at Pantheon Macroeconomics, said average monthly job gains are strong despite the revisions.

“It tells us nothing about payrolls since March and has no implications for the unemployment rate, which is measured by the separate household survey,” Shepherdson said in a note to clients.

He continued: “The monthly profile of benchmark revisions will be published next February, but the total roughly indicates that payrolls grew at a still respectable average pace of around 175,000 in the twelve months to March, compared with 232,000 previously.”

Federal Reserve Chair Jerome Powell, left, Bank of Canada Governor Tiff Macklem, center, and Bank of England Governor Andrew Bailey pose for a photo at the Fed’s annual retreat in Jackson Hole on Aug. 23, 2024. At this meeting, Powell signaled that a policy shift is coming.

Although Rosenberg believes the Fed is acting too late to contain the economic fallout, Powell appears willing to take action.

“The time has come to tighten monetary policy. The direction ahead is clear, and the timing and pace of rate cuts will depend on emerging data, the evolving outlook, and the balance of risks,” Powell said Friday at the Fed’s annual retreat in Jackson Hole, Wyoming.

The next meeting of the Federal Open Market Committee, where interest rates are decided, is scheduled for September 17-18.

The Federal Reserve is expected to cut rates by at least 25 basis points, and the consensus view on Wall Street remains that the economy will have a soft landing. This means, in essence, that we will narrowly avoid a recession.

Still, a soft landing depends almost entirely on jobs data in the coming months, and if the labor force continues to weaken, Rosenberg expects a bumpy ride ahead.