Table of Contents

Bankers are bracing for a £2bn fee bonanza after a year of frenetic takeover activity.

The value of mergers and acquisitions involving British companies has risen 36 per cent this year to £250 billion, according to data from Dealogic.

And fees earned by investment bankers working on deals have risen 19 per cent to £2.1bn, the highest level since 2021.

Accountants, lawyers and other advisers will also reap huge payouts following a wave of acquisitions.

Among the biggest deals this year are private equity giant CVC’s £5.4bn purchase of Hargreaves Lansdown, the £3.3bn sale of Britvic to Carlsberg and the £2.9bn purchase of Virgin Money by from Nationwide.

Others include Aviva’s £3.7bn acquisition of Direct Line, although mining giant BHP failed in its £39bn bid for Anglo American.

Acquisition bonanza: A wave of acquisitions and mergers has hit the city this year

Advisors typically share fees of between 1 and 5 percent of the acquisition value, with bankers taking the lion’s share.

Dan Coatsworth, an investment analyst at AJ Bell, said a bumper year will be “music to the ears of investment bankers” and other advisers.

Among those hitting the jackpot were advisers working on the £3.6bn takeover of Royal Mail owner International Distribution Services (IDS) by billionaire tycoon Daniel Kretinsky.

Deal documents reveal bankers, lawyers and others will share £146 million, 4 per cent of the price. Among those cashing in is former Labor leader Chuka Umunna, who now works for JP Morgan and advises Kretinsky.

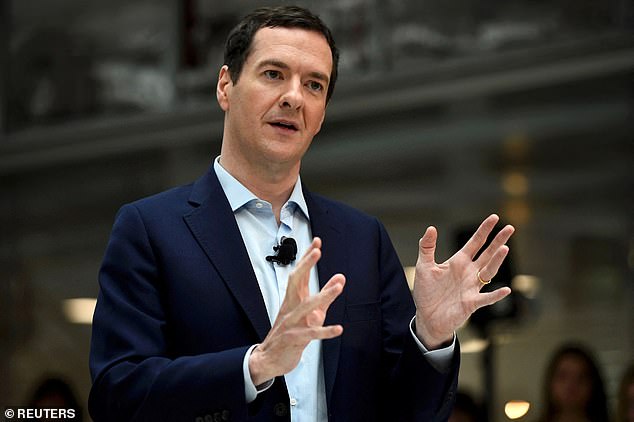

From chancellor to banker: George Osborne now works for Robey Warshaw

George Osborne is another former politician who benefited from the acquisition frenzy.

The former chancellor now works for boutique investment bank Robey Warshaw and was one of four partners who shared a £70m payday this year.

Robey is advising Direct Line on its deal with Aviva, having previously defended it against a takeover by Belgian group Ageas this year.

The investment bank, where Osborne has worked since 2021, also advised the video game company Keyword Studios when it was bought by the private equity group EQT for £2 billion.

Also in the money are bankers at Goldman Sachs, which advised on more acquisitions of UK companies than any other bank in the first nine months of the year, according to LSEG.

Lucille Jones, senior manager at LSEG, said the increase in activity has been “driven by mega deals as foreign buyers and private equity took action”.

Coatsworth said: ‘There has been a lot of action in the large and mid-cap space – music to the ears of bankers and legal advisers if they are charging a fee based on the size of the deal. The UK is for sale.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.