The American economy just achieved something that will go down in the history books: a “soft landing.”

Experts say this rare event has only happened once before, and it’s promising news for both the job market and stock performance, as it offers a boost to 401(k) plans.

A soft landing occurs when rampant inflation is controlled without pushing the economy into recession.

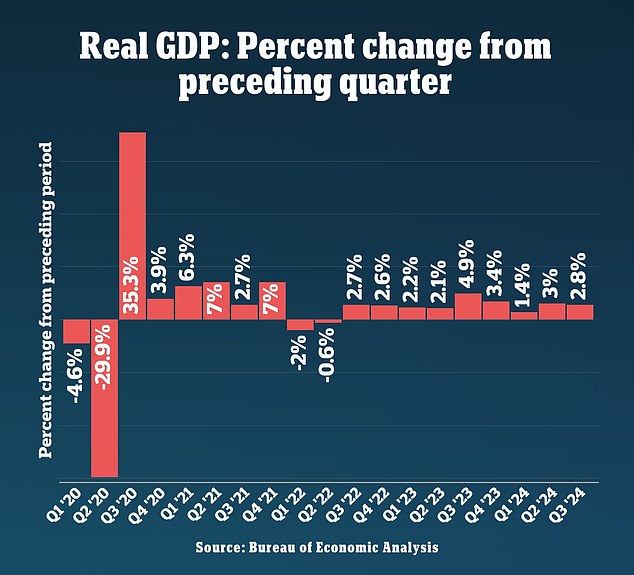

Gross domestic product (GDP), a measure of all goods and services produced in the United States, rose at an annual rate of 2.8 percent between July and September, the Commerce Department said on Wednesday. This follows a similarly strong gain earlier in the year.

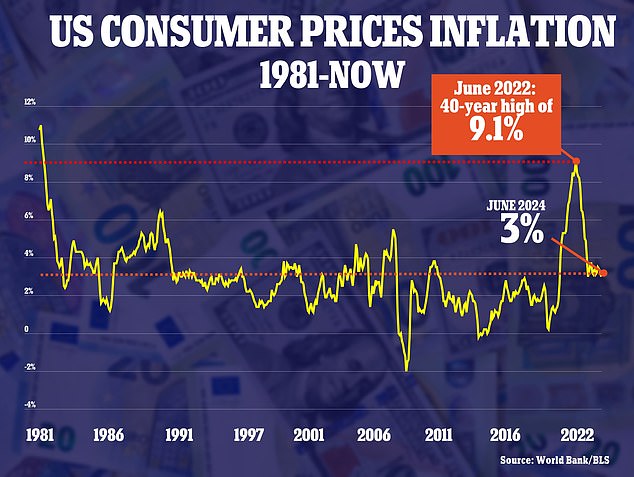

Inflation has nearly reached the Federal Reserve’s 2 percent target, now at 2.4 percent over the past month.

Meanwhile, a whopping 254,000 jobs were created in September and consumer confidence saw its biggest boost since early 2021, signaling renewed optimism.

While employment growth fell in October, economists were reassured that the shocking figure was largely due to the ongoing Boeing strike and the devastating impact of hurricanes Helene and Milton.

Economists are celebrating. “I think we should declare a soft landing now,” former St. Louis Federal Reserve President James Bullard said in an interview with CNN.

GDP increased at an annual rate of 2.8 percent during the July-September 2024 quarter.

This feat only happened once, during the 1990s, according to some economists.

This week’s GDP report showed that businesses continue to invest and household spending remains strong.

This is crucial because consumer spending accounts for about two-thirds of economic output in the United States.

American buyers are back in the game. Spending on major purchases drove growth in the third quarter, demonstrating how essential consumer confidence is to the pulse of the economy.

With business investment holding steady and federal and state spending adding fuel, the country is defying the odds of falling into a recession.

The stock has risen steadily over the past few months to record highs. Much of this is due to signs seen over the summer that the United States is on track for a soft landing, something Wednesday’s numbers all but confirmed.

A strong stock market is good for 401(K)s and other retirement accounts, which are invested primarily in indices like the Dow, Nasdaq and S&P and through stocks of individual U.S. companies like Apple.

Experts have long predicted that the high borrowing costs generated by successive interest rate increases would push the United States into a recession, but instead it has remained durably strong.

Federal Reserve officials cut rates by 0.5 percentage points in September and are expected to do so one or two more times this year. Officials had signaled they would cut interest rates as inflation moved closer to their target.

The annual inflation rate was 3 percent in June, above the Federal Reserve’s 2 percent target.

Federal Reserve officials have made clear that they would consider cutting interest rates as inflation moves closer to its target (Pictured: Federal Reserve Chair Jerome Powell)

Interest rate reductions by the Federal Reserve will, over time, reduce consumers’ borrowing costs for services such as mortgages, auto loans and credit cards.

Although inflation has slowed significantly from its 40-year high of 9.1 percent in June 2022, persistent inflation has meant that prices for some everyday goods remain well above pre-pandemic levels.

According to data from the Department of Labor, food prices have increased 20 percent in the last five years.

The cost of some everyday essentials has risen much higher: eggs and milk now cost twice as much as they did in 2019.