Jamie McPartland is trying to make sense of a takeaway receipt from a local Indian curry house.

Sitting at his desk in an office building at the Nationwide Building Society headquarters in Swindon, he studies the document on screen for evidence.

Someone emailed the receipt to customer service to claim a partial refund as when their food arrived the poppadoms and samosas they had ordered and paid for were missing.

Deciphering takeaway receipts may not seem like a job for a banker, but Jamie is part of a Nationwide team that processes 1,500 such cases each week under the so-called chargeback scheme.

I’m here at Nationwide’s headquarters in the Wiltshire town to meet Jamie and the rest of the great team dealing with these applications.

Chargeback gives customers the right to ask their credit or debit card provider to reverse a transaction worth less than £100 up to 120 days after something has gone wrong.

This could be because the goods or services they purchased are defective, not as described, or were never delivered. The bank or building society can then withdraw these funds from the retailer’s account and return them to the customer’s account.

Those who paid by credit card and spent more than £100 but less than £30,000 are also similarly covered by Section 75, a vital legal protection which forms part of the Consumer Credit Act.

You have 120 days to file a chargeback claim and six years to file a Section 75 claim, but you must do so as soon as you notice a failure in a product or service.

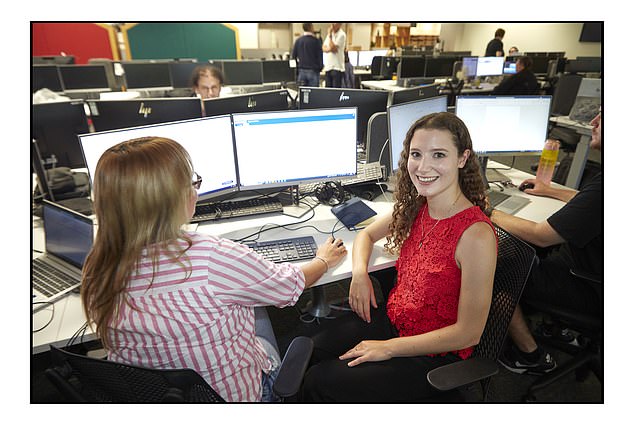

Adele Cooke visited Nationwide’s headquarters in Swindon to see its chargeback team at work

Banks and building societies can only make one claim, so it is essential to ensure they have as much evidence as possible.

The Swindon office is a hive of activity as members of Nationwide’s 16-strong chargeback unit work together (or alone if the case is simple) to resolve customer complaints. In some cases, they also seek the help of in-house counsel.

Nationwide also has a group, separate from its chargeback team, of ten legal experts who handle around 100 Section 75 cases each month.

In one corner of the room, three staff members sit inside a wooden garden hut-shaped meeting space intensely discussing a case.

Most customers submit complaints to the building society using an online form, but customers can also submit a chargeback or Section 75 claim by telephone, post or in a branch.

In the case of the Indian takeaway, Jamie will have to go back to the customer for more information as he has only uploaded half of the receipt and has not provided key details, such as dates and times, about when the delivery was made.

They will also try to find out if the customer had requested a refund directly from the restaurant. Under both chargeback and Section 75, banks will typically intervene only when a chargeback request has been denied.

Jamie will need to have this information to return to the restaurant in question and file the chargeback case.

“We only have one chance to file a chargeback claim (to the retailer), so we need to make sure it’s right the first time,” he says.

His next case is equally challenging. A Nationwide customer filed a chargeback claim after ordering gym clothes online, but when they arrived they were the wrong color.

The customer’s chargeback claim describes the items that arrived as “blue pants” when she had ordered black ones. Jamie will have to go back to her to find out if by “bottom” she meant leggings, shorts, or skirts.

Your third case already contains a lot of client information and is therefore likely to proceed quickly. The Nationwide customer had ordered some garden furniture but it did not arrive weeks later.

The customer provided a receipt confirming the purchase and a record of when he had spoken to the seller to attempt to resolve the issue directly.

In a clear case like this, the team can submit a complaint to a retailer and get a response within a few days. But, without the necessary tests, the entire process can take up to four months.

Debbie Weston, customer service manager, says evidence is key when making a claim.

Customers are encouraged to take photos of items they believe are incorrect or defective.

Most complaints involve missing airline refunds or clothing orders that arrive in the wrong size.

“The only thing we see when a purchase is made is the transaction, we don’t know the terms that were agreed upon or what they signed,” he says.

‘If there is a problem with an item then we need to know why. Was it the wrong size? Is it damaged? Why is there a problem?

He advised that customers always describe why there is a problem with the item or service they purchased. The more details you include in the description you give your card provider, the less back-and-forth you’ll have with them. Please mention if an item is the wrong size, color or is damaged and take photos to support your claim.

Always save emails from the retailer and save receipts, which should make things easier if you need to file a claim. You should also take photos when you receive an incorrect item or something defective, as this can also be used as evidence.

When you make a large purchase, always pay part of it with your credit card. Even if you only pay a deposit with your credit card, for example when you book a holiday, the full value of the goods or services purchased will still qualify for Section 75 protection.

The majority of claims the team processes are due to missing airline refunds or online clothing orders where items arrived in the wrong size or color.

Debbie says: ‘We also see issues, for example if an airline goes bankrupt we will see a lot of claims. Christmas also often sees an increase in cases.’

Any credit card claim that does not meet the chargeback criteria is automatically passed to the Section 75 team, who work on a case-by-case basis.

Retailers have much longer to process a Section 75 claim than a chargeback claim, and some of the most complex cases can drag on for almost a year.

One of the biggest differences between chargeback and Section 75 is that with the latter you can claim for subsequent losses that result from a bad service or product.

For example, you could receive compensation if you are forced to move from your home to a rental property due to an unsafe roof repair.

There are also greater protections if a company goes bankrupt, explains Matthew Roberts, who heads the Section 75 team.

‘If a company goes into liquidation, we will contact the administrators. If we can’t get the money back from the merchant, we will refund the buyer ourselves.

‘As soon as a claim comes in, we will freeze the transaction on the customer’s credit card, so it is deducted from their monthly payments and any interest is frozen.

‘In these cases, the user must demonstrate whether there was a breach of contract or misrepresentation and whether there was a subsequent loss related to this. They also need to confirm it with evidence.’

A breach of contract occurs when a business breaches any of the agreed terms and conditions of a binding contract, which may include failing to deliver the correct goods or failing to provide a service on time.

If a customer finds a defect in a product within the first six months of their purchase, it is presumed that the problem was there at the time of purchase and it is up to the retailer to prove that this was not the case.

But after six months, this passes from the retailer to the consumer and it is up to them to prove that the item was defective when they purchased it.

Many of the cases the team takes on involve defective home repairs and cowboy builders, Matthew says.

“We get a lot of claims about solar panels,” he adds. “We also recently had a case where spray foam was applied to the exterior of a roof.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.