ChatGPT can help pick winning stocks to make the “average joe” rich, but experts warn the The process is risky and can cause “painful losses.”

Researcher Sangheum Cho, who works at the World Bank, fed the OpenAI chatbot tweets from financial publications and commentators and then asked it to choose stocks to buy and sell each day.

It reported that the tips earned “significant long- and short-term returns” of up to 3.7 percent each month.

And you’re not the only one trying: social media is full of videos and tutorials with attention-grabbing captions like ‘How to Use ChatGPT to Become a Millionaire’ and ‘I Gave ChatGPT $10,000 to Trade Stocks.’

OpenAI warns against using its platform for money-making tips, answering questions with a disclaimer that “as an AI language model, I cannot provide personalized financial advice.”

But this can be quickly overcome, as the new study shows, by telling the chatbot to “impersonate a financial expert.” You are a professional intraday trader. He then spits out tips on stocks that some claim they are using to make a lot of money.

YouTube and TikTok are full of people putting AI investment advice to the test. In this video, a day trader on the Humbled Trader account tries to ask the chatbot for advice and evaluates its value.

OpenAI warns against using its platform for money-making tips, but its disclaimer can be worked around by asking the chatbot to pretend to be a financial advisor. ChatGPT stock picking has been shown by some to generate a high return on investment.

To carry out his experiment, Cho gave ChatGPT a set of instructions.

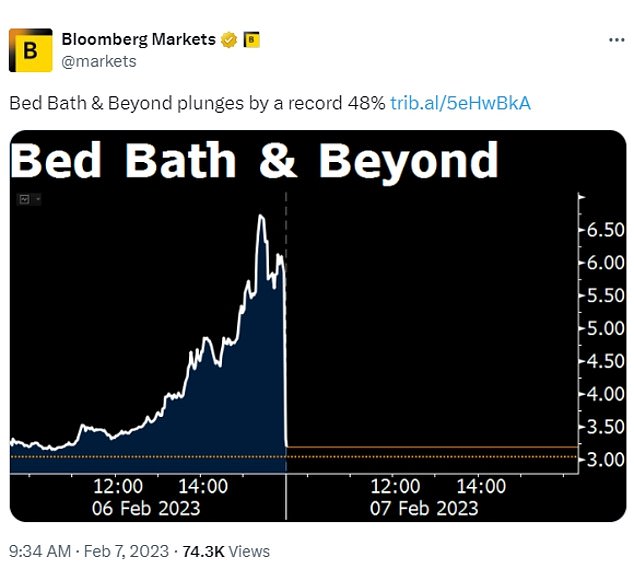

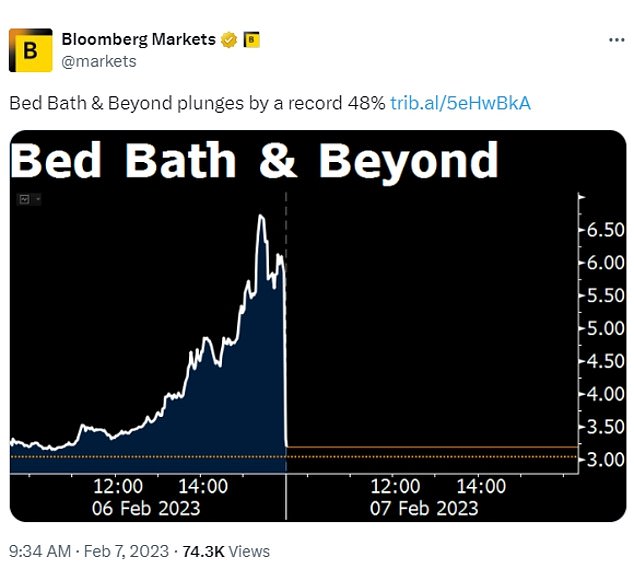

He told him: ‘Stocks are traded based on news to implement the “News Trading” strategy. He analyzes news articles from Bloomberg and the Wall Street Journal posted on Twitter.

“To make money, some individual stocks listed in the United States are chosen to buy or sell in the short term.”

He then entered news articles and tweets from the last 24 hours and told the chatbot to choose stocks to buy and sell based on them.

He repeated the process 30 times each session to refine the suggestions and selected the actions that came up the most each time.

He then followed the recommendations and recorded profits and losses. Overall, each month, he said, the strategy earned up to 3.7 percent.

By comparison, over the past six months, the S&P 500’s monthly return has ranged between -2.2 percent and 8.92 percent.

He concluded: “A trading strategy based on ChatGPT buy and sell signals generates significant long- and short-term returns.”

Cho is not the first person to try to use the powers of artificial intelligence chatbots to make money playing the stock market; Social media users say computer intelligence systems are making them rich.

An example of a Tweet Cho entered into ChatGPT for advice

Cho repeated each question 30 times to obtain the greatest certainty in each answer.

It’s not just about the financial markets, one TikTok account claims they used the bot to make money from sports betting. One of their videos claims that “this morning they won $10,000 on sports betting using ChatGPT.”

The idea of AI-based investment advice is attractive, but experts warn that it comes with a number of problems.

Alpha Cubed Investments CEO Todd Walsh said: “None of the AI tools are robust enough at this time to extract enough information to allow regular investors to rely on the data for intraday trading purposes.

‘If, and only if, it is used by experienced day traders who also use tools such as technical analysis, volume measurements, along with fundamental data, AI resources can be a useful tool.

“Inexperienced investors who do not use all the available tools in their arsenal are likely to suffer painful losses if they venture into AI-based trading without combining it with more traditional forms of research and analysis.”

The study itself acknowledged some problems with the advice provided.

ChatGPT sometimes recommended buying and selling stocks that didn’t exist.

It also included suggestions that he had been specifically told to exclude, and at one point recommended selling Twitter, which would have been impossible since it had been delisted three months earlier.

Corbett Road Wealth Management financial planner Georgia Lord warned it is risky to rely on AI for investment advice

It was also impossible to determine exactly why he was recommending the stocks he was recommending and whether it was based on opinions from financial experts or other random sources on the Internet.

Corbett Road Wealth Management financial planner Georgia Lord said: “AI is not able to fully understand your preferences as an investor, it is only as good as the questions it asks you.” As a result, you won’t get personalized financial advice.’

He added: “You wouldn’t trust ChatGPT to prescribe your medications when you’re sick, you would first inform yourself and/or visit your doctor.” This is no different.’

Lord added: “The biggest risk when it comes to relying on ChatGPT or AI to pick stocks for day trading is a lack of education.

‘Many people don’t understand how psychological and emotional investing is; It involves a lot more than just picking a few stocks here and there.

‘A human financial advisor or planner is much better suited to help you educate yourself to make financial decisions that encompass feelings and behaviors.

OpenAI told DailyMail.com that its terms of use prohibit using the bot to obtain personalized “legal, medical/health or financial advice.”

DailyMail.com has contacted Cho for comment.